Whether it's a material uptick in broader market volatility or clients affinity for avoiding turbulence, exchange traded funds dedicated to avoiding volatility are popular, generally speaking.

There are dozens of funds addressing this factor. So popular is the concept that the corresponding ETF space has long since evolved beyond domestic large caps to include mid- and small-cap stocks as well as ex-US developed market and emerging markets equities.

For the purposes of this piece, let's focus on the iShares MSCI USA Min Vol Factor ETF (CBOE:USMV) and the Invesco S&P 500 Low Volatility ETF (NYSEARCA:SPLV) – two of the oldest and largest funds dedicated to low volatility stocks. The pair combine for about $36.5 billion in assets under management.

That's large enough that advisors and likely plenty of clients know at least one of these products by name or ticker.

Fertile Ground for Advice

Data confirm investors like SPLV, USMV and plenty of the dozens of other funds of this ilk. However, market participants don't always stick with low volatility ETFs when they should.

“Over the trailing five years through February 2020, investors poured a combined $30.2 billion of their hard-earned savings into U.S. large-cap ETFs that focus on dialing down volatility,” notes Morningstar's Ben Johnson. “This represented 306% organic growth over that five-year stretch. But the early-2020 market meltdown and subsequent rebound have put them to the test, and many investors have gotten spooked. These funds saw $18.1 billion in net outflows from March 2020 through May 2021.”

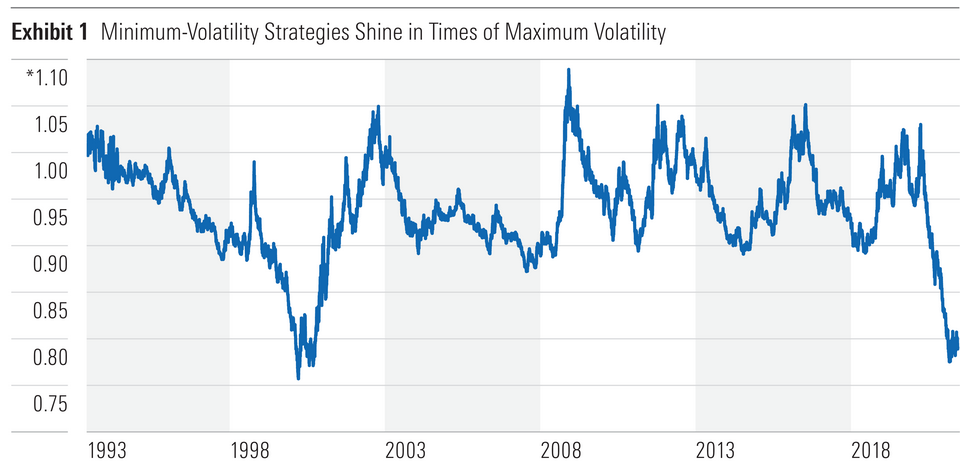

That gets us to one of the primary avenues through which advisors can help clients low vol ETF territory. Clients don't often realize this, but the objective of a fund like SPLV or USMV is to mitigate drawdowns when stocks decline, not be full participatory in bull markets. Over longer holdings, the strategy works as highlighted in the chart below of the MSCI USA Minimum Volatility (USD) Index – USMV's underlying index. An upward sloping line marks a period in which the index outperformed the broader market.

Courtesy: Morningstar

The other area in which advisors can be of assistance to clients with low volatility strategies is helping them understand that by embracing this concept, they are very much committing to a trade-off.

“Investors can't have the best of both worlds,” adds Johnson. “Low-volatility strategies will tend to lag in bull markets. This is most evident in the downward slope of the line that spans the better part of the 1990s and more recently in the post-pandemic rebound. This is what investors in these strategies signed up for.”

Another Way Advisors Can Help Clients

Cementing the notion that low vol ETFs provide advisors with ample opportunity to add value for clients is something so simple, it may go overlooked: Helping clients see important differences in similarly named products.

In fact, SPLV and USMV are a case study in this phenomenon. The Invesco ETF is a basket of the 100 S&P 500 members with the lowest trailing 12-month volatility. That methodology often leads to large allocations to consumer staples and utilities stocks, though the fund is sector agnostic. Conversely,

USMV's sector weights can't deviate more than 5% from those found in the parent index.

Another frontier for advisors, and it's a potentially fruitful, is helping clients comprehend that there are differences between “low” and “no” volatility.

“Low volatility does not mean no volatility, just less,” says Johnson. “Low-volatility stock funds are still stock funds. They are designed to be less volatile than their selection universes, and there's no question that they have delivered based on that criterion. But it can be dangerous to equate 'less' volatility with 'low' volatility.”

Bottom line: Advisors can bring a lot to the table for clients wanting to pare portfolio volatility while maintaining equity exposure.

Advisorpedia Related Articles:

A New Way to Love Low Priced Stocks

New ETF Tackles Crypto Mining Environmental Implications

Interesting Asset Class Offers Dual Benefits

Tempering Return Expectations for a Beloved Income Assets Class