I am not a “gold bug” but I will admit to being bugged by gold. That is, all of the attention it gets based on a reputation. I think that like Bitcoin, meme stocks and wildly-overvalued mega cap stocks, there’s one reason to own gold: because others are buying it, lifting the price, which can create short-to-intermediate-term profits for me.

That’s about it. And so, when the GLD ETF appears poised to break out after a dip from recent new highs, that’s a classic pattern that could allow gold to vault higher. For how long? I have no idea. But will I look more closely at participating? Yes, but not heavily, and likely more through my trading accounts than investing accounts.

For instance, implied volatility is reasonable for GLD, which has a liquid options market. So that means I can put an amount out that equals my maximum loss (so I know my risk), and the upside is theoretically unlimited. This is the type of thing I’ll do more of a play-by-play on at SungardenInvestment.com if I do indeed get involved beyond a “swing trade.” But for the here and now, the potential and hype here makes this a key chart I’m watching this week.

Performance That Matters

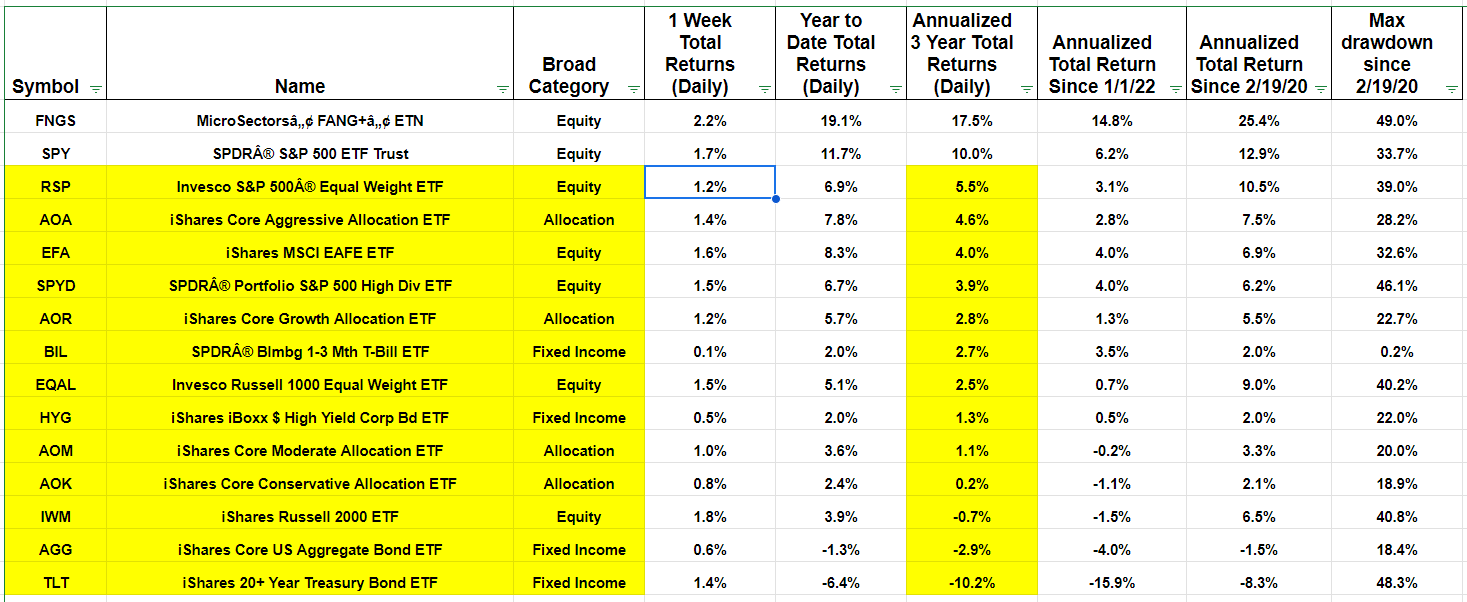

(data through Friday close)

Why so much yellow on this chart? I post it every Sunday, after all. Well, we’re reaching that point where 3-year returns will start to look even worse than they do now for all 15 of these investment styles, excluding FNGS and SPY, whose success is primarily due to what FNGS did over that time.

As it stands now, the 3-year annualized return for all 4 “allocation” ETFs: Aggressive, Growth, Moderate and Conservative, are 0.2% and 4.6% per year. In other words, bonds and most of the stock market has made the last 3 years mediocre at best. But the investing public is only focused on the 2 items not in yellow in the 3-year column.

This is not sour grapes, it is perspective

SPY closed around $415 3 years ago (5/17/21). But it close up around $450 near Labor Day before topping out at $477 between Christmas and New Year’s Eve of 2021.

That matters to me, because if we get a flat or even modestly down market the rest of this year, the media will start to remind investors that they have not made much (even in SPY) for a few years. Investors used to think in decades, but a lot of money moves markets based on much shorter time frames.

That’s why I continue to explore…and find…ETFs and stocks that are somewhat below the radar and out of the mainstream headlines. They are hiding in plain sight, but the attention is so fixated on SPY, QQQ and their biggest holdings, it is like in the move “Up” when the dogs would get so easily distracted by a “squirrel!”

I am about seeing what the market is doing, and saying, and until the current conditions change, I think that returns will come from less-obvious places going forward. Let’s see how it all plays out.

Related: