Won’t governments just ban crypto?

It’s one of the most common questions folks ask me.

“Regulation” has been a bogeyman for the space since bitcoin (BTC) burst onto the scene 13 years ago.

Folks have long speculated new rules will crush crypto markets.

I couldn’t disagree more.

Regulation won’t kill crypto. Instead, it will lead to much higher crypto prices, as I’ll show you today.

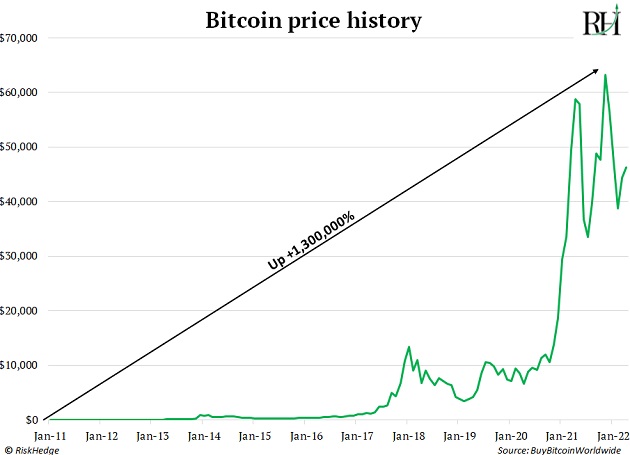

Bitcoin already wrote itself into the financial history books.

Did you know bitcoin has soared 1,300,000% since 2011?

Despite only being around for a little over a decade, it’s one of the top-performing assets of all time.

Most people who have made life-changing money from bitcoin are normal, everyday folk. They heard about some weird internet currency and took a gamble.

Bitcoin has been the “people’s bull market.” Until recently, only a handful of bankers and Wall Street pros owned it.

What’s been keeping the big money at bay?

- Most of the world’s largest investors haven’t touched crypto because of the regulatory uncertainty.

It’s not that crypto is the Wild West with no rules. Crypto exchanges like Coinbase have been regulated for years.

The problem is that a handful of different regulators all want to control crypto their way. You have the CFTC, SEC, IRS, and US Treasury all passing contradictory laws.

For example, the CFTC ruled bitcoin and Ethereum are commodities. But the SEC chairman believes many cryptos are securities.

It’s a mess! And it’s kept billionaire money managers from investing.

Ken Griffin, the billionaire founder of Citadel Securities, told the Economic Club of Chicago a few months ago, “We don’t trade crypto because of the regulatory uncertainty.”

There are hundreds of Ken Griffins out there… biding their time until a regulatory framework comes to crypto.

Charles Schwab CEO Walt Bettinger was recently asked if the brokerage was getting into crypto. He responded: “We would like to see more regulatory clarity. […] If and when that comes, you should expect Schwab to be a player.”

Why are finance’s top dogs afraid of some uncertainty?

Boston Consulting Group found that European and US banks were fined $320 billion over the past few years for failing to comply with regulations.

These hefty fines have turned banks and money managers into scared little mice. Now they seek perfect regulatory clarity before they do anything new.

Regulation will be the green light for Wall Street to finally get into crypto.

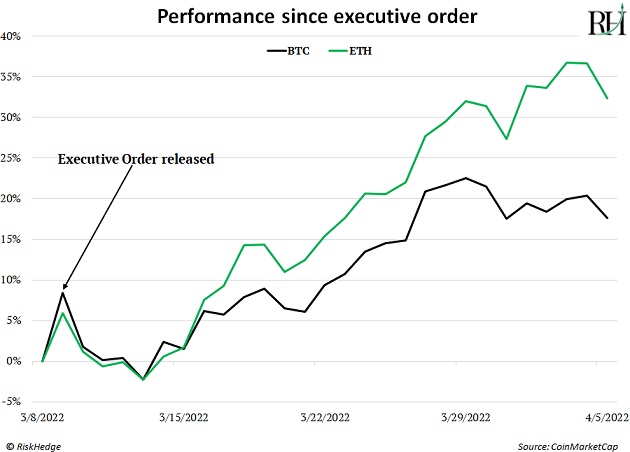

That light flashed a few weeks ago when President Biden signed an executive order regarding the regulation of crypto.

As I said, folks have long speculated new rules will crush crypto markets.

But what has happened to bitcoin and Ethereum (ETH) since the order was released? They’ve jumped higher.

After reading the order, it’s clear Washington is getting behind crypto. One of the main objectives outlined is to “drive US competitiveness and leadership in and leveraging of digital asset technologies.”

Does that sound like a big scary crypto ban is coming? Nope. Instead, the US government wants to harness crypto to remain the richest, most powerful country in the world.

Most important of all, this order clears up the uncertainty around owning crypto assets. This clarity will attract millions of money managers who haven’t put a penny into crypto yet.

In fact, guess who’s moving into crypto just as a regulatory framework is being put together? Citadel and Ken Griffin. He recently told Bloomberg, “It’s fair to assume that over the months to come, you will see us engage in making markets in cryptocurrencies.”

Ditto for the world’s largest hedge fund. Ray Dalio’s Bridgewater Associates, which manages $140 billion, plans to back its first crypto fund.

My friends, the regulation bogeyman that’s been hanging over crypto for years is starting to disappear.

We’ve seen this same pattern play out with other assets.

Venture capital (VC) has been the envy of the investing world.

According to Cambridge Associates and Invesco, top VC funds have beaten the S&P 500 by 1,100% per year… for two decades running.

And do you know who the largest backers of VCs are? Pension funds.

These are the largest pools of money in the world. US state and local pensions alone manage over $5 trillion. And they’ve plowed hundreds of billions of dollars into VC funds.

But it wasn’t always that way.

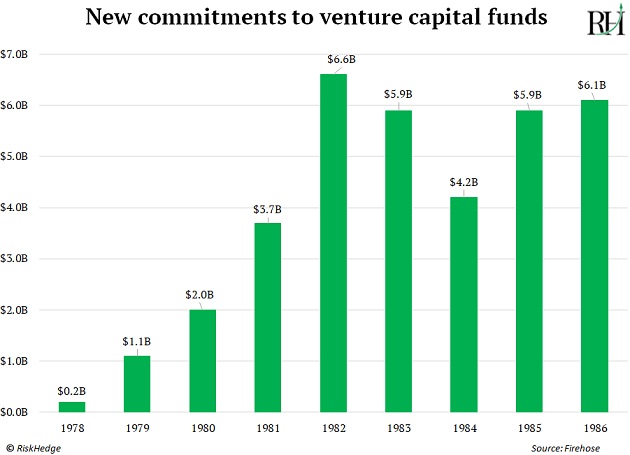

A few decades ago, regulations made it difficult for pensions to invest in “risky” assets like venture capital.

It wasn’t illegal to back early-stage companies. But there was little regulatory clarity, just like investing in crypto today. A pension fund manager could put money into VC. But if something went wrong, his head was on the chopping block.

That changed in 1979 when the Department of Labor passed new rules allowing pensions to invest up to 10% of their assets in venture funds.

I’m sure you can guess what happened next.

Pension money flowing into VC funds soared 30X in a few short years.

What happened to venture capital forty years ago is what’s happening to crypto today.

Mark my words: this is the green light for the largest pools of money in the world to pile into crypto.

Remember, US state and local pensions alone manage over $5 trillion. That’s more than twice as large as the entire crypto market.

Hedge funds, college endowments, and banks bring in another few trillion.

If these money managers put a fraction, even 1%, of their assets into crypto—just like they did with venture capital—it would likely send prices rocketing higher.

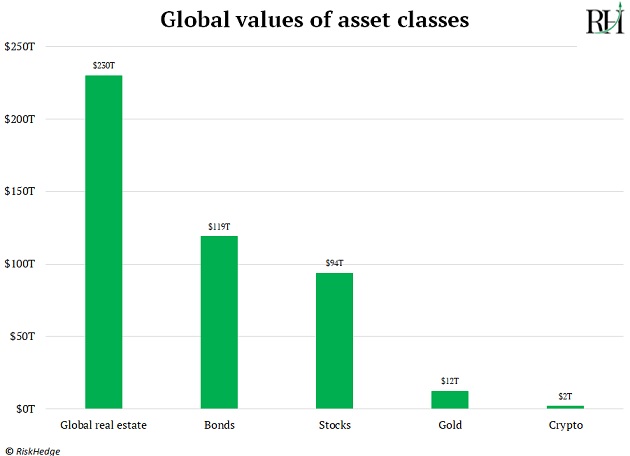

It’s easy to forget just how tiny crypto is compared to real estate, stocks, and bonds.

In fact, Apple (AAPL) is worth more than the entire crypto market. Ditto for Microsoft (MSFT).

We’ve been hearing about bitcoin for a decade, but crypto is only getting started.

Don’t trick yourself into thinking it’s too late.

There’s never been a better time to invest a small percent of your portfolio in crypto. Especially ahead of the world’s largest pools of money moving into the space.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

Related: The Biggest Reveals From Bitcoin 2022