Written by: Vishal Banè, M.SC., CA (India), CFA | AGF Investments Inc.

While soaring energy prices, conflict in Ukraine and the lingering impacts of the COVID-19 pandemic still dominate headlines around the world, the secular transition to a sustainable economy continues to evolve. Indeed, the disruptions and shortages in fossil-fuel supply only reinforce the need for and significance of this green transition, however distracting short-term crises may be. Here, we highlight three trends that we believe are crucial to the green transformation – and which could present opportunities for sustainability-themed investment strategies.

Knitting the world’s electricity grids

War in Ukraine and the ensuing power crisis in Europe have only highlighted a well-known fact: balancing the supply-and-demand of energy is never an easy task. This is as true for green electricity as it is for traditional oil and gas. The electricity infrastructures that are now in place are becoming increasingly ill-prepared to handle the variable nature of energy produced from solar and wind. As well, the best generation sources of wind and solar energy are frequently found far from the demand centres. Until power infrastructures are well-connected, stable, green and comprehensive, electricity grids will remain a distant goal.

We think, however, that the goal is attainable – and that electrical cable manufacturers will be key enablers of the energy transition by helping to bridge the gaps between distant renewable energy generation and consumption hubs. That effort will require upgrading the wiring that transports power from its source to its destination. It will, for example, involve plugging an offshore wind farm to the grid, as well as interconnecting national and provincial power networks to enable long-distance transmission of clean energy from one region to another.

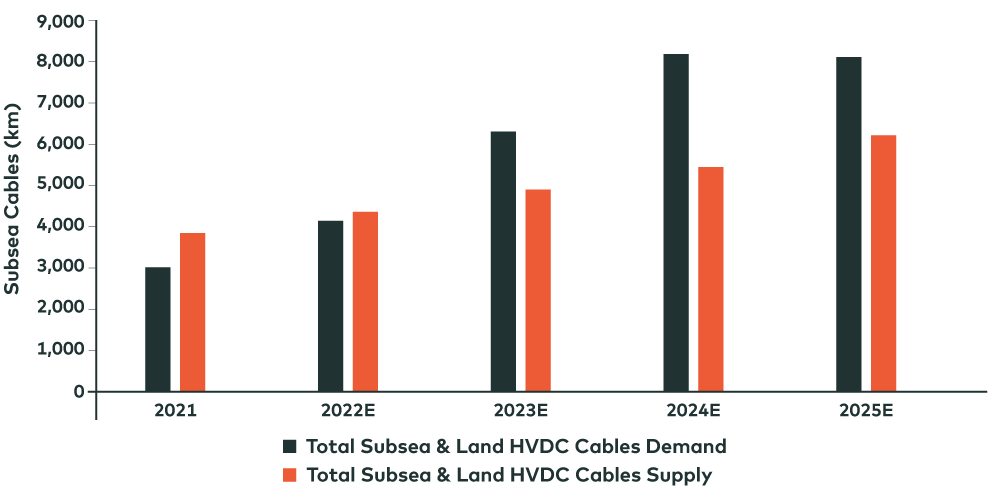

In our view, the significant cabling infrastructure investment required for net-zero carbon targets is driving rising investor interest in cable original equipment manufacturers (OEMs), especially among investors who follow so-called ESG (for environmental, social and governance) strategies. Credit Suisse forecasts significant tightness in industry demand versus supply for high-voltage direct current (HVDC) cables, leading to a favourable backdrop of growth and profits for the cable OEMs. Within the context of offshore wind rollout in the European Union and the United States, Credit Suisse analysts see cabling as a relative bottleneck, supporting a strong pricing and margin environment for these companies.

Subsea and Land High Voltage Direct Current (HVDC) Cables Annual Production Capacity Versus Demand (in Kilometres)

Source: Credit Suisse Subsea and Land HVDC supply/demand model as of April 14, 2022. Based on offshore wind forecasts and already announced interconnection projects and future ‘probable’ interconnection projects.

Renewable energy sources are a crucial component of the EU’s goals to achieve net-zero, and the EU has historically been at the forefront of cable laying and electrification. As a result, according to Credit Suisse, European cable companies hold the majority of the market share outside of China, at more than 80%. This industry consolidation, plus the high capital intensity of subsea and land HVDC cables, offers healthy industry dynamics and strong barriers to entry. The possibility of deep-in-the-ocean, floating wind farms, which are still in a very nascent stage of growth, may further add to the order books of these companies.

The International Energy Agency (IEA) estimates the offshore wind market will grow by 13% per year over next two decades. Each gigawatt of offshore capacity requires around €250mn of cable input including installation (as per Credit Suisse). That makes cables, along with their related installation and maintenance, key enablers of a decarbonized energy system.

Climate adaptation

Every eight years or so, the Intergovernmental Panel on Climate Change (IPCC) issues a fresh “assessment report.” The sixth and most recent IPCC report was published in August 2021, and the second tranche of this report, published in February 2022, addressed the need for climate adaptation. The summary makes it very clear that conditions are deteriorating, as shown by observed increases in high land and ocean temperatures, torrential rains, droughts and wildfires.

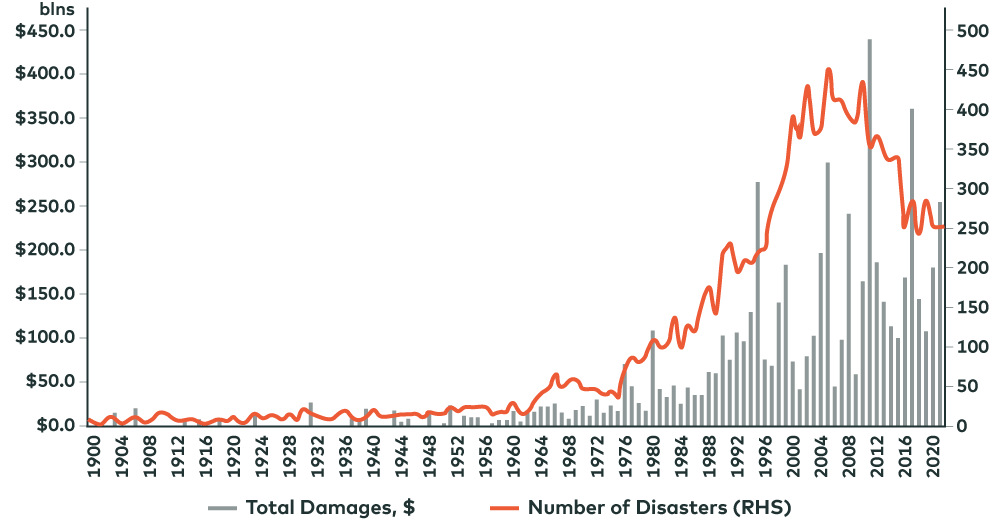

However, most initiatives globally have concentrated on attempting to limit climate change through regulation or carbon pricing, while spending on innovations that could aid society in adapting to actual climate risks has lagged. Overall, society remains underprepared for the potentially devastating human, environmental and financial toll of climate change. In just the past few years, the number and intensity of natural disasters and related damages have been staggering:

Total Damage Globally from Natural Disasters

Source: Citi Research, 2022

Lack of consistent climate reporting and little reliable data on climate-related risks, as well as the perception that adaptation offers low investment returns, have been among the reasons that policy interest in climate adaptation has been low. But this could very well change because the need for such spending is clear.

The UN Environment Programme estimates that annual adaptation costs in poor countries alone are likely to rise from around US$70 billion today to between $140 billion and $300 billion in 2030, and twice that by 2050, in nominal terms. The growing realization that lives and assets are increasingly exposed to climate risk is beginning to shift capital flows toward adaptation. Further, regulations such as “Double Materiality” in the EU and climate-related risk disclosures proposed by the SEC could force companies to disclose more data and accelerate investments into climate adaptation.

We believe a range of attractive investment opportunities could arise from the coming waves of spending on adaptation. Among them:

- Companies providing resiliency, such as backup power during disasters and upgrading the electrical grid and transmission systems.

- Engineering firms helping governments redesign infrastructure for flood mitigation and coastal protection, as well as disaster recovery.

- Companies providing solutions for stormwater management and drainage systems.

Markets are only beginning to understand the need to prepare for and hedge climate risks. An obvious example of failing to invest in climate adaptation is PG&E, a California utility that filed for bankruptcy in large part because of its failure to plan for weather-related shocks. On the other hand, the tailwinds for businesses that provide solutions to these problems are also currently underappreciated. As a result, we have an optimistic outlook about the growth of this theme.

Hydrogen’s jump-start

“After several false starts, a new beginning around the corner,” read the opening of IEA’s 2021 Global Hydrogen Review. Over the past decades, there have been several waves of excitement around replacing hydrocarbons with hydrogen that didn’t pan out as expected. However, hydrogen has gained momentum again. This time it is supported by the increasing applications offered by hydrogen, the need to green the world economy, and the rapidly evolving geopolitical landscape.

The European Commission in March 2022 significantly upgraded its hydrogen ambition by raising its renewable hydrogen target from 5.6 megatons to 20 megatons by 2030. Japan, Australia, China and India have also unveiled national hydrogen strategies. Although the U.S. is lagging the EU and Asia, the Clean Energy for America Act has proposed tax incentives to spur investments in low-carbon hydrogen production.

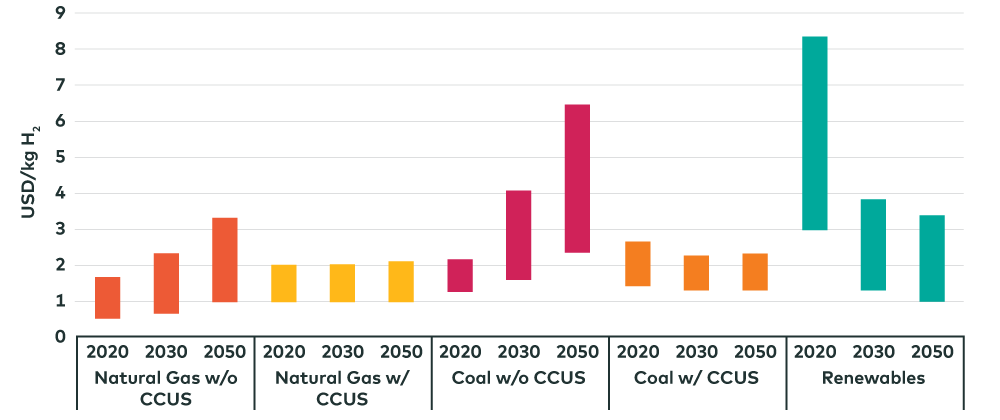

Importantly, hydrogen plays a critical role in difficult-to-abate sectors, such as long-distance and heavy transport, as well as aviation and shipping, iron and steel production, and chemicals manufacturing. At present, grey hydrogen, produced from natural gas without carbon capture, utilization and storage (CCUS), costs between US$0.80 to US$1.40/kg, according to the International Energy Agency, with the cost fluctuating with natural gas prices. Add carbon capture and storage at scale, and you get what is called blue hydrogen, and the costs start looking comparable to grey hydrogen.

Levelized Cost of Hydrogen Production by Technology

Source: International Energy Agency (IEA), 2022

However, because of high production costs, so-called green hydrogen, produced using renewable energy sources, is priced significantly higher – between US$3 and US$8/kg. That makes it an uneconomical option for several end-markets. Supportive policies, such as the proposed hydrogen tax credit in the U.S., could enable long-term technology development and cost-effective emissions reductions in the near term.

Investor interest in green hydrogen opportunities has been dampened by lumpy project outlooks, poor profitability and high capital intensity. However, there are at least two end-markets where we believe green hydrogen has the potential to become economical in this decade.

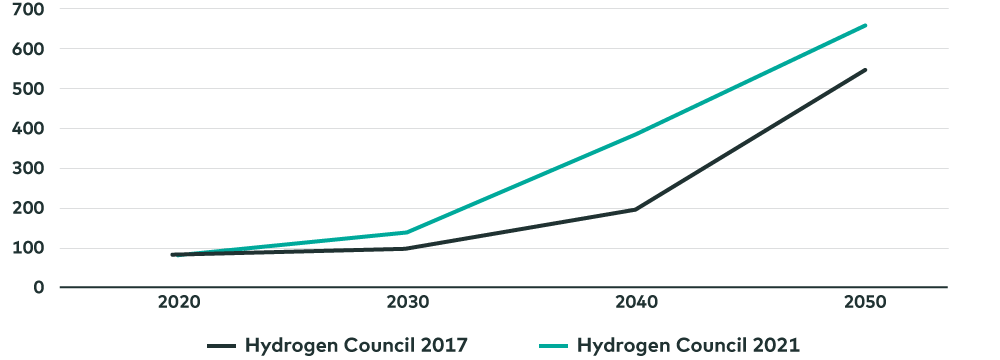

The first is a hydrogen fuel cell power system used by forklifts, which can provide significant benefits to large material-handling customers such as Amazon and Walmart. Morgan Stanley estimates that green hydrogen is already proving economical against traditional lead-acid technology, at US$5-6/kg. The second market is fuel cells used to power transportation, especially long-haul trucking, where the relative economics of green hydrogen are very much dependent on the price of the incumbent fuel, which in most cases is diesel. According to Morgan Stanley estimates, with supportive policy measures, it is not unimaginable to achieve green hydrogen costs of US$3-3.50/kg by 2025, which would become competitive with a more normalized diesel price. To achieve net-zero by 2050, the Hydrogen Council, a lobby group based in Brussels, materially upgraded its forecast for hydrogen demand in 2021. The economics, then, seem to be pointing in the right direction for hydrogen to become, if not dominant, then at least an important part of the energy mix.

Hydrogen Demand (mt)

Source: Hydrogen Council, Morgan Stanley Research as of June 21, 2022

Related: What is Momentum Telling Investors Right Now?

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of July 8, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets. ® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.