I have made no secret of my disdain for ESG, an over-hyped and over-sold acronym, that has been a gravy train for a whole host of players, including fund managers, consultants and academics. In response, I have been told that the problem is not with the idea of ESG, but in its measurement and application, and that impact investing is the solution to both market and society's problems. Impact investing, of course, is investing in businesses and assets based on the expectation of not just earning financial returns, but also creating positive change in society.

It is human nature to want to make the world a better place, but does impact investing have the impact that it aims to create? That is the question that I hope to address in this post. In the course of the post, I will work with two presumptions. The first is that the problems for society that impact investing are aiming to address are real, whether it be climate change, poverty or wealth inequality. The second is that impact investors have good intentions, aiming to make a positive difference in the world. I understand that there will be some who feel that these presumptions are conceding too much, but I want to keep my focus on the mechanics and consequences of impact investing, rather than indulge in debates about society's problems or question investor motives.

Impact Investing: The What, The Why and the How!

Impact investments are investments made with the intent of generating benefits for society, alongside a financial return. That generic definition is not only broad enough to cover a wide range of impact investing actions and motives, but has also been with us since the beginning of time. Investors and business people have often considered social payoffs when making investments, though they have differed on the social outcomes that they seek, and the degree to which they are willing to sacrifice the bottom line to achieve those outcomes.

In the last two decades, this age-old investing behavior has come under the umbrella of impact investing, with several books on how to do it right, academic research on how it is working (or not), and organizations dedicated to advancing its mission. The Global Impact Investing Network (GIIN), a non-profit that tracks the growth of this investing movement, estimated that more than $1.16 trillion was invested by impact investors in 2021, with a diverse range of investors:

| Global Impact Investing Network, 2022 Report |

Not surprisingly, the balance between social impact and financial return desired by investors, varies across investor groups, with some more focused on the former and others the latter. In a survey of impact investors, GIIN elicited these responses on what types of returns investors expected to earn on their impact investments, broken down by groups:

| Global Impact Investing Network, 2020 Report |

Almost two thirds of impact investors believe that they can eat their cake and have it too, expecting to earn as much or more than a risk-adjusted return, even as they do good. That delusion running deepest among pension funds, insurance companies, for-profit fund managers and diversified financial investors, who also happen to account for 78% of all impact investing funds.

If having a positive impact on society, while earning financial returns, is what characterizes impact investing, it can take one of three forms:

- Inclusionary Impact Investing: On the inclusionary path, impact investors seek out businesses or companies that are most likely to have a positive impact on whatever societal problem they are seeking to solve, and invest in these companies, often willing to pay higher prices than justified by the financial payoffs on the business.

- Exclusionary Impact Investing: In the exclusionary segue, impact investors sell shares in businesses that they own, or refuse to buy shares in these businesses, if they are viewed as worsening the targeted societal problem.

- Evangelist Impact Investing: In the activist variant, impact investors buy stakes in businesses that they view as contributing to the societal problem, and then use that ownership stake to push for changes in operations and behavior, to reduce the negative social or environmental impact.

The effect of impact investing in the inclusionary and exclusionary paths is through the stock price, with the buying (selling) in inclusionary (exclusionary) investing pushing stock prices up (down), which, in turn, decreases (increases) the costs of equity and capital at these firms. The changes in costs of funding then show up in investing decisions and growth choices at these companies, with good companies expanding and bad companies shrinking.

With evangelist impact investing, impact investors aim to get a critical mass of shareholders as allies in pushing for changes in how companies operate, shifting the company away from actions that create bad consequences for society to those that have neutral or good consequences.

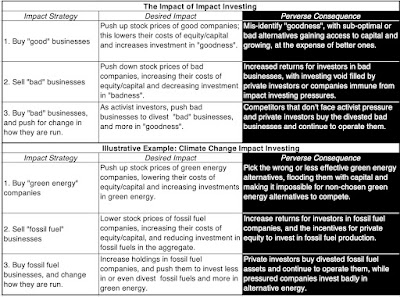

As you can see, for impact investing to have an impact on society, a series of links have to work, and if any or all of them fail, there is the very real potential that impact investing can have perverse consequences.

- With inclusionary investing, there is the danger that you mis-identify the companies capable of doing good, and flood these companies with too much capital. Not only is capital invested in these companies wasted, but increases the barriers to better alternatives to doing good.

- With exclusionary investing, pushing prices down below their "fair" values will allow investors who don’t care about impact to earn higher returns, from owning these companies. More importantly, if it works at reducing investment from public companies in a "bad" business, it will open the door to private investors to fill the business void.

- With evangelist investing, an absence of allies among other shareholders will mean that your attempts to change the course of businesses will be largely unsuccessful. Even when you are successful in dissuading these companies from "bad" investments, but may not be able to stop them from returning the cash to shareholders as dividends and buybacks, rather than making "good" investments.

In the table below, I look at the potential for perverse outcomes under each of three impact investing approaches, using climate change impact investing as my illustrative example:

The question of whether impact investing has beneficial or perverse effects is an empirical question, not a theoretical one, since your assumptions about market depth, investor behavior and business responses can lead you to different conclusion.

It is worth noting that impact investing may have no effect on stock prices or on corporate behavior, either because there is too little money behind it, or because there is offsetting investing in the other direction. In those cases, impact investing is less about impacting society and more about alleviating the guilt and cleansing the consciences of the impact investors, and the only real impact will be on the returns that they earn on their portfolios.

The Impact of Impact Investing: Climate Change

While impact investing can be directed at any of society's ills, it is undeniable that its biggest focus in recent years has been on climate change, with hundreds of billions of dollars directed at reversing its effects. Climate change, in many ways, is also tailored to impact investing, since concerns about climate change are widely held and many of the businesses that are viewed as good or bad, from a climate change perspective, are publicly traded. As an empirical question, it is worth examining how impact investing has affected the market perceptions and pricing of green energy and fossil fuel companies, the operating decisions at these companies, and most critically, on the how we produce and consume energy.

Fund Flows

The biggest successes of climate change impact investing have been on the funding side. Not only has impact investing directed large amounts of capital towards green and alternative energy investments, but the movement has also succeeded in convincing many fund managers and endowments to divest themselves of their investments in fossil fuel companies.

- As concerns about climate change have risen, the money invested in alternative energy companies has expanded, with $5.4 trillion cumulatively invested in the last decade:

| Source: BloombergNEF |

Almost half of this investment in alternative energy sources has been in renewable energy, with electrified transport and electrified heat accounting for a large portion of the remaining investments.

- On the divestment side, the drumbeat against fossil fuel investing has had an effect, with many investment fund managers and endowments joining the divestiture movement:

By 2023, close to 1600 institutions, with more than $40 trillion of funds under their management, had announced or concluded their divestitures of investments in fossil fuel companies.

If impact investing were measured entirely on fund flows into green energy companies and out of fossil fuel companies, it has clearly succeeded.

Market Price (and Capitalization)

It is undeniable that fund flows into or out of companies affects their stock prices, and if the numbers in the last section are even close to reality, you should have expected to see a surge in market prices at alternative energy companies, as a result of funds flowing into them, and a decline in market prices of fossil fuel companies, as fossil fuel divestment gathers steam.

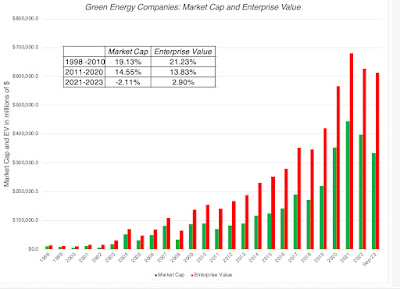

- On the alternative energy front, as money has flowed into these companies, there has been a surge in enterprise value (equity and net debt) and market capitalization (equity value); I report both because impact investing can also take the form of green bonds, or debt, at these companies. The enterprise value of publicly traded alternative energy companies has risen from close to zero two decades ago to more than $700 billion in 2020, before losing steam in the last three years:

Adding in the value of private companies and start-ups in this space would undoubtedly push up the number further.

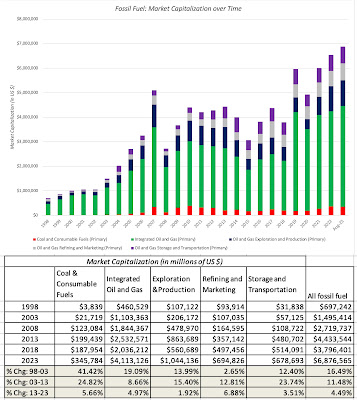

- On the fossil fuel front, the fossil fuel divestments have had an impact on market capitalizations, though there are signs that the effect is weakening:

In the last decade, when fossil fuel divestment surged, the percentage changes in market capitalization at fossil fuel companies lagged returns on the market, with fossil fuel companies reporting a compounded annual percentage increase of 4.49% a year.. The negative effect was strongest in the middle of the last decade, but market prices for fossil fuel companies have recovered strongly between 2020 and 2023.

It is worth noting that even after their surge in market cap in the last decade, alternative energy companies have a cumulated enterprise value of about $600 billion in September 2023, a fraction of the $8.5 trillion of cumulated enterprise value at fossil fuel companies.

Investor perceptions

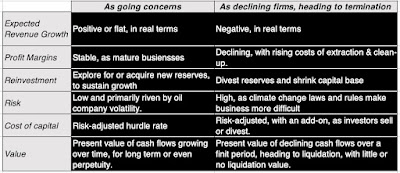

Impact investing has always been about changing investor perceptions of energy companies, more than just prices. In fact, some impact investors have argued that their presence in the market and advocacy for alternative energy has led investors to change their views about fossil fuel companies, shifting from viewing them as profitable, cash-rich businesses with extended lives, to companies living on borrowed time, looking at decline and even demise. In intrinsic valuation terms, that shift should show up in the pricing, with lower value attached to the latter scenario than the former:

On the green energy front, to see if investors perceptions of these companies have changed, I look at two the pricing metrics for green energy companies - the enterprise value to EBITDA and enterprise value to revenue multiples:

The numbers offer a mixed message on whether impact investing has changed investor perceptions, with EV to EBITDA multiples staying unchanged, between the 1998-2010 and 2011-2023 time periods, but EV as a multiple of revenues soaring from 2.62 in the 1998-2010 time period to 5.95 in the 2011-2023 time period. The fund flows into green energy are affecting pricing, though it remains an open question as to whether the pricing is getting too rich, as too much money chases too few opportunities.

Looking at fossil fuel firms, the poor performance in the last decade seems to support the notion that impact investing has changed how investors perceive fossil fuel companies, but there are some checks that need to be run to come that conclusion.

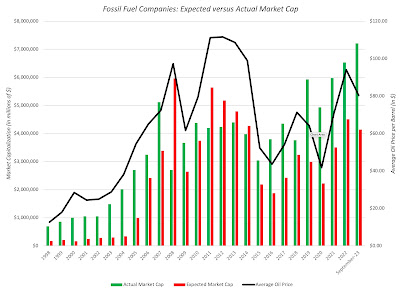

- Oil Price Effect: The market capitalization of oil companies is dependent on oil prices, as you can see in the figure below, where the collective market capitalization of fossil fuel companies is graphed against the average oil price each year from 1970 to 2022; almost 70% of the variation in market capitalization over time explained by oil price movements.

To separate impact investing divestment effects from oil price effects, I estimated the predicted market capitalization of fossil fuel companies, given the oil price each year, using the statistical relationship between market cap and oil prices in the twenty five years leading into the forecast year. (I regress market capitalization against average oil price from 1973 to 1997 to estimate the expected market cap in 1998, given the oil price in 1998, and so on, for every year from 1998 to 2023. Note that the only thing you can read these regressions is that market capitalization and oil prices move together, and that there is no way to draw conclusions about causation):

If divestitures are having a systematic effect on how markets are pricing fossil fuel companies, you should expect to see the actual market capitalizations trailing the expected market capitalization, based on the oil price. That seems to be the case, albeit marginally, between 2011 and 2014, but not since then. In short, the divestiture effect on fossil fuel companies has faded over time, with other investors stepping in and buying shares in their companies, drawn by their earnings power.

- Pricing: If impact investing is changing investor perceptions about the future growth and termination risk at fossil fuel companies, it should show up in how these companies are priced, lowering the multiples of revenues or earnings that investors are willing to pay. In the chart below, I look at the pricing of fossil fuel companies over time, using EV to sales and EV to EBITDA as pricing metrics: While the pricing metrics swing from year to year, that has always been true at oil companies, since earnings and revenues vary, with oil prices. However, if impact investing is having a systematic effect on how investors are pricing companies, there is little evidence of that in this chart.

In sum, while it is possible to find individual investors who have become skeptical about the future for fossil fuel companies, that view is not reflective of the market consensus. I do believe that investors are pricing fossil fuel companies now, with the expectation of much lower growth in the future, than they used to, but that is coming as much from these companies returning more of their earnings as cash and reinvesting less than they used to, as it is from an expectation that the days of fossil fuel are numbered. Some impact investors will argue that this is because investors are short-term, but that is a double-edged sword, since it undercuts the very idea of using investing as the vehicle to create social and environmental change.

Operating Impact

Impact investing, in addition to affecting pricing of green energy and fossil fuel companies, can also have effects on how fossil fuel companies perform and operate. On the profitability front, fossil fuel companies seem to have weathered the onslaught of climate change critics, with revenues and profit margins (EBITDA and operating) bouncing back from a slump between 2014 and 2018 to reach historic highs in 2022.

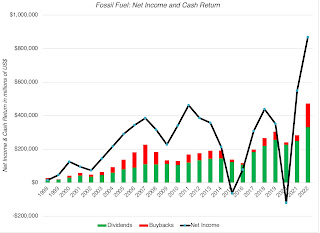

A key development over the last decade, as profits have returned, is that fossil fuel companies are returning much of cash flows that they are generating to their shareholders in the form of dividends and buybacks, notwithstanding the pressure from activist impact investors that they reinvest that money in green energy projects:

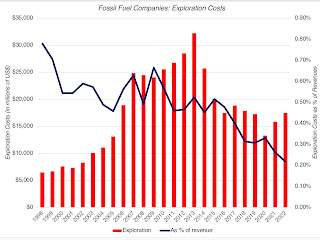

In one development that impact investors may welcome, fossil fuel companies are collectively investing less in exploration for new fossil fuel reserves in the last decade than they did in prior ones:

If you couple this trend of exploring less with the divestitures of fossil fuel reserves, over the last decade, there is a basis for the argument that fossil fuel companies are reducing their fossil fuel presence, and some impact investing advocates may be tempted to declare victory. After all, if the objective is to reduce fossil fuel production, does it not advance your cause if less money is being spent exploring for coal, oil and gas?

Before claiming a win, though, there is a dark side to this retreat by public fossil-fuel companies, and that comes from private equity investors and privately-owned (or government-owned) oil companies stepping into the breach; many of the divestitures and sales of fossil fuel assets by publicly traded companies have been to private buyers, and the assets being divested are often among the dirtiest (from a climate-change perspective) of their holdings.. Over the last decade, some of private equity’s biggest players have invested well over $1.1 trillion in fossil fuel, with the investments ranging the spectrum.

| Source: Pitchbook |

While there was an uptick in investments in renewables in 2019 and 2020, the overwhelming majority of private equity investments during the decade were in fossil fuels. In the process, private equity firms like the Carlyle Group and KKR have become major holders of fossil fuel reserves, and there are a few private buyers who have profited from buying abandoned and castoff oil wells from oil companies, pressured to sell by impact investors. While climate change advocates are quick to point to this public-to-private transition of fossil fuel assets as a flaw, they fail to recognize that it is is a natural side-effect of an approach that paints publicly traded fossil fuel firms as villains and shuns their investments, while continuing to be dependent on fossil fuels for meeting energy needs.

On the activist front, there is evidence that impact investing's capacity to change oil company behavior is losing its potency. While fossil fuel companies were quick to give in to pressure from impact investors to de-carbonize, for much of the last decade, the Russian invasion of Ukraine seems to have been an "emperor-has-no-clothes" moment for green energy advocates, laying bare how reliant the globe still is on fossil fuels for its energy needs. In the aftermath, the biggest fossil fuel companies have become bolder about their plans to stay in and grow their fossil fuel investments, with Royal Dutch taking a stake in Qatari gas field, BP announcing it will produce more oil and gas, Exxon Mobil buying Pioneer Natural Resources, a shale driller for $60 billion, and Petrobras reversing course on divestitures.

Macro Impact

The success or failure of impact investing, when it relates to climate change, ultimately comes from the changes it creates in how energy is produce and consumed, and it is on this front that the futility of the movement is most visible. While alternative energy sources have expanded their production, it has not been at the expense of oil consumption, which has barely budged over the last decade.

| EIA: World Oil Consumption |

Fairly or unfairly, the pandemic seems to have done more to curb oil consumption than all of impact investing's efforts over the last decade, but the COVID effect, which saw oil consumption drop in 2020 has largely faded.

Taking a global and big-picture perspective of where we get our energy, a comparison of energy sources in 1971 and 2019 yields a picture of how little things have changed:

| IEA: World Energy Balances Overview |

Fossil fuel, which accounted for 86.6% of energy production in 1971, was responsible for 80.9% of production in 2019, with almost all of that gain from coming from nuclear energy, which many impact investors viewed as an undesirable alternative energy source for much of the last decade. Focusing on energy production just in the US, the failure of impact investing to move the needle on energy production can be seen in stark terms:

| Source: U.S. Energy Information Administration |

Fossil fuels account for a higher percent of overall energy produced in the United States today than they did ten or fifteen years ago, with gains in solar, wind and hydropower being largely offset by reductions in nuclear energy. If this is what passes for winning in impact investing, I would hate to see what losing looks like.

I have tried out variants of this post with impact investing acquaintances, and there are three broad responses that they have to its findings (and three defenses for why we should keep trying):

- Things would be worse without impact investing: It is impossible to test this hypothetical, but is it possible that our dependence on fossil fuels would be even greater, without impact investing making a difference? Of course, but that argument would be easier to make, if the trend lines were towards fossil fuels before impact investing, and moved away from fossil fuels after its rise. The data, though, suggests that the biggest shift away from fossil fuels occurred decades ago, well before impact investing was around, primarily from the rise of nuclear energy, and that impact investing's tunnel vision on alternative energy has actually made things worse.

- It takes time to create change: It is true that the energy business is an infrastructure business, requiring large investments up front and long gestation periods. It is possible that the effects of impact investing are just not being felt yet, and that they are likely to show up later this decade. This would undercut the urgency argument that impact investors have used to induce their clients to invest large amounts and doing it now, and if they had been more open about the time lag from the beginning, this argument would have more credibility today.

- Investing cannot offset consumption choices: If the argument is that impact investing cannot stymie climate change on its own, without changes in consumer behavior, I could not agree more, but changing behavior will be painful, both politically and economically. I would argue that impact investing, by offering the false promise of change on the cheap, has actually reduced the pressure on politicians and rule-makers to make hard decisions on taxes and production.

Even conceding some truth in all three arguments, what I see in the data is the essence of insanity, where impact investors keep throwing in more cash into green energy and more vitriol at fossil fuels, while the global dependence on fossil fuels increases.

Impact Investing: Investing for change

Much of what I have said about impact investing's quest to fight climate change can be said about the other societal problems that impact investors try to address. Poverty, sexism, racism and inequality have had impact investing dollars directed at them, albeit not on the same scale as climate change, but are we better off as a society on any of these dimensions? To the response that doing something is better than being doing nothing, I beg to differ, since acting in ways that create perverse outcomes can be worse than sitting still. To end this post on a hopeful note, I believe that impact investing can be rescued, albeit in a humbler, more modest form.

- With your own money, pass the sleep test: If you are investing your own money, your investing should reflect your pocketbook as well as your conscience. After all, investors, when choosing what to invest in, and how much, have to pass the sleep test. If investing in Exxon Mobil or Altria leads you to lose sleep, because of guilt, you should avoid investing in these companies, no matter how good they look on a financial return basis.

- With other people's money, be transparent and accountable about impact: If you are investing other people’s money, and aiming for impact, you need to be explicit on what the problem is that you are trying to solve, and get buy in from those who are investing with you. In addition, you should specify measurement metrics that you will use to evaluate whether you are having the impact that you promised.

- Be honest about trade offs: When investing your own or other people's money, you have to be honest with yourself not only about the impact that you are having, but about the trade offs implicit in impact investing. As someone who teaches at NYU, I believe that NYU's recent decision to divest itself of fossil fuels will not only have no effect on climate change, but coming from an institution that has established a significant presence in Abu Dhabi, it is an act of rank hypocrisy. It is also critical that those impact investors who expect to make risk-adjusted market returns or more, while advancing social good, recognize that being good comes with a cost.

- Less absolutism, more pragmatism: For those impact investors who cloak themselves in virtue, and act as if they command the moral high ground, just stop! Not only do you alienate the rest of the world, with your I-care-about-the-world-more-than-you attitude, but you eliminate any chances of learning from your own mistakes, and changing course, when your actions don't work.

- Harness the profit motive: I know that for some impact investors, the profit motive is a dirty concept, and the root reason for the social problems that impact investing is trying to address. While it is true that the pursuit of profits may underlie the problem that you are trying to solve, the power from harnessing the profit motive to solve problems is immense. Agree with his methods or not, Elon Musk, driven less by social change and more by the desire to create the most valuable company in the world, has done more to address climate change than all of impact investing put together.

I started this post with two presumptions, that the social problems being addressed by impact investors are real and that impact investors have good intentions, and if that is indeed the case, I think it is time that impact investors face the truth. After 15 years, and trillions invested in its name, impact investing, as practiced now, has made little progress on the social and environmental problems that it purports to solve. Is it not time to try something different?