Written by: Samuel Rines

Key Takeaways

-

GM defied expectations this earnings season by offsetting EV headwinds and labor costs with higher vehicle pricing, signaling strong profit potential despite broader industry challenges.

-

Homebuilders like Pulte have thrived post-COVID by leveraging mortgage incentives and steady pricing, maintaining growth even as higher interest rates strain the housing market.

-

Polaris, once buoyed by pandemic-driven demand for recreational vehicles, now faces a sharp reversal in fortunes with declining volumes, pricing pressure and rising promotions, dimming its near-term outlook.

Every earnings season, there is something odd that emerges. This time around one of the most intriguing is the difference in fortunes seen by companies that are supposed to be sensitive to the interest rate environment. From autos to housing to recreational vehicles, different sectors enjoyed different tailwinds during the COVID recovery. Some are seeing their fortunes reverse. Others are riding surprising shifts in sentiment, challenging the perceived weakness in the economy or their specific end markets.

General Motors

Source: GM Investor Presentation, 10/22/24 (emphasis added).

GM is one of the surprising winners this earnings season. The sentiment around electric vehicles has been—to put it kindly—horrid. It is not as though GM was immune to the EV headwinds (the “volume ramp” was specifically cited as a challenge to profits), but it more than compensated for them by selling more vehicles at higher prices. Not long ago, the auto workers strike was making headlines. That was supposed to be problematic for GM. It was not. The $200 million of increased labor costs was covered by the $1 billion in pricing.

Source: GM Investor Presentation, 10/22/24 (emphasis added).

Increasing volumes and prices is going to be good for revenues. And GM does not see that changing. Management is being careful not to “stuff the channel” with inventory (more on that in a minute), and the incentives—read “sales” —spending remains under control. That bodes well for future revenues. On the profit side, the much-maligned EV segment is set to transform into a rather significant boost for the company. That may be the most out-of-consensus narrative pivot so far this earnings season.

Pulte Homes

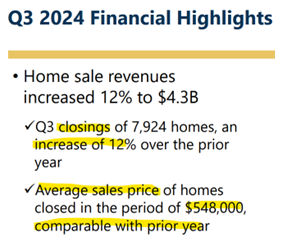

Source: Pulte Homes Investor Presentation, 10/22/24 (emphasis added).

Homebuilders have consistently surpassed expectations in the post-COVID, higher interest rate environment. The natural assumption would be higher rates lead to fewer new home sales. But the homebuilders did not get the memo. Instead, the past couple of years have seen the homebuilders boom as homeowners stayed put with their ultra-low mortgages. Pulte closed 12% more homes in the most recent quarter from a year earlier at similar pricing.

Source: Pulte Homes Investor Presentation, 10/22/24 (emphasis added).

That is not the entirety of the story, however. Part of the reason homebuilders have fared well despite higher mortgage rates has been their ability to offer mortgage and other incentives to homebuyers. That is somewhat unique to the builders (some of whom have their own mortgage companies) and has given them an advantage in competing for customers. Notably, incentives costs ticked higher, and—if that continues to escalate—that could be a bit of an issue for the homebuilders.

Polaris Industries

Source: Polaris Industries Investor Presentation, 10/22/24 (emphasis added).

Both GM and Pulte have exposure to interest rates. After all, cars and homes are pricy purchases, and many are financed. The same could be said of Polaris Industries, which manufacturers side-by-side recreational vehicles, motorcycles, snowmobiles and boats. What cannot be said of Polaris is that volumes, pricing or the incentive environment is going well. Volumes? Down. Pricing? Down. Profit? Dismal.

To be clear, Polaris is facing the problem of the longtails of COVID. During the pandemic, consumers bought these motorized “toys” in droves. Polaris struggled to keep up with the demand, and dealers saw their inventories plummet. Polaris ramped up production, refilled inventories and saw booming earnings as a result. That tailwind has now reversed, and the company is talking about reducing dealer inventories as demand wanes.

Source: Polaris Industries Investor Presentation, 10/22/24 (emphasis added).

If poor volumes, pricing and profit were not enough, Polaris is also facing an elevated promotional environment. None of this bodes well for the near future. It takes time for dealers to work through inventories, which will continue to pressure volumes, and the promotions and discounts mean pricing will not be a positive either.

It is a tale of three companies. These companies all manufacture or build expensive, often financed, products that are at some level interest rate sensitive. But the results are strikingly different. GM is seeing improving volumes, pricing and profit in a reasonably promotional environment. Pulte has increasing volumes with steady pricing and a slight uptick in incentive spend to ward off higher mortgage rates as profits move steadily higher. Polaris has none of the positives and all the negatives as volumes, pricing and profits deteriorate in a competitive promotional atmosphere. Sometimes, incentives matter.

Related: The Appeal of Agency Mortgage-Backed Securities in a Shifting Economic Landscape

Important Risks Related to this Article

Past performance is not indicative of future results.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship.