Key takeaways:

- As the recent record-high levels of contango have demonstrated, there are many pitfalls associated with futures-based commodities investing, however the IQ Global Resources ETF (GRES) seeks to avoid many of these risks.

- Commodities have historically been one of the better performing asset classes in the early stages of an economic recovery.

- GRES has a 4-star overall Morningstar Rating™ based on the risk-adjusted returns from among 117 Natural Resources funds as of 4/30/2020.

The extreme excess supply of oil caused by the Saudi-Russia price war in combination with a world-wide halt in consumption due to the Covid-19 lockdowns has led to a historic crash in oil price crashes and a contangoed curve of a lifetime.

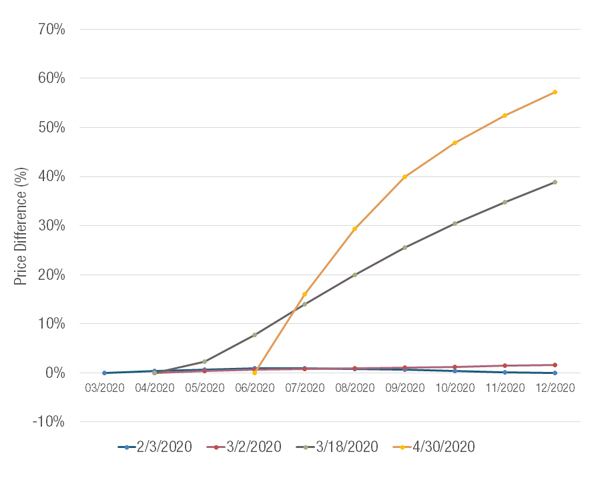

Contango is when the future prices of a commodity are higher than current month’s price. As you can see in the chart below, as of 4/30/2020 (the yellow line), the July 2020 futures contract is trading almost 20% higher than the June 2020 contract. For an investor that has to sell the June contracts to purchase the July contracts, the cost would be a whopping 20%! The August contracts are an additional 13% higher than July.

Oil futures curve in % over spot price

Source: Bloomberg, as of 4/30/2020.

There are many pitfalls associated with futures-based commodity ETFs including:

- the cost of rolling contracts due to contango (see the oil chart above),

- CME (Chicago Mercantile Exchange) position limits on what percentage of the open interest in a contract, or total number of outstanding derivative contracts that have not been settled, that a single investor is allowed to own. This prevents from any one fund, trader, or investor from gaining a controlling interest over the market.

- limits on share issuance for the ETF can cause the ETF arbitrage mechanism to breakdown, and allow the ETF to trade like a closed-end fund,

- excessive concentration in the energy sector, and

- overly high correlation to the broader equity markets.

While some futures-based commodities ETFs are experiencing difficulty in this environment, as an equities-based commodity ETF, the IQ Global Resources ETF (GRES) has no direct exposure to futures contracts rolling month-to-month. This means that GRES is not subject to CME limits on position exposure or on how many shares of the ETF can be created. GRES also limits its weight in energy holdings to help ensure better diversification, and features equity hedges to help reduce the equity market correlation.

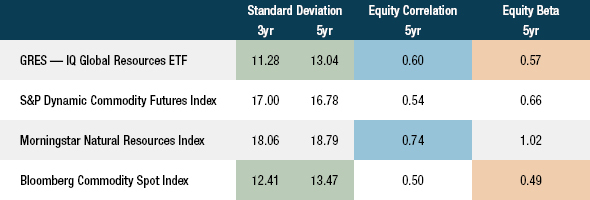

As shown in the table below, GRES has demonstrated 3- and 5-year standard deviations closest to the commodity spot index, meaning that historically, the movement of its returns have been most similar commodities than commodity futures or the Morningstar peer group. In regards to equities, its correlation has been closer to the commodities index than the peer group, meaning that GRES’ daily movements are more like commodities than the peer group. And with an equity beta closest to the commodity spot index than any other approach, GRES moves to the least degree with equity market volatility.

Source: Morningstar, as of 3/31/20. Equities are represented by the S&P 500. Past performance is not a guarantee of future results. It is not possible to invest directly in an index.

Commodities have historically been one of the better performing asset classes in the early stages of an economic recovery.

While no one can accurately predict when that will start, investors may want to start considering which ETF they would want to use. GRES was designed to avoid many of the risks associated with futures-based commodity ETFs and offers a compelling opportunity for clients seeking to invest in commodities to participate in the potential economic rebound in an efficient exposure that is closest to the risk/return characteristics of the commodity spot index.