Municipal bonds issued by school districts can have a direct impact on helping kids stay in school, especially in communities where they’re most likely to drop out. But the need isn’t always easy to spot. This makes it challenging to know if a bond will effectively target the problem. So, how can muni investors know where or whether their bond will make an impact? Here’s how we figure that out early on, and it starts with data. For example, school districts generally offer free or discounted meals to students who qualify. Understandably, schools within underserved communities experience higher participation in such programs.

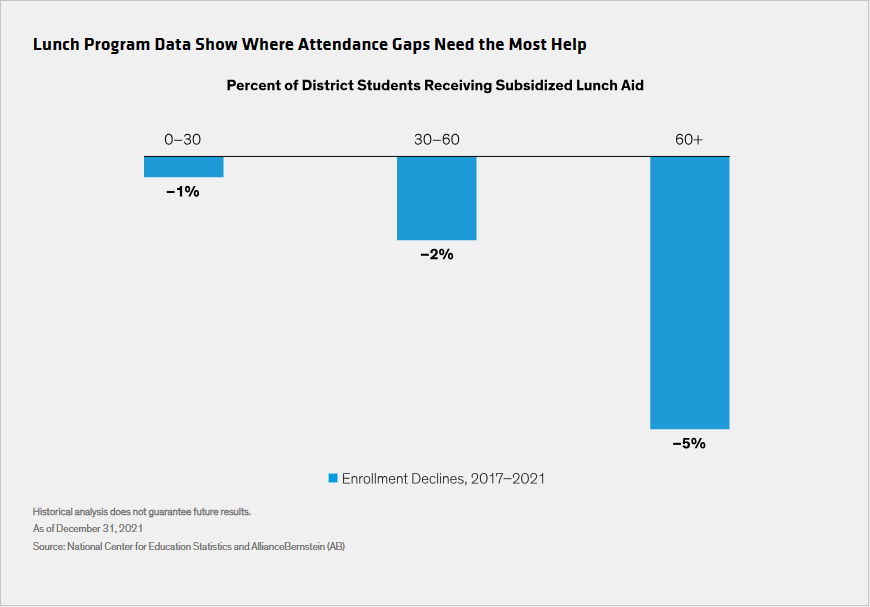

But if we overlay meal program participation rates with enrollment trends from 2017 to 2021, another troubling pattern emerges: the same communities that heavily rely on subsidized school lunches—60% and up—also struggle the most to keep their students in classrooms. Enrollment declines in these districts were almost five times greater than those with the lowest lunch program participation.

Declining enrollment can have concerning developmental consequences for students and financial consequences for schools, which rely on enrollment-based state and federal support. The reasons behind enrollment losses can vary, from outward migration to the rise in homeschooling. But disturbingly, over one-third of enrollment declines in recent years can’t be accounted for by increases in private or home schooling or by changes in demographics. These students have simply gone missing from the system.

Clearly, a bond that targets struggling districts with programs to support higher attendance would stand the best chance of making a meaningful impact. Early data are the key, not only for focusing a bond’s goals, but also for helping muni investors know whether proceeds are likely to reach their objectives in the end.

Related: Capital Markets Outlook: Opportunities for Patient Investors