Written by: Matthew J. Bartolini, CFA | State Street

Proponents of active strategies often point to the ability of active managers to rotate into defensive segments or increase cash positions during market downturns as a key reason why they continue to use such strategies within portfolios.

Putting aside whether active strategies really perform better in severe market downturns, it’s fair to examine even whether this approach is a good use of capital in general. The approach allocates for something that happens roughly every 10 years1 and costs more than 30 times the fees of lower-cost index-based solutions.2 If the goal is to miss out on major down moves, a simple trend-following strategy using the last price of the S&P 500® Index versus its 200-day moving average as a trigger to move to cash from a low-cost indexed vehicle could provide the same theoretical objective at a fraction of the cost.

The costs of the active route are even harder to comprehend given the underperformance trends of active strategies and the relative loss of wealth during the last bull market, where 42% of active managers underperformed their benchmark by an annualized average of 2.2%.3 Overall, the high fees, frequent tendency for capital gains dividends and persistent underperformance are major potential costs for an approach that hopes an active manager can make the right decision as the market rolls over and bounces back.

In this edition of Charting the Market, we examine the environment for active management as well the performance trends of active managers this year to see if they have lived up to the expectations of performance prowess during a downturn.

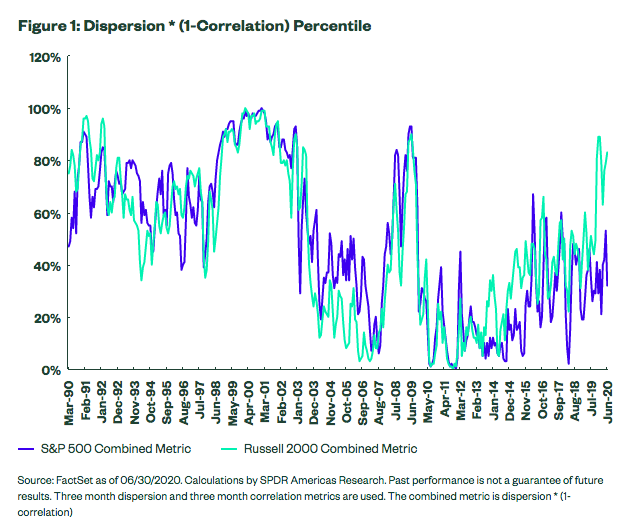

Assessing current dispersion and correlation metrics

High stock dispersion is conducive for active managers: When stock returns are differentiated, there is arguably an abundance of potential alpha generation—provided the stock selection process lands on the right side of the market leaders. Notably, dispersion is more indicative of the amount of available alpha than the direction of the market. It just so happens that high dispersion typically occurs at the same time as market meltdowns, when the market identifies specific winners and losers based on macro events. Dispersion, however, can also be wide even when markets aren’t volatile—in fact, dispersion was in the 50th percentile after the 2016 US presidential election, right as the S&P 500 rallied and the CBOE VIX Index traded in the low teens.4

A low correlation among stocks is also helpful for active managers’ performance, as stocks are moving with more independence, reflecting a more idiosyncratic/non-macro driven market. Correlation and dispersion are the indicators we monitor to decipher whether the market environment is conducive for potential alpha generation.

In today’s market, the rolling three-month dispersion for both large and small caps is elevated, registering in the 81st and 96th percentile, respectively.5 When we take a step back and consider sector dispersion, levels are also high, landing in the top 90th percentile, historically.6 Given the macro-oriented COVID-19 shock, pairwise stock correlations are also high, plotting in the 95th percentile. This creates a mixed market environment; however, the strong dispersion trends (at both the stock and sector levels) are indicative of alpha generation potential being in high supply.

We can clear up the picture to a degree by combining these metrics. As shown below, the combined metric reveals the small-cap segment is currently more conducive (higher percentile rank) for active management—something to remember as we delve into the performance data.

US active manager performance trends: Growth wins

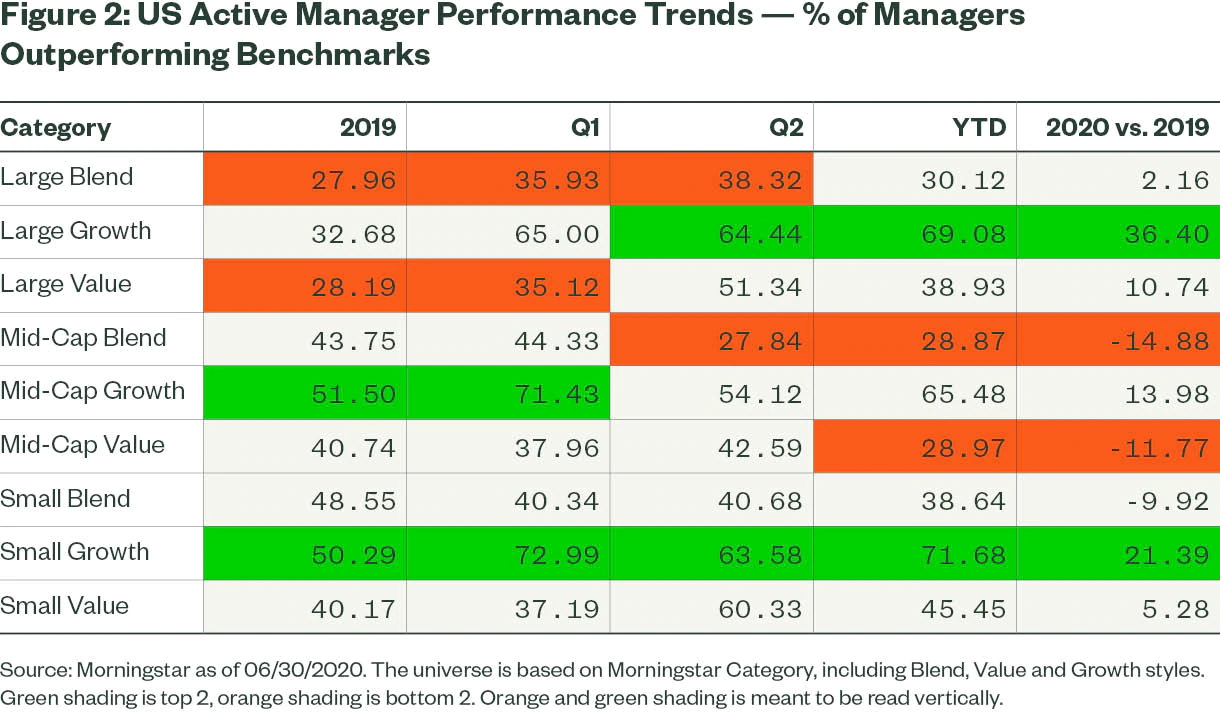

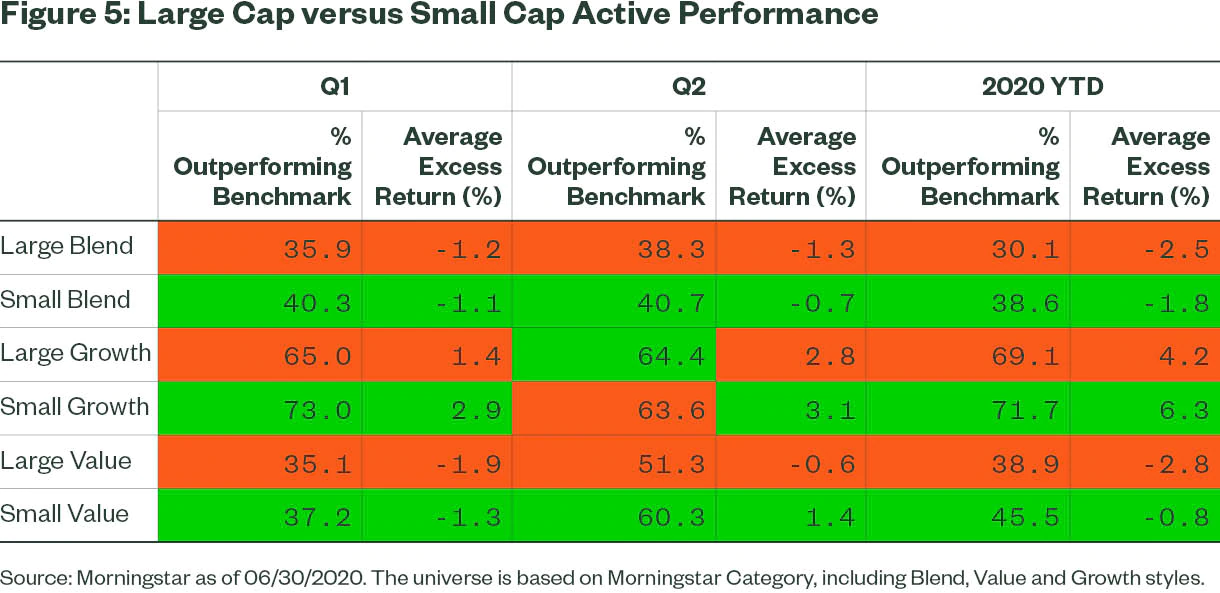

To ascertain performance trends for active managers, we grouped managers by their Morningstar Category and analyzed performance versus prospectus-stated benchmarks. Next, we needed to define a “good performance trend.” If more than 50% of active managers have outperformed their benchmark and the average excess return is positive, then we consider this an area of the market where active management has performed well in our current environment.

These hurdles would need to be met across all three periods of consideration: Q1, Q2 and 2020 year-to-date. While Q1 saw the drawdown, Q2 saw the rally. If we are to understand if active does well in bear market environments—which have rallies—it’s important to identify the ability to mitigate downturns and also capture the rally from the bottom. We would also like to see a meaningful spread increase in 2020 from 2019, as it pertains to the percentage of managers outperforming. The performance trends are shown below.

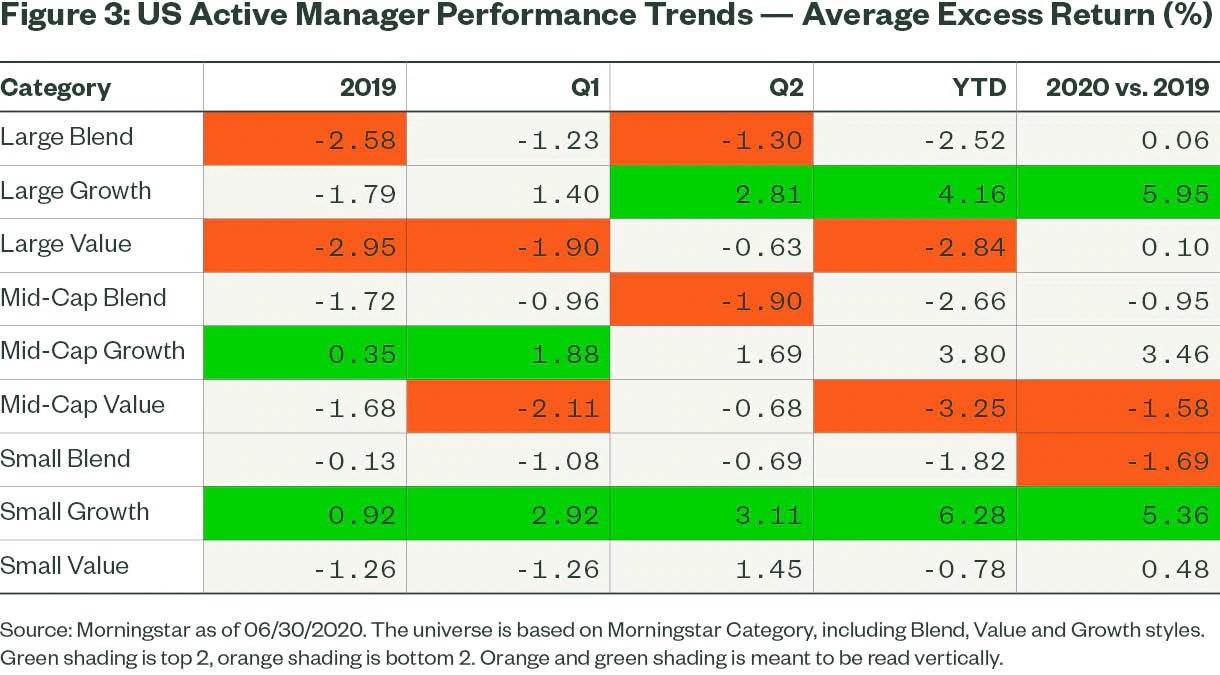

Only three categories can be placed into the “good performance trend” camp—and they are all similar: large-cap growth, mid-cap growth and small-cap growth. Performance in these categories has been consistent in both Q1 and Q2, bolstering their “good” qualifications. In each of the three segments, more than 60% of managers outperformed each quarter, and the excess return was positive and meaningfully better than 2019, as shown below.

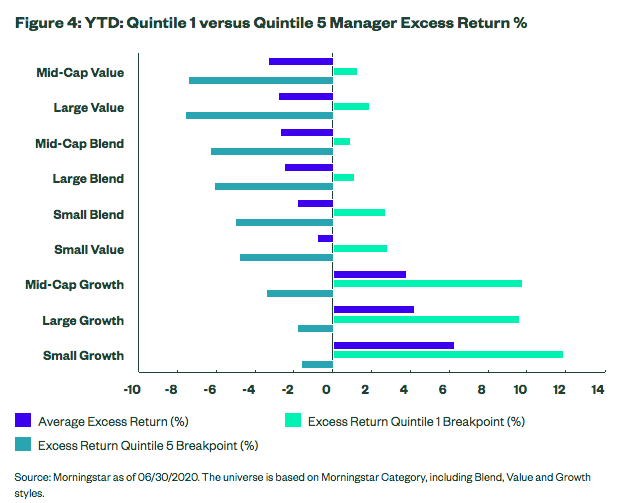

A positive excess return is not always guaranteed, as outliers can bring it down. We see this in the large-cap value space, where 50% of managers outperformed in Q2 but the average excess return was negative. This is also why it is constructive to examine performance throughout the category to see the magnitude of the poor and good performers. The year-to-date excess returns of the average as well as the quintile 1 and quintile 5 managers (based on the breakpoints, i.e., manager at the 20th and 80th percentile) are shown below to illustrate this.

For all of three of the categories discussed earlier as having “good” performance trends (large-cap growth, mid-cap growth and small-cap growth), each has the largest quintile 1 excess return and the shallowest quintile 5. Taken together, this indicates that most growth managers have performed strongly during the current idiosyncratic period.

What’s behind this? Growth is a style that has worked well in 2020, and active managers have been able to capitalize across the cap spectrum. Based on holdings data compiled by Bank of America,7 active growth managers have taken on more growth exposure, as measured by their aggregate price-to-earnings and price-to-book ratios being higher than benchmark levels. Additionally, based on the same data, active growth managers have been overweight Health Care, Technology, Consumer Discretionary and Communication Services stocks—four sectors that rank high on momentum, as shown in our current Chart Pack . Lastly, the same holdings data reveals an overweight in software firms and other stay-at-home plays .

Another observation—which reinforces the dispersion and correlation data presented earlier—is that in almost every category (blend, growth, value) small cap managers outpaced large cap. As shown below, every metric points towards a more favorable performance trend for small caps, with the exception of the percent of small-cap growth managers outperforming their benchmark in Q2.

Does it pay to be active in a down market?

Based on the events of 2020, which have featured a violent downturn along with a vibrant rally, all within a narrow span of time, it’s difficult to assert that active managers shine in down or volatile markets. Active growth managers have done well, but this is more a function of style behavior and dispersion than market direction; active growth managers did well in Q1 when growth stocks fell 14.5% but also performed well in Q2 when growth stocks rallied 26%.8

If we examine the percent of active managers outperforming in Q1, Q2 and 2020 year-to-date, we see six, four and six segments with less than 50% outperformance, respectively. All six such segments in 2020 have produced negative average excess returns, and there are some active managers underperforming by more than 5% in those categories. Also of note, the differential between percentage of managers outperforming in 2019 versus 2020 is negative in three segments. Based on these metrics, and the fact that the positive performing outliers all belong to the same style group, it is difficult to conclude that active managers have shined during this volatile period.

As we venture further into 2020, lackluster performance trends in the blend and value categories shown above are likely to lead to more portfolio discussions about, and ultimately reviews of, investors’ asset allocation mixes. Combined with the high fees and potential for capital gains at year-end, the exodus from active in certain areas is likely to continue.

For those wanting to utilize active management but conscience of fee budgets, the optimal strategy—based on dispersion and correlation metrics as well as performance trends—may be allocating to low-cost index-based vehicles in large- and mid-cap segments while deploying active management in small-cap categories. Whether or not growth managers are able to keep up the current pace will depend upon two primary factors: First, the sustainability of growth stock valuations; second, the magnitude of earnings declines evident in the latter half of 2020, as investors continue to pay up for growth in a market devoid of it.

Continue following SPDR® Blog to keep up with my Charting the Market series and other market insights. You can also download our full monthly Chart Pack .