Written by: Erin Bigley, Vivek Bommi, Eamonn Buckley and Markus Peters

The European Central Bank (ECB) is set to tilt its monetary policy strategy towards corporate bond issuers with “better climate performance.” That’s a laudable but challenging goal to implement. While simple decision rules may seem useful, we think investors need a holistic understanding of climate issues to address the causes and effects of climate change.

Last month, the ECB announced an official start date of October 2022 for building climate change into its monetary policy operations. The climate policy tilt will include not only the ECB’s corporate bond-buying programs but also the bank’s disclosure policies, risk assessment and collateral framework. Under the plan, the share of assets on the Eurosystem’s balance sheet issued by companies with a better climate performance will be increased compared with that by companies with a poorer climate performance. That sounds straightforward, but there are formidable practical difficulties around this plan.

Practical Issues for Climate Investing

Climate issues are complex. We see four main areas where climate-aware investors need better data, expert insights and a more nuanced approach in order to create an effective decision framework.

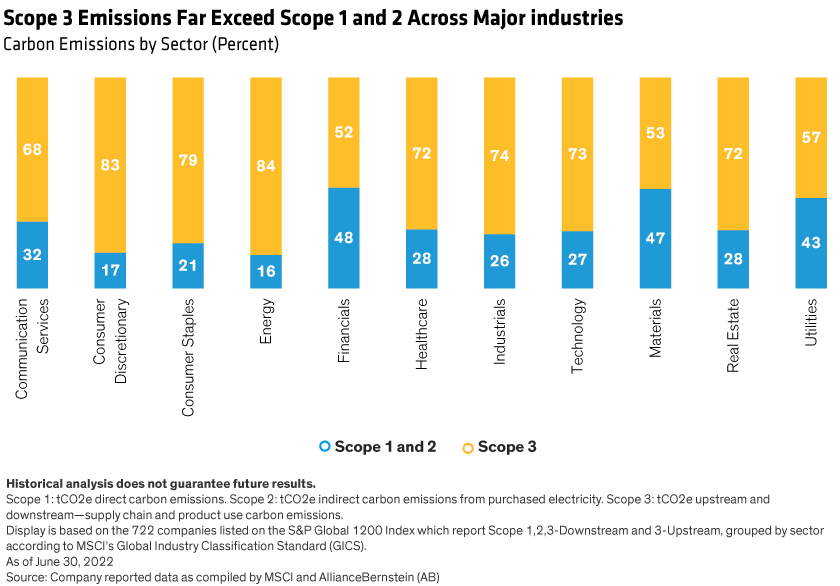

Understanding Emissions: A purely quantitatively driven selection process that rewards companies with lower carbon emissions is likely to prove insufficient. Only companies’ scope 1 and scope 2 emissions are widely reported and accounted for today, but scope 3 emissions represent the primary environmental impact for many industries (Display).

Because scope 3 emissions have so far not been widely reported, investors frequently rely on estimated data by third-party providers. But inevitably their estimated numbers have limitations that may be significant. Through direct engagement with companies, investors can understand and assess the true size of scope 3 emissions.

For instance, we recently met with a large Latin American fast-food franchise company. Although categorized in the apparently innocuous restaurants sector, it emerged that its scope 3 emissions are material. In fact, the company’s carbon intensity was on par with an average chemicals firm, and its carbon emissions were around thirteen times higher than a widely available third-party estimate. (We believe that, as more companies start to publish their scope 3 emissions data, current estimation methodologies will likely be revised.)

While the European Union (EU) is still working towards mandatory disclosure practices through the proposed Corporate Sustainability Reporting Directive, the ECB may try to address the shortage of scope 3 data by tilting to companies with voluntary disclosure practices on indirect emissions.

We believe that this approach could create a valuable incentive to expedite climate disclosures as it would reward companies for improving transparency. However, the resulting data might not be definitive, and reliable comparators would be lacking amid the current limitations of third-party industry estimates.

Assessing Transition Plans: Past performance is not a guide to future performance. Sustainably reducing carbon emissions means that companies’ strategic plans should aim to reduce their future emissions. So it’s vital to identify companies that have credible climate commitments for the long run. Drawing on independent sources of expertise and transparent climate pledges such as the Science Based Targets initiative (SBTi) and the Net-Zero Banking Alliance (NZBA) can help differentiate between companies with demonstrable long-term commitments and those who are not yet willing to walk the walk.

It’s still unclear how the ECB will assess long-term commitments. The SBTi, for example, is not yet directly supported by the EU. And without an active engagement program, it will be hard for the ECB to gauge a company’s progress over time.

Appreciating Climate Innovation: Some industries that currently have high emissions will play a pivotal role in providing future climate solutions. For instance, the automotive industry is developing technologies and products to transition away from high-emitting internal combustion engine technology. A number of automotive original equipment manufacturers, and suppliers, have ambitious long-term climate targets and high capex commitments that could be truly transformative for the industry—and hence require a deeper dive into the companies’ strategies than may be captured by just a single emissions metric.

Encouraging Climate Resilience: Even if humanity successfully limits global warming to 1.5 Celsius in line with the Paris Agreement, we will still need to upgrade our infrastructure and societies to adapt to climate change’s irreversible effects. That’s because extreme weather is very likely to continue to increase, stressing our buildings, transport and healthcare systems. For example, the energy-intensive construction industry must play a pivotal role in advancing sustainable technologies, structures and materials, such as through more effective building insulations.

Transitioning towards a low-carbon economy is a critical and urgent step to address the causes of climate change. We strongly support climate action and those that take steps to address global warming.

But it’s important to ensure that action is well considered, is based on a holistic understanding of the issues and rewards companies whose activities will be vital to a successful transition.

We see the ECB’s initiative as a step in the right direction, and we look forward to the evolution of its policy guidelines to further reflect the complex reality of climate issues.

Related: Emerging Markets: Fewer Risks on the Road to Equities