Another cryptocurrency bull market may be upon us as highlighted by a gain of nearly 23% by bitcoin for the week ending Oct. 6.

Not that crypto went out of style – it didn't – but fresh bitcoin rallies have a way of not only bringing other cryptocurrencies along for the ride, but also renewing clients' interest in digital assets. Another result of digital currency rallies is clients inquiring about some of the credible alternatives to bitcoin.

With north of 7,100 digital tokens on the market, this is an expansive asset class with far more “fly by night” options than credible destinations for investor capital. Still, given bitcoin's meteoric rise, it's a given that investors are clamoring for answers about what's the next big thing in crypto.

A good place to start is with ethereum – the blockchain platform on which the digital token known as ether trades. With a market capitalization of $424.6 billion, ethereum is the second-largest digital asset in the world behind only bitcoin. Data confirm investors are optimistic about the outlook for ethereum.

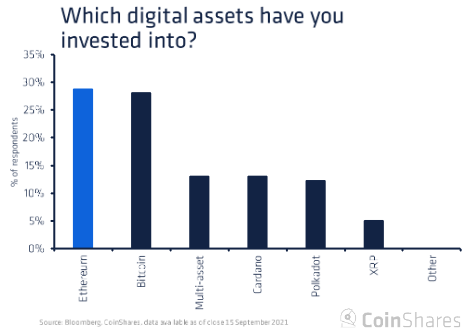

In CoinShares' inaugural bi-monthly survey, which polled investors with a combined $400 billion in assets under management, 42% said they believe etheruem has the most compelling growth outlook among cryptos – far ahead of the 18% that said the same of bitcoin.

Why Ethereum Could Soar

Advisors are undoubtedly familiar with the size factor – the premise that smaller stocks outperform large caps over the long-term. It's applicable in the crypto space, too, where it's not uncommon for smaller, highly speculative digital tokens to double, triple or more in the span of a few days or weeks.

Ethereum isn't speculative – its adoption rates and usage case are rapidly growing. While it's not a small cap in the purest sense of the term, it is smaller than bitcoin, implying greater potential for price appreciation. That out-performance is already happening and some market observers believe it will continue for several years.

Interestingly, crypto investors that are enthusiastic about ethereum's long-term prospects haven't yet fully invested, according to the CoinShares survey, indicating there's room for more upside as those market participants put their money where their mouth is.

Courtesy: CoinShares

Another interesting tidbit from the CoinShares survey and it's a notable one for advisors, is that when it comes to crypto investing, one of market participants' biggest concerns is volatility. However, few of those polled view digital assets as fundamentally flawed.

In fact, weak fundamental was the least cited reason for lack of crypto exposure, trailing regulatory concerns, corporate restrictions, volatility, perceived reputational risk and custody concerns.

Future Is Bright

The attractive outlook for ethereum could result in a rising tide lifting more boats throughout the decentralized finance (DeFi) space, unearthing more credible cryptos in the process.

That's a longer ranging theme. For now, the evolution of crypto and clients increasing interest in the asset class presents advisors with a prime opportunity to add value for clients and help them navigate an asset class rife with pitfalls but serious potential as well.

And know this: Clients definitely need assistance when rightsizing crypto allocations, indicating this asset class could be ripe for advisor attention for years to come.