The ides of March have arrived in the form of an interest rate increase by the Federal Reserve. At this juncture, it'd be stunning if the Fed doesn't raise rates and the only mystery now appears to be if the increase will be 25 or 50 basis points.

While some clients are likely fretting about the specter of new Fed tightening cycle, advisors know that rising rates don't always damn equities. In fact, it's possible to capitalize on rising rates with stocks if the right strategies are deployed. That's why clients have advisors, confirming that the imminent rising rates environment could be fruitful for advisors in terms of rekindling and establishing client relationships.

Getting back to the more tactical side of the equation, there are some corners of the equity market with reputations for thriving when rates rise. Of course, there are others that are vulnerable to Fed tightening while others are mostly neutral against this backdrop.

Again, many clients aren't aware of what realms of the stock market can be durable when rates rise, and if they are, the thinking is usually limited to the financial services. However, advisors can unlock efficient avenues for broad equity-based protection from soaring interest rates.

Enter EQRR

Not surprisingly, a variety of exchange traded funds are designed to provide investors with rising rates protection. Many are in the fixed income arena, but one of the equity funds in this category is the ProShares Equities for Rising Rates ETF (EQRR).

EQRR, which is nearly five years old, follows the Nasdaq U.S. Large Cap Equities for Rising Rates Index. That index is designed to provide exposure to a basket of stocks with high positive correlations to 10-year Treasury yields. Advisors shouldn't be hasty to dismiss this strategy as gimmicky because, well, data confirm it works.

The fund “has nearly doubled the return of the S&P 500 since the 10-Year U.S. Treasury’s lowest historical closing level in the summer of 2020,” according to ProShares research.

As noted above, some sectors simply perform better than others when interest rates rise. To that end, EQRR is relevant because its heavily allocated to those groups.

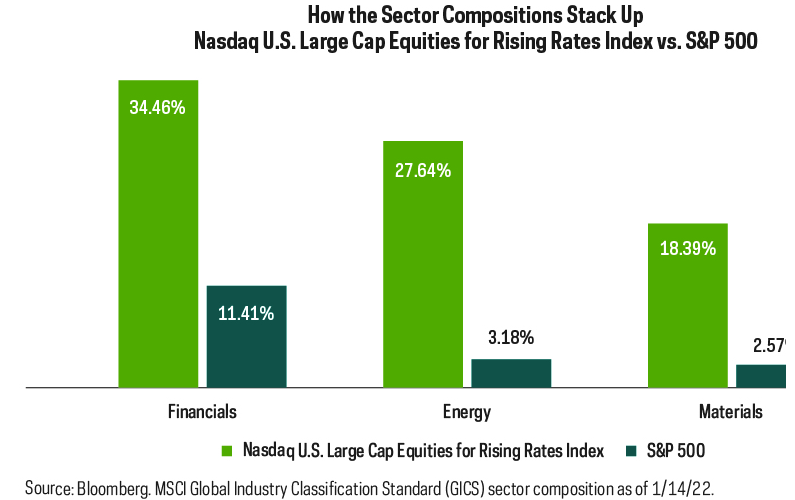

“Perhaps not surprisingly, financials have been at the top of the list as rising rates can lead to higher margins. In addition, energy and materials stocks both stand to benefit from the inflation that usually accompanies rising rates,” adds ProShares. “As the graph that follows illustrates, EQRR’s index has a total allocation of more than 80% to the financials, energy and materials sectors, while the S&P 500’s allocation to these totals only 17%.”

Courtesy: ProShares

EQRR Doing Its Job

To start 2022, EQRR is doing its job. The ProShares ETF is higher by 5%, as of Feb. 25, while the S&P 500 is lower by almost 8%.

As noted above, sector attribution is critical with EQRR and it just so happens its largest sector weights are considered value groups. That's meaningful because value stocks are beating the broader market this year and, for its, part, EQRR is beating the S&P 500 Value Index.

The point: Clients don't have to run for the hills and avoid stocks simply because of Fed tightening. They can benefit from it if advisors discuss with them strategies like EQRR.