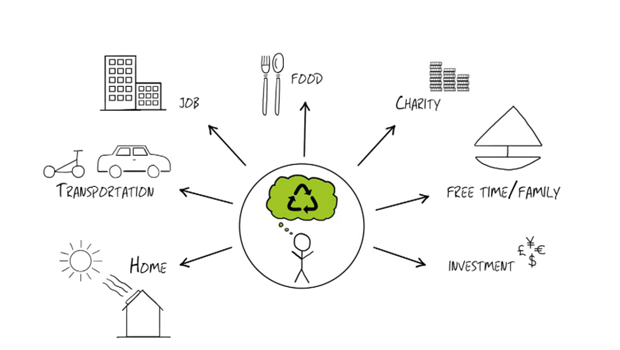

Increasingly, we as investors want to incorporate sustainable companies and business practices into our lives. Fortunately, there are many areas of our lives where we can intentionally spend and direct our dollars to facilitate the change we want to see in the world. The illustration below from Dimensional Fund Advisors shows many of the areas we have direct control over as we make our day-to-day decisions:

Incorporating your values into your investment strategy is just one of the areas that may make an impact. Social and Sustainable investing has also become increasingly accessible to everyday investors, with smaller necessary sacrifices in terms of performance and cost. However, before deciding if this method of investing is right for you, it’s important to consider some of the challenges and tradeoffs.

Traditionally, ESG or Social mutual fund strategies exclude companies that provide products and services that investors find problematic. This is the standard approach when investors express a desire that their money not go toward a particular area. This may mean a focus on reducing greenhouse gas emissions or excluding stocks of companies that derive a large percentage of their profits from gambling, adult entertainment, or tobacco (“Sin Stocks”).

The theory with this approach is that it will become harder for these companies to build capital which may lead them to change their behaviors. There is still a question of whether this is an effective way to facilitate the changes investors may want to see in the world or if other behaviors would be more effective. For example, if a large enough segment of investors divest from companies that derive profits from the unsustainable production of palm oil, it might drive down those stock prices. However, if consumer demand exists, there will likely be other investors who will be willing to buy at those cheaper prices, resulting in higher profits for them and no incentive for change.

In addition to a question on the basic theory of excluding certain areas of the market from investment, there are some additional risks like emotional manipulation by investment companies, higher fees, green washing, ratings inconsistencies, and potential for lower investment returns.

On the flip side, there may be opportunities for investors, particularly at the institutional level, to practice engagement with those companies. This engagement has the potential to influence future business practices for the better. Examples of this might include oil companies working to provide clean energy solutions and tobacco companies working to create less harmful products. Individual investors utilizing mutual fund managers that adopt this approach could benefit financially from the positive changes that may occur.

A recent Bogleheads podcast featuring Larry Swedroe and Ellen Quigley does a great job of outlining the challenges, risks, and opportunities. Taking these considerations into account, you may decide that maintaining a broadly diversified portfolio is the right approach and choose to pursue changes in other areas of your life. You may alternately decide that you don’t want to profit from a particular practice or industry. Both approaches have merit.

Beyond your investments, you can also exercise consumer and philanthropic practices to influence change. Examples of this might include:

- Installing solar panels on your home

- Driving an Electric Vehicle

- Choosing not to patronize business that support or engage in practices you don’t agree with

- Shopping at retailers whose values align with yours

- Donating to or volunteering with organizations that you believe are making positive contributions to society and will move us in the direction toward a more sustainable, just future

Related: Climate Crisis: Investors Snap Up Sustainable Funds as Temperatures Soar