Written by: Samuel Rines

Key Takeaways

-

The U.S. economy has slowed steadily throughout the year, with GDP growth decreasing from 3% in the first quarter to 2.1% in the third quarter, which aligns with pre-COVID norms.

-

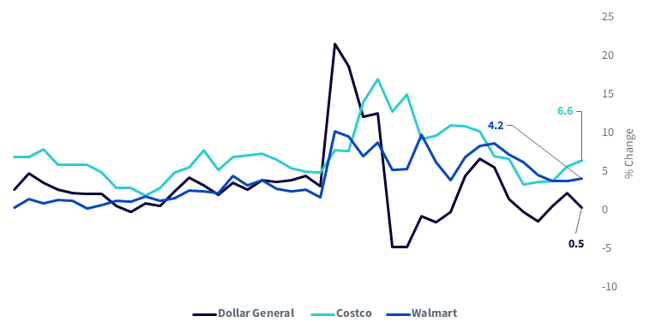

Retail performance varies, with Dollar General showing weakness, while major retailers like Walmart and Costco report stable or increasing sales, signaling resilience in consumer spending.

-

The economic slowdown reflects a normalization after years of volatility, particularly in sectors like rural America, and should not be seen as alarming.

The U.S. economy has slowed. But “slowed” requires a bit of context. There is no shortage of ways to parse the economic outlook, and—with the benefit of hindsight—point out the places and times the variables appear to have broken. In some circumstances, that may be a useful exercise. Most of the time, it is not. It is important to note where the economy has been only in the context of where it may be going. Thankfully, there is the Atlanta Fed’s GDPNow metric. It is a sort of “wayback” machine for the U.S. economy.

Source: Atlanta Fed (emphasis added).

In late January, the GDPNow Model for the first quarter—basically, a pseudo real-time estimate of GDP growth—was showing a 3% growth rate. That was the initial estimate for growth in the first quarter. By the time the quarter closed, it was down to 2.7%. Today, the estimate for the third quarter is 2.1% growth. The takeaway is straightforward: there has been a slow and steady deceleration from the beginning of the year to today.

GDPNow

Source: Atlanta Fed, as of 9/4/24.

What does 2.1% real GDP growth mean? Looking at the pre-COVID period (from the beginning of the GDPNow dataset), the average quarter-end reading was 2.1%. That perspective matters only in framing the current outlook. The current slowdown is not all that disturbing within this context. It might even be described as normal. And, after the last four years, ”normal” is a strange thing for the economy.

Not to mention, there have been plenty of one-off earnings reports to raise eyebrows about the health of the U.S. consumer and economy. The comments from Dollar General pointed to their core consumers, those making under $35,000, being under pressure. That should not be ignored, but it should also be heavily caveated. Dollar General has not exactly been one of the better operators in the post-COVID era.

Same Store Sales Last 10-Years

Source: Dollar General Company Filings, as of 9/4/24.

In the grand scheme of retail, Dollar General’s comments are only potentially important on the margin. Costco and Walmart are having none of it. In fact, they are going in the opposite direction with either stable or accelerating comparable sales. The combination of Walmart and Costco increasing their sales is far more important than Dollar General’s comments. Taking Dollar General as a signal of a broad economic problems would have sent numerous false positives. Incorporating a wider swathe of retailers would have avoided these issues. That is likely the case today.

Insight into the Rural Economy?

Source: Casey’s General Store, as of 9/5/24 (emphasis added).

Casey’s General Store is a gas station. That also happens to be the fifth- largest pizza company in the U.S. The company targets smaller population towns in Middle America and flyover country. If there is a public company with insight into the rural economy, it is Casey’s. Its results showed something similar to the rest of the economy: a normalization. A 4.4% same-store sales figure in prepared food and beverage is not a blowout figure. But it is not disturbing, either. Middle America remains in decent shape.

The U.S. economy is muddling through the middle of normalizing. It feels strange. And that is ok.

For more information about WisdomTree go to wisdomtree.com/investments.

Related: Will July 2024 Be a Harbinger of Small-Cap Strength in U.S. Equities?

Important Risks Related to this Article

Past performance is not indicative of future results.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship.