The rise in popularity of prediction markets leading up to the recent US elections spotlighted the benefit of forecast contracts across many aspects of society, including the environment and economy.

Prediction markets such as IBKR ForecastTrader offer investors a means to hedge their portfolios and express their views on the critical issues impacting society. They also provide a transparent way to understand the consensus opinion and what others are thinking.

For example, the United Nations has issued dire warnings due to failed efforts to address climate change, while a stark discrepancy has developed between weather scientists and the IBKR ForecastTrader market regarding the outlook for average global temperatures.

The disconnect illustrates how investors, scientists and other professionals can have significantly different views on climate change, which is a polarizing issue.

Some individuals are pleading for imminent action to address warmer temperatures, while others deny that the problem even exists. Others think some measures are warranted but not enough to meaningfully alter the roles of governments, individuals, and private institutions. What all these individuals have in common is the potential to benefit from participation in prediction markets regardless of their views.

The following are potential advantages for IBKR ForecastTrader participants:

- Earn capital gains on correct “Yes” or “No” Forecast Contracts

- Interest-like incentive coupons, which accrue daily and increase in proportion with forecast contract odds/values

- Speculate on climate change

- Hedge against the adverse financial impacts of warmer weather or other environmental changes

Specific Climate-Related Forecast Contract Example:

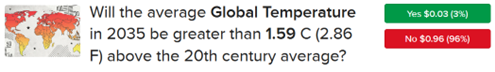

IBKR ForecastTrader Contract: “Will the average Global Temperature in 2035 be greater than 1.59 degrees C (2.86 degrees F) above the 20th century average?”

Source: ForecastEx

30x Potential Capital Gain Opportunity If Warming Intensifies

This Forecast Contract is priced at $0.03, reflecting only a 3% likelihood of the threshold occurring. This contradicts many organizations that believe the outcome is much more likely. Indeed, the Intergovernmental Panel on Climate Change (IPCC) maintains that a more than 50% chance exists that temperatures will surpass 1.5 degrees C (2.7 degrees F) above the 20th century average between 2021 and 2040. Individuals who agree with the IPCC shouldn’t think twice about purchasing the “Yes” version of the aforementioned forecast contract, because if it is correct, it would deliver a 3,233% return since the contract owner would receive $1 for each instrument, not including incentive coupons that can increase monumentally if the odds of the contract rise. Yes, the $1 payout would be over 33 times the initial investment if the National Oceanic and Atmospheric Administration (NOAA) reports temperatures above 1.59 degrees C (2.86 degrees F) above the 20th-century average for 2035.

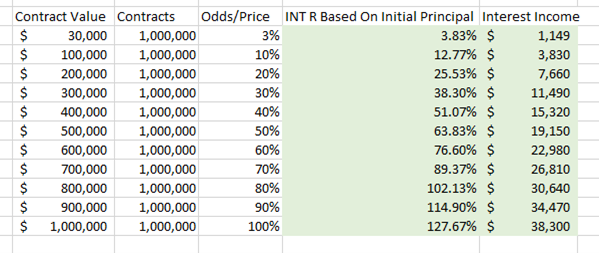

Cash Flow in Motion

Forecast Contracts through Interactive Brokers also pay an interest-like incentive coupon, which is currently 3.83%, which allows investors to earn interest income regardless of whether a purchased Forecast Contract is correct or incorrect. If an investor buys 1 million of this Forecast Contract at $0.03 each for a total cost of $30,000, the initial annual income stream based on the current 3.83% interest rate would be $1,149. If some climate scientists’ IPCC view and outlook are correct, however, chances of average temperatures exceeding the 1.59 degrees C (2.86 degrees F) threshold are likely to increase over time. Since the contract price is correlated with the probability of an outcome, the “Yes” contract price would increase. Assuming the contract’s price hits $0.10 over time, the value of the holdings would be $100,000. If the fed funds rate remains unchanged, the annual income payments will total $3,830, or 3.83% of $100,000, representing a positive return relative to the initial $30,000 principal. Furthermore, let’s say that weather reports have been arriving much hotter, driving up the odds of the event occurring to 50%. Assuming the fed funds rate hasn’t changed from the previous example, the annual income stream would represent a significant interest return from the original $30,000 investment.

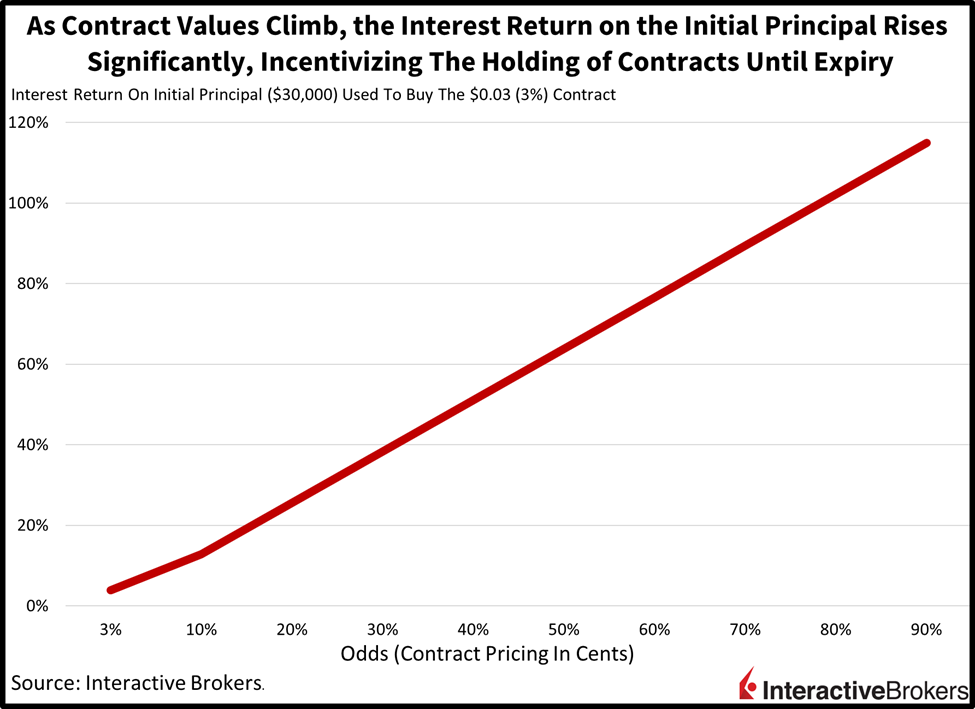

The interest growth dynamic incentivizes participants whose Forecast Contracts rise in value to hold them until settlement to attain attractive income streams rather than closing them before expiry, which in this case is 2036. The additional cash flow on top of the potential for Forecast Contract appreciation is an integral component of the ForecastEx exchange, a wholly-owned subsidiary of Interactive Brokers. For folks whose Forecast Contracts depreciate, they walk away with some interest income and are not empty-handed. This kind of derivative is not a zero-sum game, offering cash flow to correct and incorrect IBKR ForecastTrader participants.

Triple-Digit Interest Income Potential

Using the same Forecast Contract example, the first chart below shows the increased interest return relative to the initial investment that would occur as the contract value climbs. The second chart shows this characteristic in dollar values. The income stream could continue to increase as ForecastTrader participants further price the instruments to reflect the higher likelihood of the average global temperature in 2035 being 1.59 degrees C (2.86 degrees F) above the 20th-century average.

What Are Forecast Contracts?

Forecast Contracts through ForecastEx facilitate a unique trading approach. They allow investors to hedge against or express conviction on the outcome of key economic, climatic, and political events. The contracts provide a direct method for investors to protect their portfolios from volatility related to economic indicators, climate patterns and elections.

Half a Penny on Each Side

Interactive Brokers has long been committed to providing market access to customers at a low cost, and this product is no different. The only fee required to participate is one penny, but it’s only paid after a pairing is executed. For example, if an investor believes an event will occur, such as an increase in the US Consumer Price Index above a specific value, they can buy a “Yes” contract. Conversely, if they think the event will not happen, they can purchase a “No” contract. Contract purchase prices range from $0.02 to $0.99. The value of these contracts will continue to fluctuate based on market participants’ evolving judgment of probabilities, directly reflecting the collective market view of the likelihood of the event. Upon the event’s resolution (e.g., when the US Bureau of Labor Statistics announces the CPI), the contract settles at a predefined value — $1 for a correct answer and $0 for an incorrect one.

No Sellers, Both Sides Collect Incentive Coupons

If an investor wants to close an open position but doesn’t want to wait until the contract settlement date, they can purchase the opposite contract at a gain or loss. For example, if Sally purchases the mentioned above “Yes” climate Forecast Contract for $0.03, but before 2036 market participants push up the pricing to $0.20 in light of hotter weather reports, Sally can then purchase the “No” for $0.81 ($1.01 minus $0.20) and realize a gain on her initial investment. In this scenario, the exchange will deliver a dollar when IBKR ForecastTrader participants close positions before expiry by buying the other side of the pair. Sally paid $0.03 for the “Yes” and $0.81 for the “No” for $0.84 while collecting a dollar, earning a $0.16, or a potential return on the initial $0.03. However, as Sally closes, she gives up the enhanced income stream associated with the appreciating value of the Forecast Contract.

Pricing Moves Alongside Probabilities

As reports are released and economic conditions evolve, the chances of specific events occurring and pricing can shift as well. Pricing and current odds of anticipated results are available at no cost on the Interactive Brokers website and the IBKR ForecastTrader platform, offering full transparency for market participants and the general public.

Carbon Emissions and Climate Expectations

The UN’s IPCC has determined that greenhouse gas emissions must be slashed by 43% relative to 2019 levels before 2030 to limit the average global temperature increase of 1.5 degrees C (2.7 degrees F) above the average during the entire 20th century, which is generally used as a benchmark for temperatures before the extensive use of hydrocarbon fuels. Since industrialization didn’t start until the late 20th century, the difference in the average temperature for the 19th and 20th centuries is negligible. The IPCC, furthermore, believes emissions must be cut by 60% before 2035, but the world is not even close to that goal. Slashing carbon emissions is intended to limit the anticipated increases in damages caused by climate change rather than eliminate the adverse consequences of higher average temperatures. Indeed, the World Economic Forum reports that climate-change-attributed costs are already significant. For example, climate change resulted in $2.86 trillion in damages from 2000 to 2019 and considerable loss of lives.

Emission Goals

The world is far from meeting the 43% reduction goal, according to UN Climate Change Executive Secretary Simon Stiell. Furthermore, under current plans, greenhouse gas emissions would be cut by only 2.6% by 2030 from 2019 levels. While many countries have embraced solar energy, wind power and nuclear facilities to produce power, the reduction in greenhouse emissions has been offset, at least in part, by growing demands for power for artificial intelligence and cryptocurrency computing. Additionally, poorer countries lack the resources to move away from hydrocarbon fuel, which is cheap and efficient from a short-term business perspective. Furthermore, authoritative regimes like those in Beijing, Moscow, Tehran and Riyadh have driven an elevated share of emissions but are unlikely to cooperate with initiatives that impair their economies, which would include accepting painful sacrifices in their pivotal manufacturing and energy production sectors.

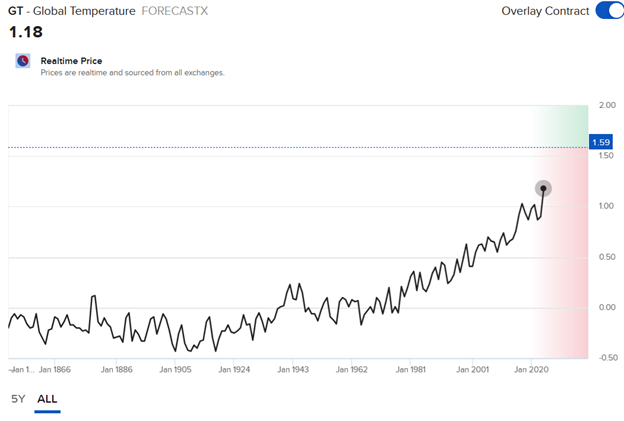

Potential For Big Profits

Climate change-related Forecast Contracts available through IBKR ForecastTrader, offer different thresholds and settlement dates for individuals who may want to tailor their investments to their liking. Contracts are expiring as soon as January 2025 to as far as January 2036, with thresholds ranging from 1.15 degrees C (2.07 degrees F) to 1.6 degrees C (2.88 degrees F) above the 20th-century average. The most recent report, issued in January 2024, depicted a global temperature of 1.18 degrees C (2.12 degrees F) above the 20th-century average in the year 2023. Meanwhile, the trajectory for loftier temperatures has been accelerating since 1980, but the pivotal question is whether it will continue. The environmental community is quite sure it will, and the IBKR ForecastTrader marketplace is ripe for individuals who believe in climate change to speculate and/or hedge against the risks of hotter temperatures. And even if the climate deniers are dealt with a reality check of a much different world in 10 years, the buyers of the “No”, win or lose, will still collect incentive coupons along the way. In conclusion, if you believe in climate change, the odds are attractive on the “Yes” contracts, which represent temperatures above the selected thresholds and have the potential for significant interest income growth on top of capital gains.

IBKR ForecastTrader can be a valuable tool offering the world a view of the current consensus as more investors embrace this new innovative platform. The ForecastEx exchange serves as an opinion aggregator, taking the diverse views of participants and offering probabilities of the future.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here