Written by: Dan Petersen

By now, most people paying attention to market news have learned about the power of a short squeeze. Unlike being long an equity with a limited downside of -100%, the theoretical unlimited upside to prices means that being short has no limit to how much can be lost. As a price rises, a short seller is forced to buy into the rise either by a margin requirement or because they hit their threshold of how much they are willing to lose, and that added buying pressure exacerbates the rise in prices. Take an equity which has a finite number of shares outstanding, with a large percentage of its total market cap sold short and, like the case of GameStop (GME), the domino effect can be tremendous.

So why were all of these hedge funds shorting GameStop to begin with? Being a company that sells physical media-based games in brick and mortar store fronts in the age of cloud-based gaming and online retail, the outlook has been a bit grim. Hedge funds shorted over 130% of the outstanding shares of GME. Retail investors took notice and decided to buy shares of GME, presumably with the hope of driving the price high enough to trigger the hedge funds to have to buy back the shares, forcing a “short squeeze” that would drive the price even higher. And they were largely successful not only in GME but other stocks as well.

So how did the GME activity affect liquid alternative long/short funds? When it comes to liquid alternative funds that seek to provide exposure to alternative strategies, including Long/Short, there are two general approaches to implementation: active or passive.

On the actively-managed side, managers attempt to identify individual securities and/or asset classes that exhibit short or long biases using manager experience combined with professional networks and other publicly available data including SEC Form 13F, a report required to be filed by all institutional asset managers with $100 million or more in assets under management. An active manager would then implement the positions while meeting the liquidity guidelines of ‘40 Act Funds required by the SEC that provide disclosure regarding fund liquidity and redemption practices to enhance funds’ management of their liquidity risks and better protect investors. With GameStop having such a large percent of its outstanding shares short, there is potential for active managers to piggyback on the short-biased trade and also position a short exposure.

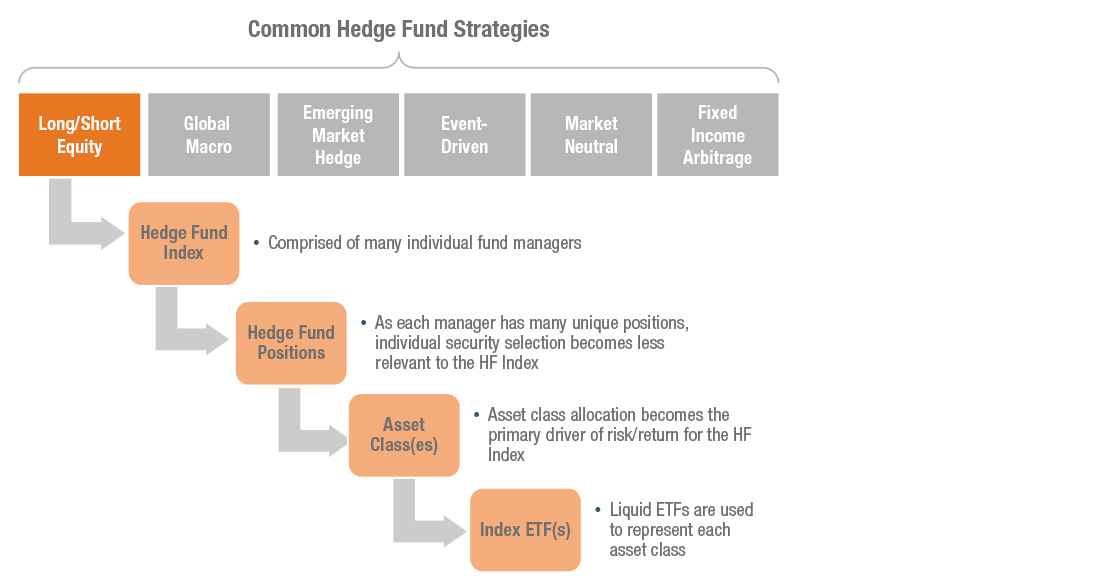

For a passive or indexed approach, such as the systematic, rules-based process IndexIQ developed for its suite of liquid alternative hedge fund replication ETFs, including the IQ Hedge Long/Short Tracker ETF (QLS), a regression approach can help identify which asset classes generally exhibit long or short exposure, as shown in the chart below:

IndexIQ Hedge Fund Replication Index Construction: Systematic, Rules-Based Investment Process

For example, a hedge fund index is comprised of many individual fund managers. As the underlying positions are aggregated, the asset classes that are the primary driver of risk/return are identified. Liquid ETFs are then used to represent each asset class, effectively creating an exposure resembling a Long/Short strategy, without the individual security selection risk. However, while single-manager risk is reduced, the potentially significant alpha that one single successful active hedge fund manager may experience through individual security selection would also not be available.

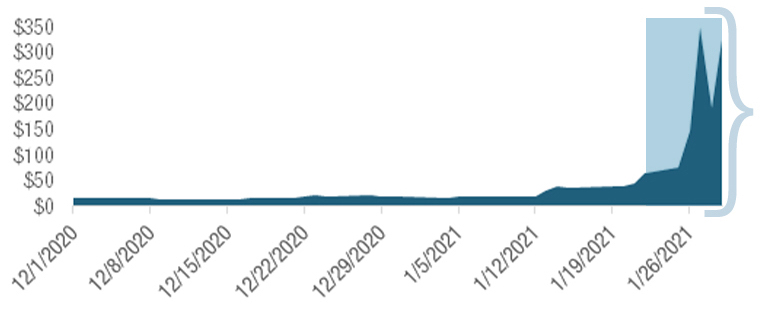

To demonstrate how this significant localized event had a dampened effect on a passive asset-class driven strategy like QLS, we compared GME trading activity (Chart 1) to the performance of the Morningstar Long/Short Equity peer group (Chart 2), comprised of actively managed mutual funds and ETFs from January 12 to January 31 to the IQ Hedge Long/Short Tracker ETF (QLS). It stands to reason that the substantial losses as demonstrated by the peer group may have stemmed from active funds that implemented a long/short equity approach at the individual security level with a short exposure to GME.

Chart 1. GameStop Stock Price ($)

Source: Bloomberg, IndexIQ. Past performance is not a guarantee of future results.

Chart 2. Long/Short Equity Mutual Fund & ETF Performance (%)

(1/12/21-1/28/21)

Source: Morningstar, IndexIQ. Long/Short Equity mutual funds and ETFs represented by the Morningstar Long/Short Equity category. Max is highest return amongst the funds in the category; Median is the return of the fund at the middle of the category sorted in numerical order; AUM Weighted is the overall return of the category reflecting the asset bases of the underlying funds; Min is the lowest return amongst the funds in the cateogory. Past performance is not a guarantee of future results.

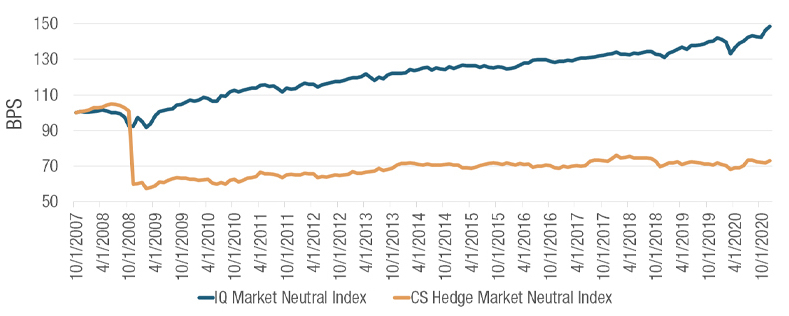

The benefits of a passive approach to hedge fund replication were also demonstrated by the multiple and massive liquidity events of the 2008 Great Financial Crisis that exposed the Bernie Madoff investment scandal. At the time, the Bernie Madoff investment fund, known as the “world’s largest hedge fund”[1], was classified as a market neutral hedge fund and was comprised of several individual market neutral hedge funds. As many of the underlying funds in the Madoff investment fund were constituents of the Credit Suisse Hedge Market Neutral Index, a popular market neutral hedge fund index, we believe this event was a substantial contributor to the negative impact experienced by the market neutral hedge fund category as a whole.

As shown in Chart 3 below, the IQ Hedge Market Neutral Index, the underlying index of the IQ Hedge Market Neutral Tracker ETF (QMN), experienced less drawdown that the Credit Suisse index during the time of the Madoff event that started in October 2008. Similar to the IQ Hedge Long/Short Index, the IQ Hedge Market Neutral Index is not exposed to the individual investments of hedge funds, but rather seeks to replicate the overall asset class exposures:

Chart 3. Market Neutral Hedge Fund Performance

(10/1/2007-9/30/2020)

Source: IndexIQ. Market Neutral Hedge Funds are represented by the Credit Suisse Hedge Market Neutral Index. Max is highest return amongst the funds in the category; Median is the return of the fund at the middle of the category sorted in numerical order; Min is the lowest return amongst the funds in the cateogory. It is not possible to invest directly into an index. Past performance is not a guarantee of future results.

The choice between alpha and beta, or active and passive, has been age-long. Many categories of strategies have seen a shift towards the lower cost passive side as ETFs proliferated. IndexIQ pioneered the development of alternative strategies in an ETF vehicle, an efficient way to provide exposure to these hedge fund styles without the localized risk of individual security selection.

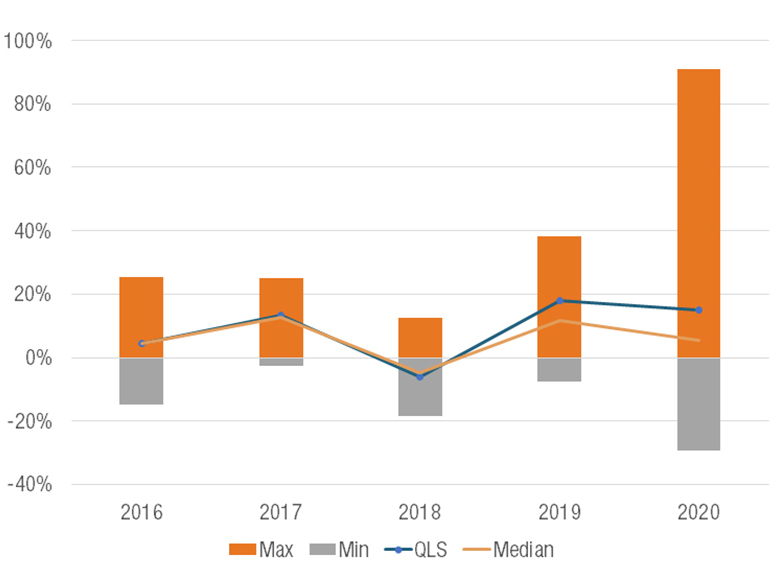

Historically, the IQ Hedge Long/Short Tracker ETF (QLS) has held true to its beta approach avoiding the wide dispersion of managers that can significantly vary away from the median return amongst funds in the Morningstar Long/Short Equity Category, as shown in Chart 4 below:

Chart 4. Long/Short Equity Mutual Funds and ETFs Performance (%)

(2016-2020)

Source: Morningstar Long/Short Equity Category, IndexIQ, January 1, 2016 – December 31, 2020. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

IQ Hedge Long/Short Tracker ETF (QLS) - Average Annual Total Returns (%) as of 12/31/2020

Returns represent past performance which is no guarantee of future results. Current performance may be lower or higher. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Expenses stated are as of the fund's most recent prospectus.

Index performance is for illustrative purposes only and does not represent actual Fund performance. One cannot invest directly in an index. Performance data for the Index assumes reinvestment of dividends and is net of the management fees for the Index's components, as applicable, but it does not reflect management fees, transaction costs or other expenses that you would pay if you invested in the Fund directly. No representation is being made that any investment will achieve performance similar to that shown.

1. Harry Markopolos statement to the SEC, November 7, 2005: The World’s Largest Hedge Fund is a Fraud.

About Risk:

Before considering an investment in the Fund, you should understand that you could lose money.

Related: Finding Next Generation of Innovators Is Easier than You Think