It's probably safe to assume many advisors are aware that a bitcoin exchange traded fund finally debuted in the U.S. last week.

The ProShares Bitcoin Strategy ETF (NYSEARCA:BITO), which is based on bitcoin futures, raced to $1 billion in assets under management in a matter of days, easily making it one of the most successful new ETFs on record in terms of immediate asset-gathering proficiency.

Another fund followed BITO and it's likely a few more will do the same in the coming days. While futures-backed ETFs aren't the ideal bitcoin fund structure – crypto-enthused clients want physically backed funds – futures funds are the U.S. bitcoin ETF landscape for the time being.

That's alright because it provides value add opportunity for advisors. Some clients aren't familiar with the benefits and drawbacks of futures, regardless of underlying asset class. Others may be pondering if this is the right way for them to get involved with crypto. The list of potential conversation starters goes on.

ETFs Already Affecting Futures Market

Obviously, BITO is a new ETF, but it's already making its presence felt in the bitcoin futures market to the point that the new fund is bumping up its against contract limit and may need to use swaps.

“Still, total Bitcoin futures open interest, of which the CME has an 8% market share, has exploded in the last week, reaching $105B, up from $42B on the day before any Bitcoin futures ETFs began trading,” according to VanEck research. “For comparison, gold futures total $98B and copper futures at $90B. Seen from this vantage point, perhaps the $1B in assets accumulated by the world's first Bitcoin (futures) ETF in two trading days may be less surprising.”

Those are some interesting stats about bitcoin futures, but the points advisors likely want to drive to home clients are the following. First, futures and the related funds act as solid portfolio diversifiers. Second, commodities futures are, historically speaking, great inflation fighters and that's highly relevant today. Finally, bitcoin's track record, though still short relative to other asset classes, shows the digital coin is has diversification and inflation-fighting properties.

“In the wake of recent acceleration in global inflation, Merrill Lynch recently declared 'the end of the 60/40 portfolio,' noting that since 2009, both a 60/40 mix and a 100% equity portfolio had Sortino ratios of about 1.6, meaning annual returns were 1.6 times the downside portfolio volatility,” adds VanEck. “In other words, the lower volatility gained by owning some bonds didn't make up for significantly lower total return in bull markets. We should also note that Merrill Lynch followed up that "end of 60/40" report with 150 pages on digital assets titled 'Only the First Inning.'”

Ethereum Meaningful Here, Too

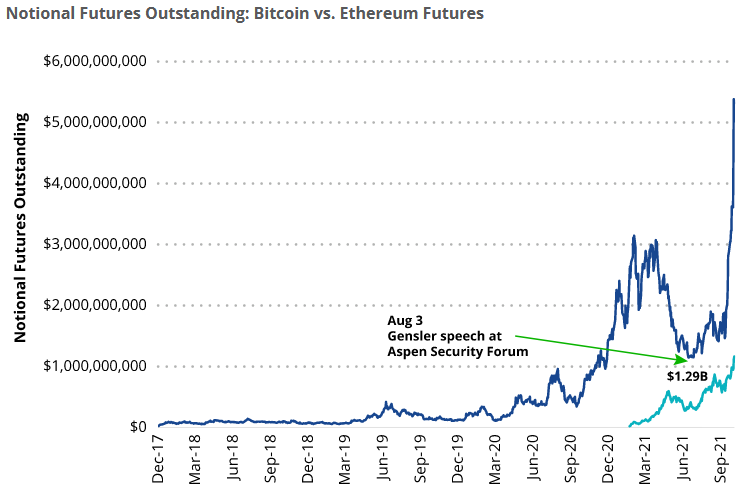

Ethereum, the second-largest digital asset behind bitcoin, is important in this conversation as well because data confirm it's growth, meaning more clients are becoming aware of it and its potential. As the chart below indicates, ethereum's futures market is growing in its own right.

Courtesy: VanEck

Some experts believe ethereum's liquidity is on pace to surpass bitcoin's, potentially paving the way broader adoption in the investment community and more inquiries from clients.

“There will likely be more Ethereum users and more Bitcoin users on each network. In the absence of an enforcement action against Ethereum, which would represent a change in precedent, it will get increasingly harder for the older generation to deny the youth what they already hold. Successful execution of the futures ETFs only reinforces this view,” notes VanEck.

Bottom line: Futures are a foundational piece in the crypto ETF market, but advisors should expect more evolution both in product structure and underlying assets in the future.