In this final installment of considerations for achieving net zero carbon emissions, we consider the investment opportunities that arise from carbon neutral world. Our prior posts identified sources of carbon emissions, discussed a range of solutions, and considered implementation strategies for policymakers. With momentum behind environmental sustainability from policymakers, consumers, corporations and investors, it can create powerful long-term opportunities for growth in portfolios.

Some of the evident opportunities are in burgeoning industries like electric vehicles and renewable energy, which are regarded as critical pieces of the puzzle to reducing emissions from energy and transport. However, in order to enable EVs or solar and wind power, the ecosystem must be established—real estate for charging stations or wind farms, efficient and affordable batteries for EVs, inputs like semiconductors that also have other broad applicability, or the commodities required in some of these technologies. This creates opportunities for both new and existing automakers, utilities, energy, industrials, transport, and materials companies, to name a few. Companies that produce technology that facilitates waste reduction in food and agriculture can benefit. Consumer goods and retailers that adapt to changing consumer preferences like vegan diets, alternative meats, sustainable textiles, or more sustainable supply chains that can reduce environmental impact and emissions are growing in popularity as well.

Investors can evaluate newer innovations, but should be mindful that while rewards could be lofty, there will also be many failures, so investments should be scaled appropriately to risk appetites. Yet, there are still many opportunities within more established companies that diversify their business segments to adapt to a carbon neutral world, and manage the regulatory environment deftly.

The most successful companies of the past decade are not necessarily going to be the leaders of the next decade. Sustainability is likely to be a decade-defining theme, creating opportunities for the next generation of innovative companies.

For more information, please read our paper Achieving net zero: The path to a carbon-neutral world

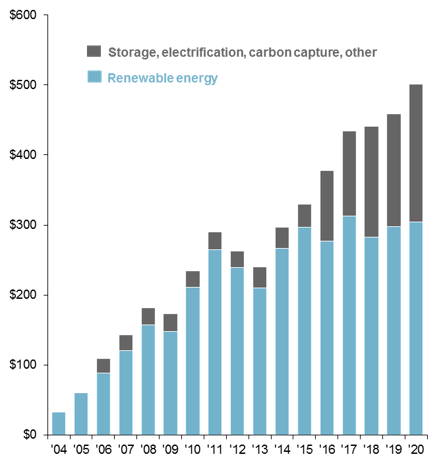

Global investment in energy transition

Billions USD, nominal

Source: Bloomberg NEF, J.P. Morgan Asset Management. Storage, electrification, other includes hydrogen, carbon capture and storage, energy storage, electrified transport and electrified heat. Guide to the Markets – U.S. Data are as of May 17, 2021.

Related: Net Zero: How Can Policymakers Drive Net Zero Carbon Emissions?