Written by: Dave Mazza | Roundhill Investments

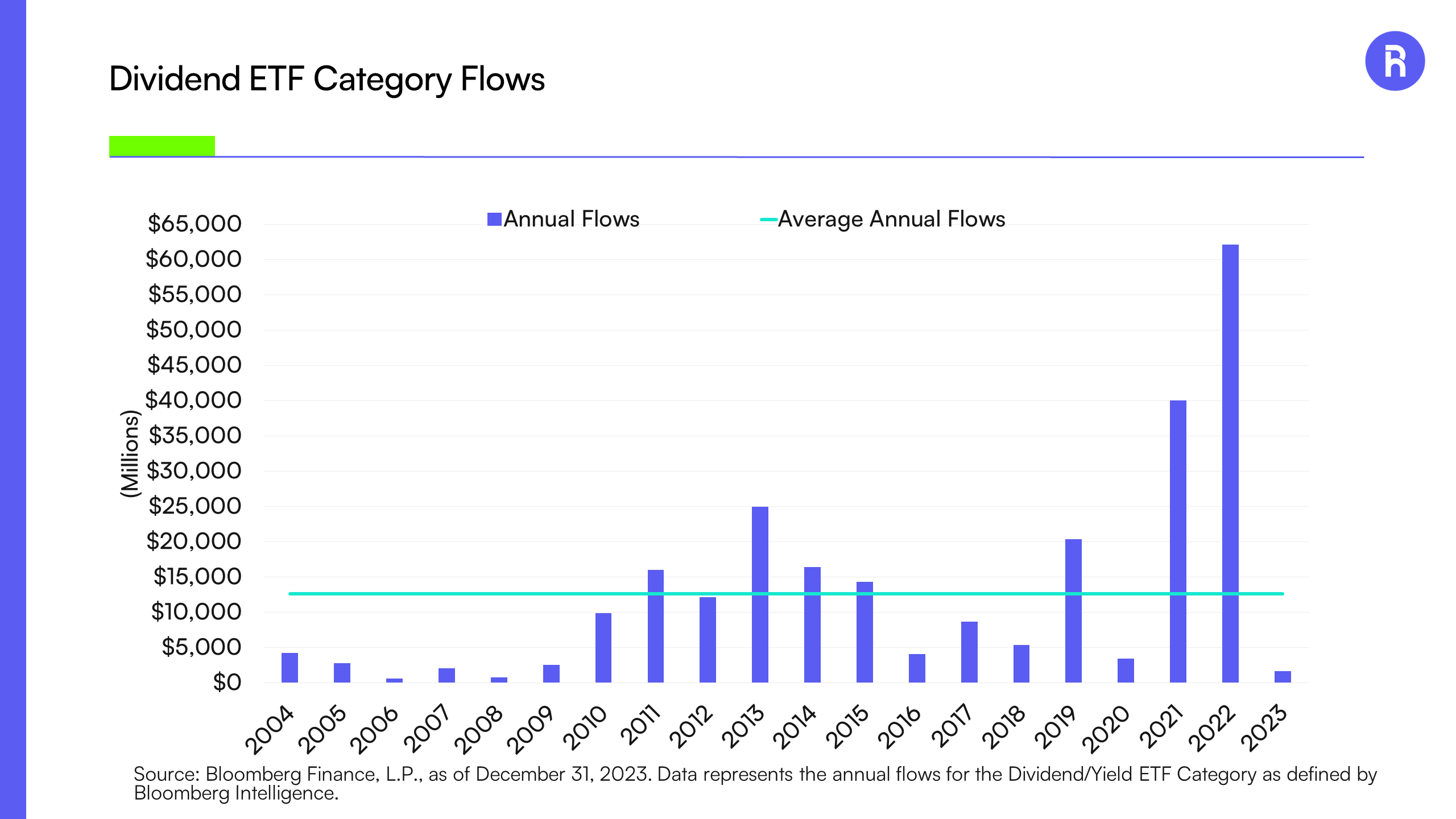

A recent Bloomberg News article highlighted how flows into U.S.-listed dividend exchange-traded funds (ETFs) were weak in 2023.1 In fact, with inflows of only $1.64 billion the category experienced its weakest annual flows ever,2 solidly behind the 20-year average of $12.6 billion.

Flows into Dividend ETFs were Lackluster in 2023

Source: Bloomberg Finance, L.P., as of December 31, 2023. Data represents the annual flows for the Dividend/Yield ETF Category as defined by Bloomberg Intelligence.

Why were flows into Dividend ETFs so modest last year?

On the one hand, investors loaded up on Dividend ETFs in 2021 and 2022, with combined flows in those years topping $100 billion. They may have felt full, especially as US T-Bills and other cash-like instruments offered compelling yield. On the other hand, performance may have had something to do with it.

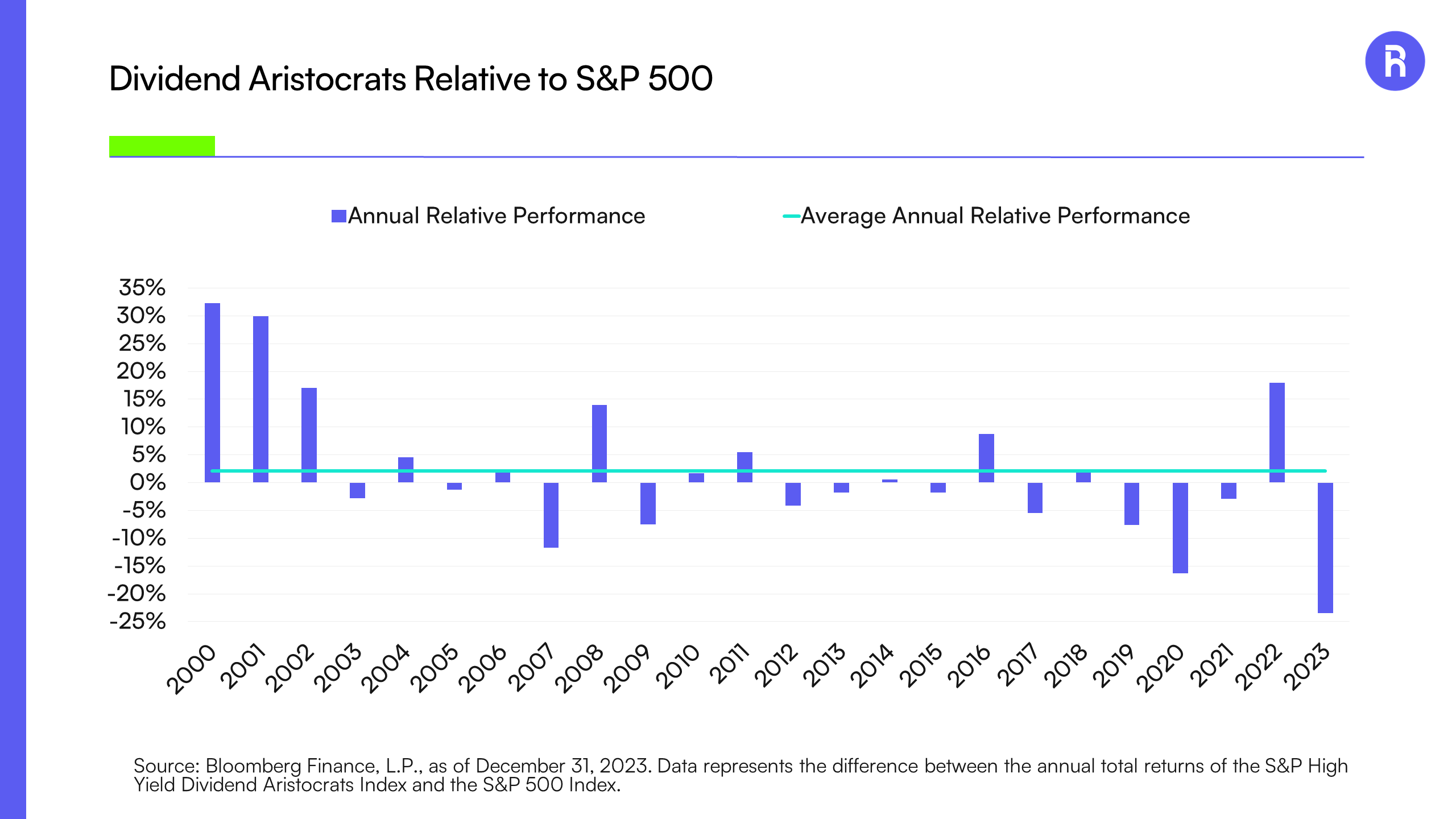

While elite dividend growth companies have been incredibly resilient over long time periods, with average annual outperformance of over 2%, they performed poorly relative to the market in 2023. The S&P High Yield Dividend Aristocrats Index returned a modest 2.83% in 2023, underperforming the S&P 500 Index by 26.29%. This is the worst ever relative performance in the index’s history, dating back to 2000.

The main driver of the group’s 2023 underperformance was lack of exposure to the Magnificent Seven stocks, as not owning these names contributed nearly 40% of the underperformance alone. More broadly, underweights to the top performing Information Technology sector and overweights to the underperforming Utilities and Consumer Staples sectors, did not help either. In short, the weak relative performance may be logical in the context of an extremely narrow market led by a handful of mega cap tech giants. While past performance is not indicative of future results, some of the best years of outperformance for Dividend Growers came in 2000, 2001, 2002, 2008, and 2022, all of which were challenging years for the broader market.

Dividend Aristocrats Underperformed in 2023

Source: Bloomberg Finance, L.P., as of December 31, 2023. Data represents the difference between the annual total returns of the S&P High Yield Dividend Aristocrats Index and the S&P 500 Index. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities mentioned herein, to adopt any investment strategy, or as any call to action. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Please see important disclosures at the end of this commentary regarding hypothetical performance.

After the significant underperformance in 2023, is there an opportunity for dividend stocks in 2024?

Yes. Let’s look at valuations.

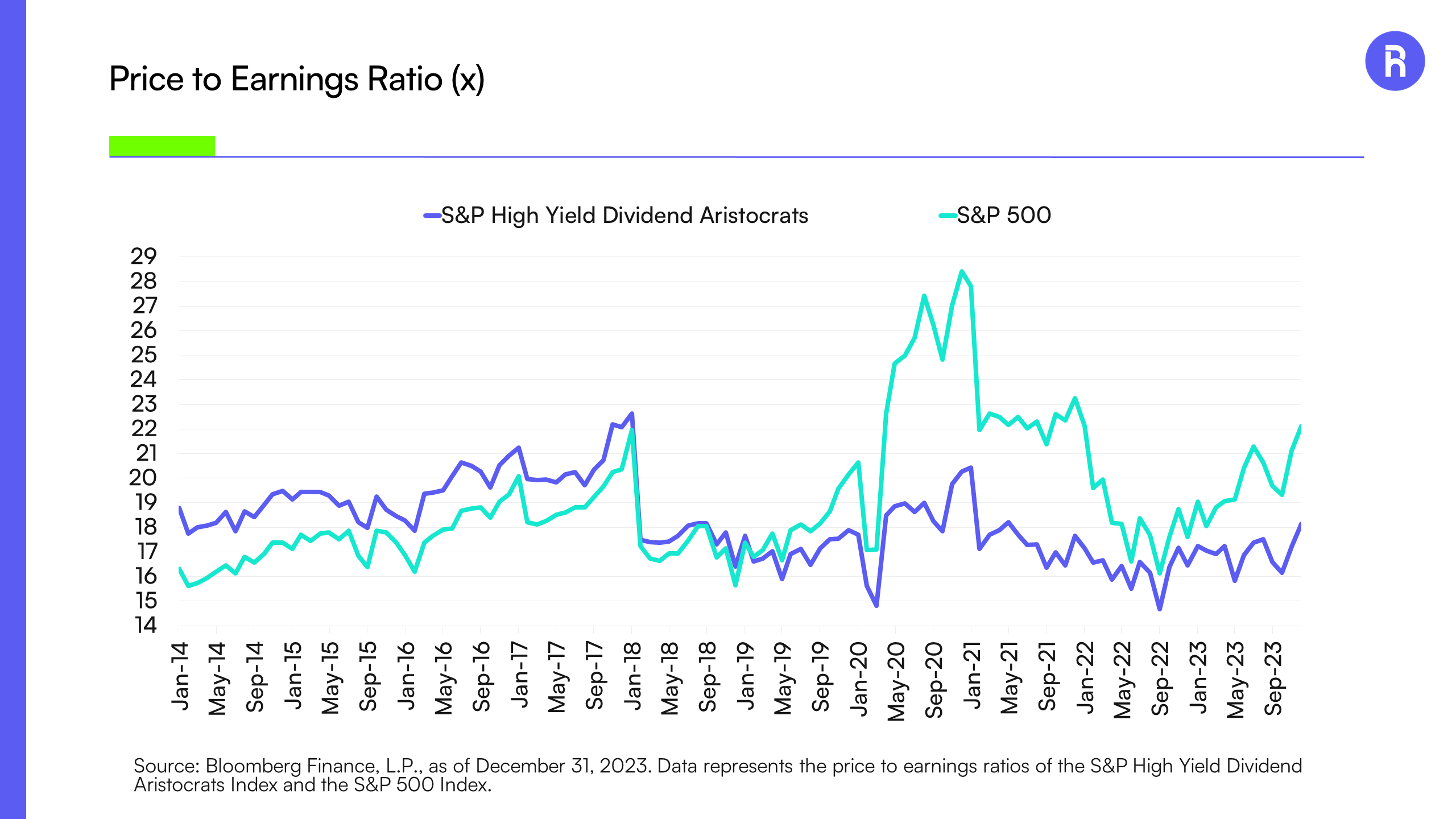

Historically, the Price-to-Earnings (P/E) ratio of Dividend Aristocrats is lower than the S&P 500, indicating they are often valued less expensively, consistent with companies that offer relatively stable income. However, the relative valuation shows that the Dividend Aristocrats were valued more expensively than the S&P 500 for a multi-year prior to the COVD-19 pandemic. At the end of 2023, the Aristocrats were trading at inexpensive valuations compared to the market. Specifically, the Aristocrats closed the year at a P/E ratio of 18.15x (versus the S&P 500 at 22.13x), which is inline with its average P/E over the last 10 years. One way to interpret this is that investors valued stability more than growth prior to the pandemic.

Dividend Aristocrats are Trading at Attractive Valuations

Source: Bloomberg Finance, L.P., as of December 31, 2023. Data represents the price to earnings ratios of the S&P High Yield Dividend Aristocrats Index and the S&P 500 Index. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities mentioned herein, to adopt any investment strategy, or as any call to action. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Please see important disclosures at the end of this commentary regarding hypothetical performance.

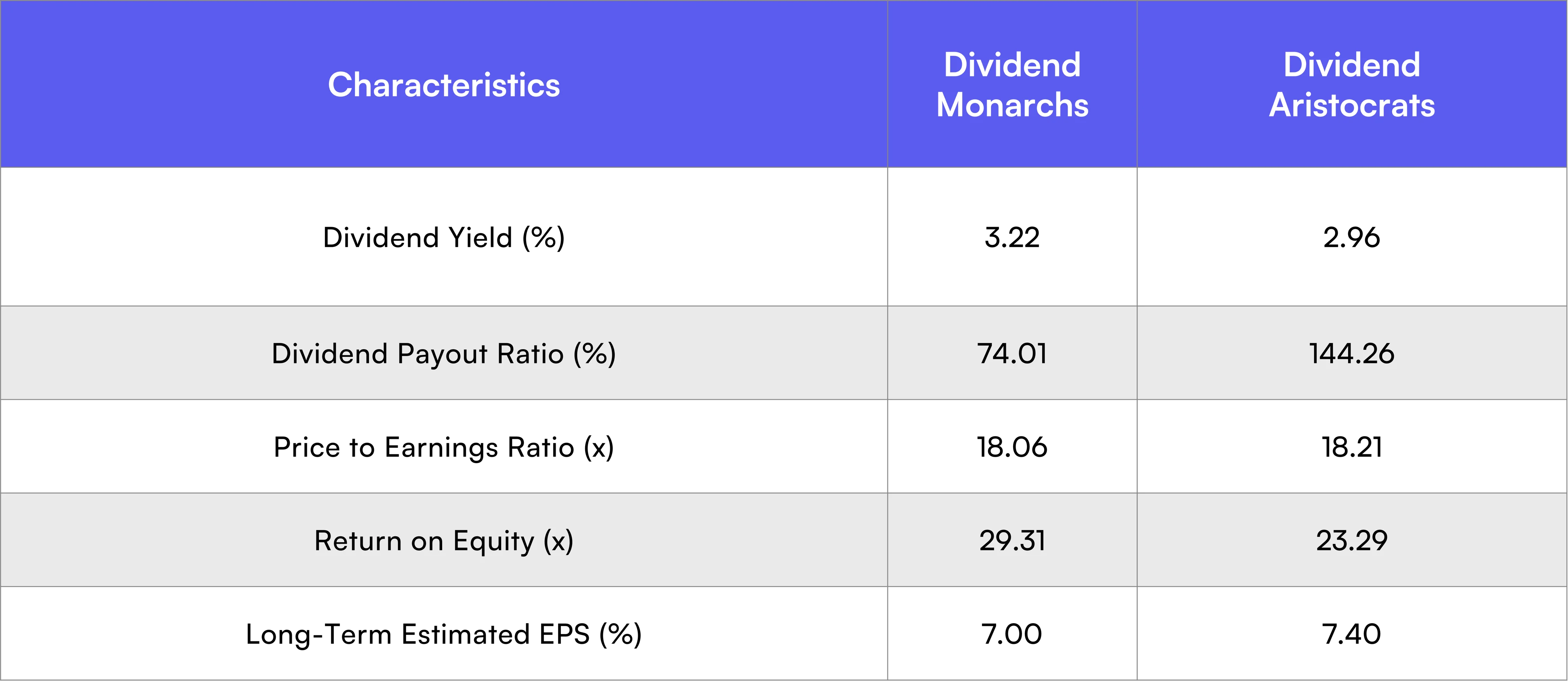

Investors looking to add exposure to high quality, resilient companies may want to look beyond the Dividend Aristocrats and to the Dividend Monarchs, a group of companies which have an even more exclusive 50+ years of consecutive dividend increases.

Comparatively, the Dividend Monarchs, with a higher dividend yield and a lower payout ratio potentially offer a better balance between offering an attractive yield and retaining earnings. Their higher return on equity (ROE) may indicate more efficient use of equity, while the P/E ratios of the two groups are similar, suggesting comparable market valuations.

Dividend Monarchs Potentially Offer Higher Yield with Lower Payout Ratios

Source: Bloomberg Finance, L.P., as of December 31, 2023. Data represents the price to earnings ratios of the S&P High Yield Dividend Aristocrats Index and the S&P 500 Index.

Investors may look to capitalize on these attractive valuations and consider Dividend Monarchs for potentially more stable, value-oriented investments during times of high valuation for the broader market.

Forecasts are inherently limited and should not be relied upon when making investment decisions. There is no guarantee projected growth will occur.

1 https://www.bloomberg.com/news/articles/2023-12-22/wall-street-diversification-trades-get-crushed-as-s-p-500-soars

2 Source: Bloomberg Intelligence, as of December 31, 2023.

Related: Managing Return Expectations for 2024, Under Any “Landing” Scenario