Written by: Daniel Petkau

"If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” – Satoshi Nakamoto, founder of Bitcoin

“Stay away from it. It’s a mirage, basically. In terms of cryptocurrencies, generally, I can say almost with certainty that they will come to a bad ending.” – Warren Buffett, legendary investor

“It’s money 2.0, a huge, huge, huge deal.” – Chamath Palihapitiya, venture capitalist

“I do think Bitcoin is the first [encrypted money] that has the potential to do something like change the world.” – Peter Thiel, co-founder of PayPal

“The Federal Reserve simply does not have authority to supervise or regulate Bitcoin in any way.” – Janet Yellen, former chair of the US Federal Reserve

To be honest, when I was asked to write about cryptocurrency, I was a little nervous. The quotes above are just a handful of quotes from some very well known (not to mention highly successful) individuals in the financial industry. As you can tell, there is quite a range of opinion when it comes to the topic of cryptocurrency. This should not come as all that much of a surprise, as the cryptocurrency industry is still very much in its infancy with Bitcoin only being “born” in 2009. My goal with this blog is not to give you my opinion on cryptocurrency, but to shed some light on the industry and present to you some facts by (attempting) to answer three questions.

What Kinds of Cryptocurrency are There?

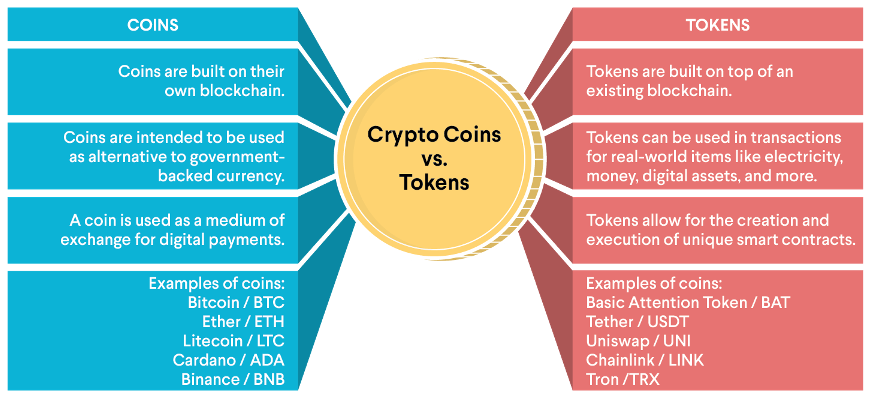

To answer this question very simply, there are thousands of types of cryptocurrencies out there. It all started with Bitcoin back in 2009 when it was launched by Satoshi Nakamoto (which is a pseudonym…no one really knows who this is). From there, other types of cryptos have emerged as competitors have built and launched their own platforms to try and capture a share of this market. Without getting too deep into the weeds, all these different types of crypto can generally fall into one of two categories; coins and tokens. Coins include Bitcoin and altcoins (which are alternatives to Bitcoin created to try and improve on Bitcoin). This map below does a great job of outlining the main differences between the two:

How Big is the Cryptocurrency Market?

In November of 2021, the crypto market cap had just surpassed $3 trillion after more than quadrupling from its 2020 year-end value. However, as of the writing of this article, the total global crypto market cap is right around $1.28 trillion. What’s interesting about the crypto market is that some cryptos, like Bitcoin, have a limited supply of coins. Because there are so many different types of cryptos out there, let’s just look at Bitcoin for a minute. Currently, the price of Bitcoin sits right around $30,000 (yes, for ONE Bitcoin).

The total amount of Bitcoin that can be created is 21 million coins – which is decided by the creator(s) of Bitcoin. A limited number of coins helps create demand and give value to the existing coins out there. This means that not all 21 million are available to be bought or sold right now…they have to be mined. As of today, there are 19,043,118.75 Bitcoin that are currently in circulation leaving 1,956,881.25 left to be mined.

That means that the Bitcoin market cap alone is roughly $571 billion. For the sake of not writing a 20 page blog, I won’t go into what it means to mine Bitcoin, but it is quite the industry. If you are interested, you can learn more about this process here: Bitcoin Mining.

Is cryptocurrency the future?

It depends who you ask! While there is certainly a lot of skepticism surrounding the crypto market, there is also a lot of optimism in what crypto can mean for our future. That optimism comes from the principles that Bitcoin and other cryptocurrencies were founded on:

-

Cryptocurrencies are not issued, regulated or backed by a central authority like a bank

-

They are created using a distributed ledger (blockchain)

-

Coins are encrypted with cryptography (specialized computer code)

Now, some people may look at those principles and say that is a bad thing and a reason to be skeptical. To be honest, I really don’t know if cryptocurrency is the future (okay, I guess I did give my opinion on one thing). I think what’s important is to understand that the crypto market is growing and is important to pay attention to. There are a lot of different areas of the crypto market that I did not get into as there is a lot to learn about this industry. The question we often get from people is “Should I be in crypto?”. Well, let’s look at 7 reasons to avoid Bitcoin and 6 reasons to consider Bitcoin. These all come from an article written by Debra Taylor who is a very well-known and well-respected financial advisor out on the east coast.

7 Reasons to Avoid Bitcoin

-

Bitcoin is extremely volatile, making it a bad store of value and an unreliable means of exchange.

-

Ownership is concentrated in the hands of very few – Most of the Bitcoin that has been mined is owned by long-term investors and they don’t circulate the currency. 95% of all Bitcoin is controlled by 2.4% of all accounts (furthermore, an estimated 20% of the supply could be sitting in lost or stranded digital wallets)

-

Bitcoin is an unregulated asset

-

Bitcoin and crypto are bad for the environment (refer to the Bitcoin Mining article to understand why this is)

-

Compliance issues – Advisors have to be careful giving any advice in regards to the crypto market

-

Speculation – Until Blockchain technology becomes more widely adopted, it is unlikely that cryptocurrencies will be a widely accepted form of payment and it will continue to be a very volatile sector.

-

There are better ways to mitigate legitimate risks in the market

6 Reasons to Consider Bitcoin

-

Amazing performance – Over the past decade, Bitcoin was the best performing asset class by far

-

Scarcity increases an asset’s value and Bitcoin is no exception – as referenced earlier, a limited supply increases value

-

Pioneers are beginning to accept Bitcoin as payment

-

Bitcoin does not damage the environment – Contrary to what some think, others argue that mining Bitcoin is not bad for the environment because miners operate in areas where electricity is cheap and can utilized hydro power

-

No restrictions – It is positioned to be universally accepted.

-

Lack of regulation increases the value

The best advice I can give when it comes to crypto is to tread lightly. As always, I’m a firm believer that there is no good product and no bad product. What matters are your goals and outcomes and if that product will help get you there. If you do put money into cryptocurrency, you need to be confident that it aligns with your goals and that it will help you accomplish where you are trying to go.

Related: How to Make Money With NFT?