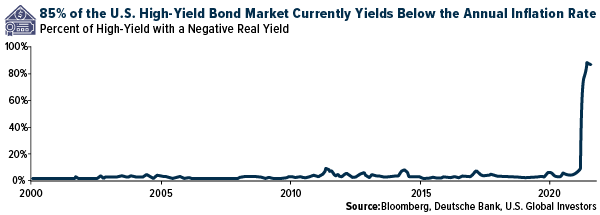

With real rates trading below zero right now, many yield-starved investors are being forced into riskier and riskier assets, including high-yield junk bonds. But even these are no longer offering a positive real return, what with inflation at multiyear highs.

According to one estimate, by Deutsche Bank’s Jim Reid, a whopping 85% of the U.S. high-yield bond market currently yields below the annual inflation rate. It’s important to note that this figure has never been above 10% in the past. Even if the consumer price index (CPI) were to fall to 3% (from 5.4% currently), that would still be above 35% of the high-yield market.

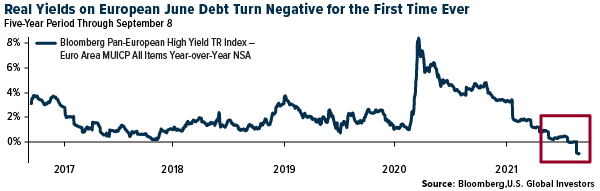

And it’s not just the U.S. For the first time ever, inflation-adjusted yields on European junk-rated debt have turned negative after consumer prices increased the most in over a decade in Europe.

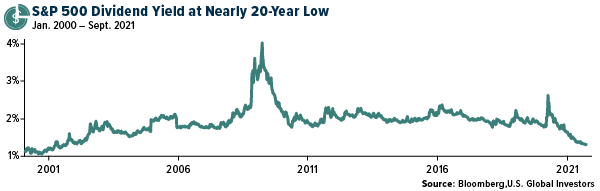

Stock prices have gained significantly so far this year, which is good, but this has had the effect of making the dividend yield look less appealing. As of last Friday, the S&P 500 dividend yield was 1.32%, the lowest point since March 2002, and well below the annual inflation rate.

So, where’s the yield? Some investors had hoped to try their hand at crypto lending, but the future legality of this activity is now in the air.

Coinbase’s Crypto Lending Program Halted by Regulators

Before I proceed, it’s important to note that crypto lending isn’t entirely new. Similar to securities lending, it allows investors to earn interest on select crypto holdings. Some online platforms have already been letting customers lend out their assets in exchange for income.

But not Coinbase, the largest U.S. cryptocurrency exchange, which has been hoping to launch its own crypto lending platform for months.

That’s because the Securities and Exchange Commission (SEC) has warned the company that if it takes the next step in launching the service, nicknamed Lend, the SEC will sue. Making matters worse, the SEC refuses to explain what law Coinbase is in danger of violating; nor will it give guidance on how Coinbase can launch Lend and still comply with federal securities law. That’s according to Coinbase’s chief legal officer Paul Grewal, who detailed the company’s legal struggles last week in a blog post.

All Coinbase knows at this point, Grewal writes, is that it can “either keep Lend off the market indefinitely without knowing why or we can be sued.” He adds that regulatory uncertainty and ambiguity “only serve to unnecessarily stifle new products that customers want and that Coinbase and others can safely deliver.”

Indeed, investors are starving for yield right now, and it appears some will remain so.

As I’ve said before, commonsense regulations are important to help maintain a safe, level playing field for all parties. Imagine a basketball game with no referees. Cheating would have no repercussions. Now imagine the same game, but with too many referees, and with the rules changing arbitrarily. Unfortunately, that’s the scenario Coinbase finds itself in right now.

Related: Decrypting Bitcoin and Gold