When it comes to sectors that emanate positive environmental, social and governance (ESG) vibes, technology, communication services and other Silicon Valley-laden growth fare are usually first to clients' minds.

Advisors, too. That's not surprising. Most of the widely followed ESG indexes on the market and the fund's benchmarked to them, are heavily allocated to those sectors. So it's likely surprising to some advisors and many, many more clients that the stodgy old utilities sector is a credible of investing to make an impact.

Utilities are typically prized for above-average dividend yields and lower volatility than cyclical and growth sectors. The group is classified as a defensive sector, meaning advisors typically don't overweight these stocks and related funds for younger clients, but will often steer retirees and older clients in this direction.

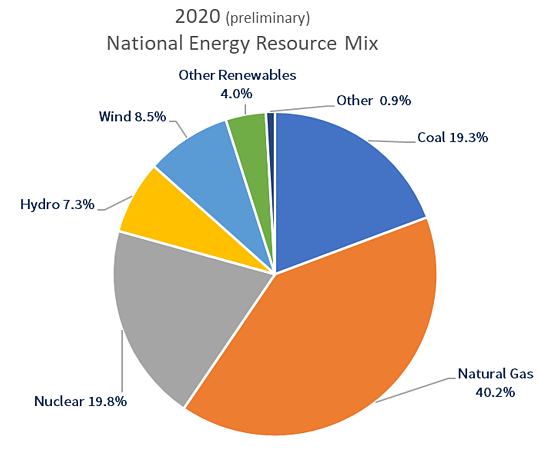

As for environmental friendliness, well, let's just say there are good reason utilities isn't the first idea that comes to mind, as the chart below indicates.

Courtesy: Reaves Asset Management

Reconsidering Utilities Impact

With nearly 60% of the U.S. power mix in 2020 coming from dirty coal and cleaner-burning though still a fossil fuel natural gas, there a couple of things to consider. First, there's ample room for growth by renewable energy sources – in itself an exciting investment prospect.

Second, there are plenty of ways for utilities to shed their boring status and get in on that renewables growth. That scenario is unfolding today and it adds ballast to the notion that utilities are a credible destination for clients seeking exposure to the green energy boom.

“The argument may seem counterintuitive. ESG (Environmental, Social, and Corporate Governance)-labeled strategies, that typically appeal to investors wanting to affect change, tend to own companies that are considered to already have relatively minimal impact on the environment,” according to Reaves Asset Management. “However, we believe that this group of companies will not necessarily be the ones with the potential and opportunity to improve the quality of the environment in the future.”

As seemingly every summer in California and this winter in Texas prove, utilities play vital roles – perhaps the most vital – in renewable energy execution. The concepts of delivering renewable power and keeping the lights on with wind or solar isn't a concept at all without the help of utilities. That's one piece of the puzzle, but there's depth to the utilities/renewables story.

“The move toward renewables is the big macro change that utility investors are funding, but many utility companies are also creating other smaller, but still significant, programs and services that will help to reduce future levels of energy consumption,” adds Reaves. “A few examples include the eventual buildout of electric vehicle charging stations, subsidizing the purchase of energy efficient household appliances, conducting energy audits to help customers identify ways to make their home more energy efficient, and starting initiatives that encourage heat pump installations – a device that lowers household energy use in the summer and winter.”

Other Positive Surprises

Obviously, ESG is a three-pronged idea, but the “E” usually takes precedence over the “S” and “G.” All three are important and it's worth noting utilities are already scoring well on governance and social metrics.

“We believe investors should also feel positive about how utilities screen for the social and governance aspects of their ESG ratings,” said Reaves. “According to Morningstar, utility companies in the S&P 500 Index ranked fifth of eleven sectors on social metrics such as workforce diversity, labor relations, and product safety risks. Since utilities are often large employers within the communities they serve, and provide a vital service, they are held to high standards by regulators and elected officials.”

In other words, there's a lot to like with utilities when it comes to ESG and advisors can position this to clients as an income-generating avenue to contribute to the positive change they want to see.

Advisorpedia Related Articles:

Clean Energy History Is Repeating, Sort of, But There's Opportunity to Consider

ESG Adoption Barriers Are Declining. That's Good for Advisors

ESG Is Finally Making its Way to Smaller Stocks