Written by: Jeff Weniger, CFA

When you do this for a while, there are years that really stick in your head when it comes to the notable and quotable dates of stock market lore. The years 1999 and 2000 are among them, for reasons of the end of the dot-com bubble. Keep those two specific years in mind as we look at four charts.

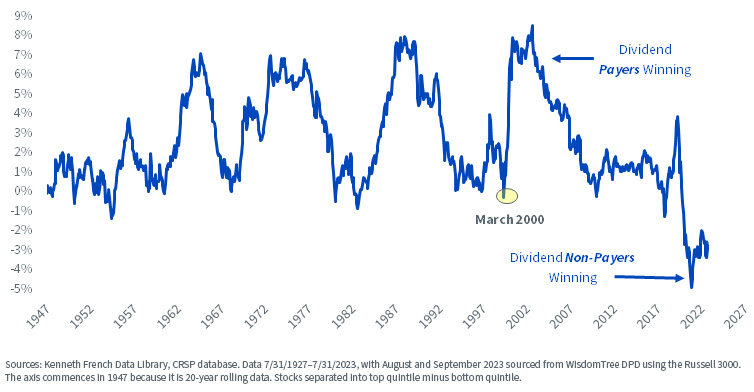

Right now, the stock market is blowing out the 20 years from 1980 to 2000 on a specific performance metric. The last two decades have witnessed firms with a 0% dividend yield outperforming the highest yielders by a larger amount than at any time in pre-Covid history, including that one. In figure 1, see the boldness with which the snapbacks hit.

Figure 1: 20-Year Rolling Annualized Outperformance, Top Quintile of Stocks by Dividend Yield minus Stocks Paying No Dividends

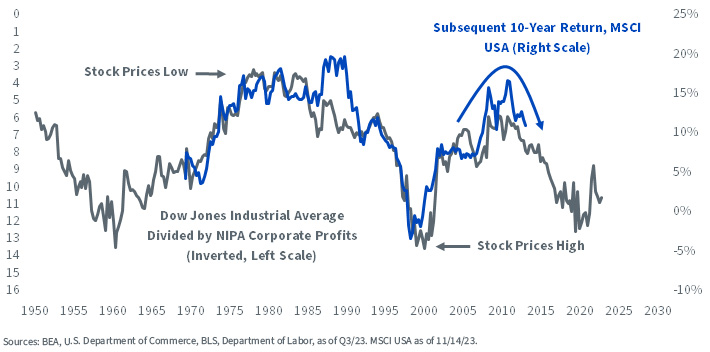

In figure 2, I divided the Dow Industrials by NIPA corporate profits. Because the market bolted so boldly from the 2009 lows until the height of the mania in 2021, the relationship is near historic extremes. If the chart’s fit is any guide, maybe the coming years witness a market that frustrates the bulls.

Figure 2: Dow Industrials Relative to NIPA Corporate Profits

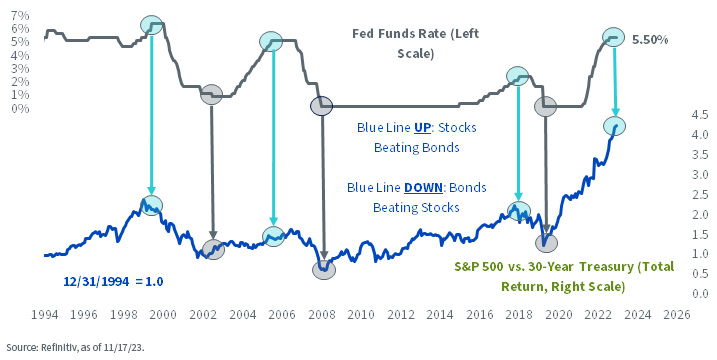

Another situation that may just mean revert is the relationship between stock and bond returns. If the consensus has it right, that the Fed is done tightening for this cycle, take heed of the message from figure 3. Maybe the hated bond market is ready to start outperforming.

Figure 3: The End of Tightening Cycles Tends to Favor Long-Term Bonds over Stocks

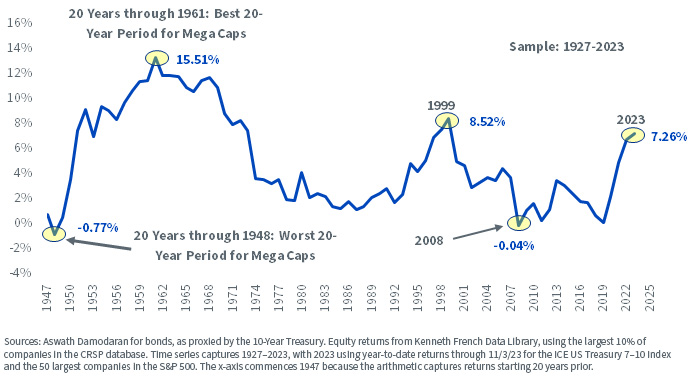

Figure 4 helps that argument. We are at a 20-year extreme in equity outperformance over bonds. Like the chart of dividend payers versus non-payers, the pre-Covid precedent for such things takes place in about the eighth inning of the dot-com bubble: 1999.

Figure 4: 20-Year Annualized Performance Differential, Mega-Caps vs. Bonds

Let’s summarize our four charts:

1. Companies that paid no dividend just had the greatest 20-year bout of outperformance over the biggest dividend payers on record.

2. The Dow relative to NIPA corporate profits points to 2023–2033 being a tough market for stocks.

3. The end of the Fed’s tightening cycles points to bonds beating stocks.

4. 2003–2023 witnessed stocks beating bonds by an order of magnitude that is only matched by the 20 years after the Second World War and by 1979–1999.

We see a lot of portfolios land on our desk. Top-heavy in tech, Magnificent Seven all over the place, huge overweights in U.S. equities, general disdain for fixed income, little or nothing in the way of deep value and on it goes. If any or all of these charts revert to the mean, heads will spin.