Written by: Ayush Babel

Key Takeaways

- India has experienced a significant economic turnaround, transitioning from one of the “Fragile Five” economies to the fifth-largest economy in the world, with high growth rates and the potential to become the third-largest economy by 2027.

- India has made strides in manufacturing, particularly in the technology sector, with the country becoming a leading manufacturer of cutting-edge technology, including smartphones and semiconductor chips.

- India has established a strong foundation for growth through investments in infrastructure, digitization and the development of new industries, positioning the country for continued economic expansion and the potential to reach ambitious export targets.

Just a decade ago, the Indian economy was struggling and was dubbed as one of the “Fragile Five” economies. This was due to many serious structural problems, such as mass corruption, failed government services, poor infrastructures and ailing banking and energy sectors, just to name a few. Contrast that to current times, with India registering one of the highest growths of any major economy with a stellar 8.4% surge in the last quarter of 2023, surprising consensus estimates on the upside. A host of reforms (the impact of which is detailed here) by Prime Minister Narendra Modi’s administration has led to a massive turnaround, leading India from “Fragile Five” to the fifth-largest economy in the world. With the current growth rates, it is set to surpass Japan and Germany to become the third-largest economy by 2027.

India’s stock market has witnessed one of the best spells of outperformance over the broad emerging markets, and global markets in general, delivering 23.16% returns in the last year and close to annualized 11% returns in the last decade (based on S&P BSE Sensex total returns as of March 7, 2023). This has been supported by a strong underlying economy, growth in services and manufacturing, a rise in the ease of doing business, better corporate governance standards, political stability and favorable global sentiment. On the ground, the Indian population also witnessed an improved quality of living, a tangible reduction in extreme poverty and a significant drop in unemployment, which stood at 3.1% for calendar year 2023 as per the Periodic Labour Force Survey (PLFS). In a world where most countries are grappling with geopolitical challenges, India has emerged as a bright spot with unhindered growth. The question that faces us is, will the growth continue?

India Is Transforming from the Back Office of the World to a Leading Manufacturer of Cutting-Edge Technology

Most reforms and initiatives in the two terms of Narendra Modi’s government were focused on building a strong foundation. We have seen that in the form of an exponential increase in infrastructure spending, Adhaar—a digital biometric identification system, UPI (United Payments Interface)—which helped digitize money transfers in what was a largely cash-dependent economy, GST (Goods and Services Tax) to streamline the complicated tax regimes across different states and “Make in India,” a government-run initiative to boost manufacturing in the country. The country has also been quick to capitalize on them in order to take it a step further. For instance, India realized the opportunity after the “global chip shortage” and dedicated two tranches of subsidies amounting to a combined US$25 billion in order to attract semiconductor manufacturing in the country. The country’s first fabrication plant is estimated to be a US$11 billion joint venture between PSMC (Powerchip Semiconductor Manufacturing Corp) and Tata Electronics, a branch of the US$370 billion Indian conglomerate. Similar joint ventures have been announced with established companies from Japan, Thailand, Korea and the U.S. to bring the technology skillset and manufacturing process know-how to India.

Phone manufacturing is another sector in which India has massively improved scores. The sector has transitioned from being 78% import-dependent in 2014 to 97% self-sufficient currently. Over the past decade, a number of mobile phone manufacturing units have come up in the country, including that of the world’s largest contract manufacturer, Foxconn Technology Group, which is the largest producer of Apple’s iPhones globally. Apple is continually ramping up exports from India and aiming to produce a quarter of all iPhones in India by 2025. Other major players include Samsung, which has its largest manufacturing facility in the world based in Noida, India, and Google, which has recently announced plans to manufacture its flagship Pixel devices in India starting in the second quarter of 2024. To put this into perspective, phone production has surged by more than 1,700% over the last decade, making India the second-largest producer of mobile phones globally.

India was also successful in accomplishing impressive feats in aerospace and defense, such as becoming the only country to land an exploratory rover on the south pole of the moon, launching close to 400 foreign satellites from 23 different countries in the last 10 years and developing the indigenous Light Combat Aircraft (LCA) Tejas, which has been inducted into the Indian Air Force.

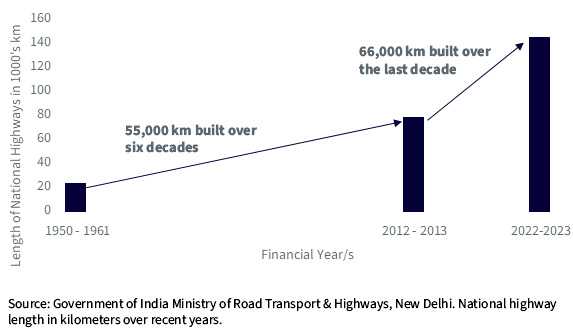

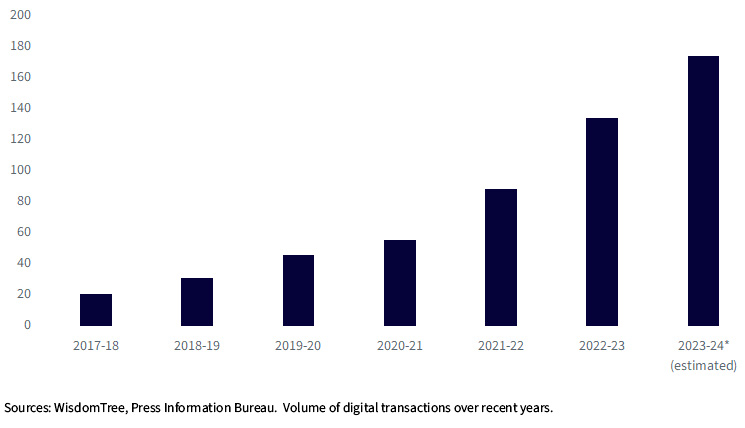

The length of national highways has increased by 60% over the last nine years, strengthening the foundation for economic activity growth. This has been accompanied by similar growth in digitization, with an exponential increase in digital transactions, bringing a larger proportion of the population under the formal economy.

Length of National Highways in India

Volume of Digital Transactions

We believe a strong foundation has been established and continues to be developed in the form of a robust digital and physical infrastructure, which is reminiscent of China from a couple of decades ago. India’s efforts to increase its share of manufacturing in what has historically been a services-dominated economy have been supported by tailwinds in the form of countries looking to diversify imports from China. This has led to the development of new industries, such as semiconductor manufacturing, and also boosted previously lagging sectors such as smartphones, automobiles and defense and aerospace. The government is ambitious and targeting exports from 11 sectors—namely, auto components, automobiles, capital goods, chemicals, drones, medical devices, aerospace and defense, leather and footwear, textiles and space—to reach US$500 billion from the current levels of US$160 billion, and we believe that India currently has the momentum, with a combination of internal and external factors that could help it get close to this target.

Conclusion

As we have highlighted time and again, India continues to benefit from the wave of structural reforms, and we are convinced that it might just be the beginning of a multi-decade growth story. A glimpse of India’s growth could also be seen in India’s phenomenal rise in manufacturing activity, which is starting to supplement a robust services sector.

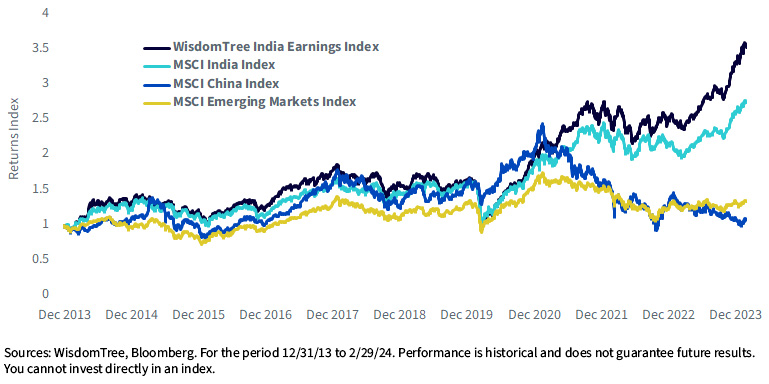

India decisively outperformed emerging markets and China over the last decade, with MSCI India gaining more than 176% while MSCI China gained close to 13% and MSCI EM gained 39%. The WisdomTree India Earnings Index (WTIND), with its smart beta construction, proved to outperform MSCI India by more than 93%, delivering total returns of 269% over the 10 years ending February 29, 2024.

India still has a long way to go before realizing its full potential. Despite making tremendous strides over the last decade, the GDP per capita currently stands at US$2,612, as per 2023 IMF estimates. This underscores India’s potential to continue to generate multifold gains for investors, as saturation remains distant at this point.

Performance review of WisdomTree India Earnings Index vs MSCI India Index, MSCI China Index & MSCI Emerging Markets Index

Important Risks Related to this Article:

There are risks associated with investing, including the possible loss of principal.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship.

Related: Beyond Tomorrow: Investing in AI Innovations with Chris Gannatti