The Invesco QQQ Trust (QQQ) debuted 25 years ago today and over that quarter century, QQQ has cemented itself as an indomitable force in the world of exchange traded funds.

QQQ enters its 25th birthday with $257.65 billion in assets under management, making it one of just five US-listed ETFs to top $200 billion in AUM. By that metric, QQQ is also nearly double the size of its nearest rival. That’s confirmation that institutional investors, registered investment advisors (RIAs) and retail market participants have gravitated to QQQ’s innovative posture.

“Over the last 25 years the evolution of the Invesco QQQ, and the Nasdaq-100® Index, have mirrored the expansion of its constituents, as well as the investor mindset around technology and innovation,” according to a statement issued by Atlanta-based Invesco. “This has contributed to Invesco QQQ’s position as one of the most important large-cap growth strategies, making it the second most traded ETF1 in the world based on average daily value traded.”

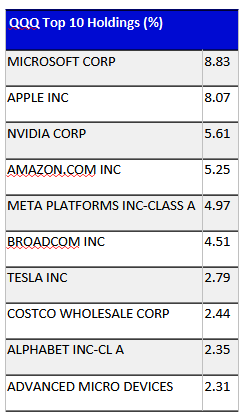

Over the course of its 25 years on the market, QQQ has developed a track record as one of the top large-cap growth funds due in part to its often sizable exposure to disruptive technology companies. As reflected in the chart below, that remains the case today.

As of February 29, 2024, Holdings are subject to change and are not buy/sell recommendations.

QQQ Performance History Enviable

While QQQ is often viewed as a de facto ETF, the reality is weight to that sector is significantly lower today (about 51.5%) than when it debuted in 1999 (70.7%).

Still, the fund’s often overweight tech exposure has served long-term investors well. Had a market participant allocated $1,000 to QQQ on its first day of trading, that stake would have been worth nearly $9,400 at the end of last year.

By comparison, the same $1,000 directed to the S&P 500, Russell 1000 or the Russell 1000 Growth indexes on March 10, 1999 would have been worth almost $5,900, $6,161.62 and $6,277.66, respectively, at the end of 2023.

“The average market cap of companies included in QQQ was $157.5 billion in 1999, growing to $882.1 billion at the end of 2023. Innovation-through-technology extends to companies beyond the technology sector, as evidenced by the shift in the weighting of the technology sector of Invesco QQQ from 70.7% in 1999 to 49.6% at the end of 2023,” adds Invesco.

QQQ Creates a Legacy

Beyond performance, QQQ has created a legacy in other ways. For example, its lower-cost counterpart, the Invesco NASDAQ 100 ETF (QQQM), is barely more than three years old and already has nearly $23 billion in assets under management, making it one of the fastest-growing ETFs in the U.S.

QQQ innovation didn’t end with QQQM. The methodology has been applied with success to environmental, social and governance (ESG) investing as highlighted by the Invesco ESG Nasdaq 100 ETF (QQMG).

Add to that, the QQQ suite has grown to include the Invesco ESG Nasdaq Next Gen 100 ETF (QQJG), Invesco NASDAQ Next Gen 100 ETF (QQQJ) and the Invesco NASDAQ Future Gen 200 ETF (QQQS).

Related: Strategic Alliances: The Value of Advisors Having Relationships with Tax Experts