Whenever investors believe they are swimming in uncharted waters, their risk of taking extreme actions rises —including pulling their assets out of the market. It’s a challenge at a time when the word ‘unprecedented’ is being heard far too often, referring to everything from stock valuations and inflation, to the US political environment and the war in Ukraine.

Happily, there is one area where uncertainty is markedly absent: automation. Even in these ‘unprecedented’ times, there is little doubt that investments and innovations in automation will continue to increase rapidly. The reason: the shift toward greater automation has become a business necessity due to its ability to drive productivity and spur economic growth.

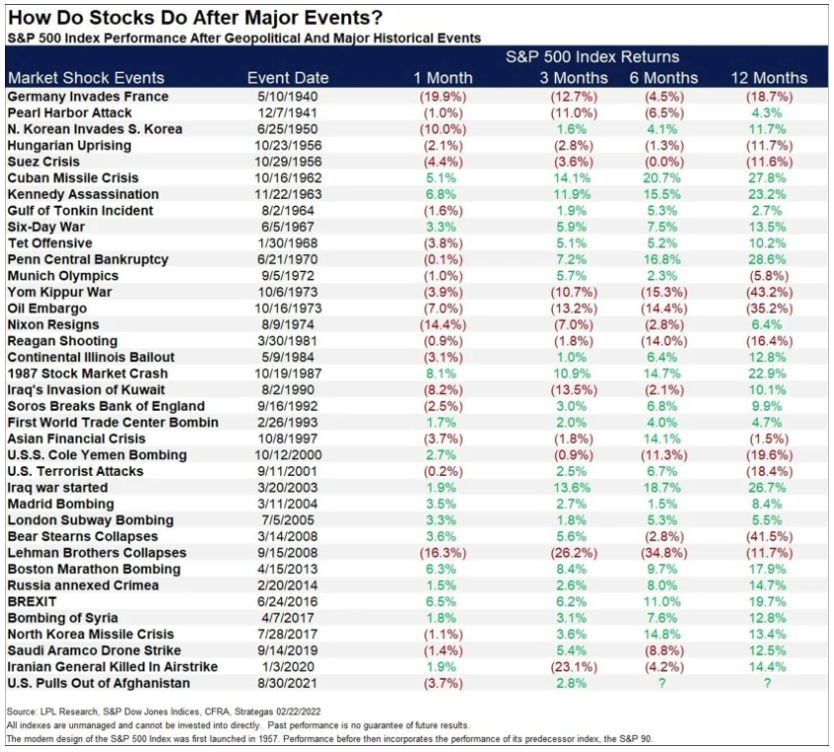

It is abundantly clear that now is the time to be invested—and stay invested—in automation. For those not already invested, the recent market pull-back provides an easy entry point with immense growth potential. And for investors who harbor any doubts about the growth to come, a brief look at history can quickly put them at ease. While current events can certainly feel ‘unprecedented,’ in fact, almost every decade in recent history has included notable conflicts, stresses, and fears that created seemingly unprecedented conditions for the capital markets. Yet, as illustrated in the chart below, the market has proven remarkably resilient in the face of these conditions, providing ample returns to investors from decade to decade:

When looking at several decades of asset class returns, it is also clear that stocks have generally outperformed almost all other asset classes. The S&P 500 average annualized return since its inception in 1926 through Dec. 31, 2021, is 10.49%. While that is not news to any seasoned investor (there is good reason we choose to invest in stocks!), it is important to note that, when we look at market history, the biggest risk for investors at any point in time is simply not being invested.

Even knowing that, staying invested can be a challenge because, unfortunately, we investors are not as calm and rational as we perceive ourselves to be. One of the inherent flaws in investor behavior is the tendency to act on our emotions—and react to the market. It’s all too common for self-proclaimed ‘long-term investors’ to change their tune once the stock market falls, choosing to withdraw their money and run for short-term safety. The danger, of course, is that few investors are lucky enough to reinvest in time to benefit from the inevitable market rebound, jumping back in only after most new gains have already been achieved. It is this type of reactive behavior that drives investors to buy high and sell low, ultimately crippling returns and permanently damaging their portfolios.

For wise investors who are able to overcome those emotions and stay invested through a down cycle, there is no better place to reach for growth than automation. Despite the ‘unprecedented’ events occurring around the globe, we see many predictive trends emerging in 2022 that point to decades of future growth for automation. Over the past few years, we have witnessed continuous and significant developments across the automation industry, as well as wider adoptions, more rapid growth, and consistent and improved efficiencies in nearly every market sector—all thanks to the power of automation. The analysts concur. According to McKinsey, automation is now the #1 trend in technology. A Gartner survey recently reported that more than 80% of organizations plan to ‘continue or increase’ their spending on automation technologies. Enthusiasm around automation is intensifying, and we expect it to grow exponentially in the years and decades ahead. At the same time, the disruption in the supply chain—including the supply of labor—is creating a huge surge in spending on robotics and artificial intelligence. With the law of supply and demand at work, turning to automation to reduce labor costs and increase productivity is an obvious choice.

It is unlikely that the world around us will ever feel calm—at least not for more than a minute or two. We are living in an endless cycle that seems doomed to repeat. While that may not be a comfort, from an investor perspective, it does offer this upside: an ‘unprecedented’ opportunity to invest in the future of automation.