In today’s Jolt, I talk to Stephen about the memecoin frenzy that’s accelerating on the heels of Trump’s victory. What do we make of these 1,000% gains popping off everywhere? Read on to find out.

Chris Reilly: Stephen, it’s a memecoin frenzy:

Max on ETH (MAXETH), up 2,445%...

GoldenRat (RATS) +1,789%...

Hua Hua (HUAHUA) +1,633%...

Good Morning! (GM) +1,328%...

These are all in just the past week alone.

I could keep going. Here’s MusCat (MUSCAT), up 850%... and DOGO (DOGO), up 634% in the past 24 hours.

Stephen McBride: Frenzy is an understatement.

Meanwhile, bitcoin’s (BTC) at an all-time high, about to cross $100,000 any moment now.

Ethereum (ETH) and Solana (SOL)—my two favorite large cryptos—are up 25% and 55%, respectively, in the past month.

Any stock market investor would be thrilled with those returns. But you can see why they’re not as “exciting” as the tiny memecoins that can spike 1,000% overnight.

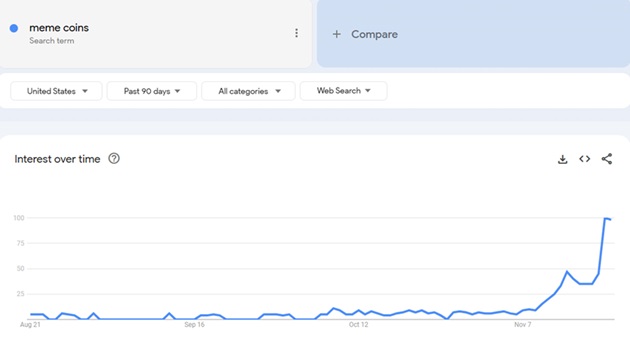

Chris: Here’s the chart of Google searches for the term “meme coins” over the past 90 days. Talk about hockey stick growth:

First question: Is this a flash in the pan, or will it last?

Stephen: This is just the beginning. Readers who’ve been following along know the whole crypto sector was like a basketball held underwater. Now, thanks to Trump’s victory, it’s being unleashed all at once. The sector is a Wild West of new opportunity—with all the good, bad, and ugly that comes with that.

Chris: Many readers probably wonder what a memecoin even is. A meme is basically a joke or funny visual that originates and spreads on the internet. A memecoin is a crypto based on a specific joke.

That being the case… is there any substance here? Or is this all purely fun and speculation? What does a coin like Bonk (BONK), up 130% in one month, do for example?

Stephen: It’s a dog-themed coin on the Solana blockchain. It’s known for its fast and low-cost transactions. According to crypto news, Bonk plans to burn 1 trillion tokens by Christmas, which would boost scarcity and potentially drive up the price. At least, that’s what its fans are betting on.

Pepe (PEPE) is an Ethereum-based coin that was inspired by the Pepe the Frog meme.

There’s a Pikachu Inu (PIKACHU) coin up 350% in a week.

These are entertainment—pure speculation. This part of the crypto market is like the world’s greatest casino. Like any casino, some folks get lucky. A lot of folks are getting very lucky lately.

Chris: So there are no fundamentals going on here? Memecoins don’t “do anything?”

Stephen: Some do. Pump.fun is a fast-growing revenue-generating app on Solana. The business model? It lets you create your own memecoin. Click a few buttons, and you can spin up your own memecoin in a matter of minutes.

But 99% of these coins are jokes and will go to zero. Memecoins for the most part are a bad look for the crypto industry. A distraction that causes people to not take the whole industry seriously. Which is a shame because there’s real, exciting innovation going on in the space.

Chris: In your premium RiskHedge Venture crypto advisory, you recommend real crypto businesses making real money. The only thing they have in common with memecoins is they’re cryptos, and they’re often tiny.

And you say these kinds of businesses are now set to thrive thanks to the new pro-crypto Congress. Less regulations and more innovation. SEC Chair Gary Gensler (who led the crackdown in crypto), just announced on X/Twitter that he’s stepping down.

Stephen: Yes. The crypto renaissance is unfolding fast.

Chris, for almost four years, building a legitimate crypto business in America has been basically illegal. Entrepreneurs who wanted to build real businesses in this industry risked jail time.

This put innovation on pause. Developers told me, “I’d love to build this, but I don't want to go to jail.” It was a constant regulatory barrage. Crypto banks were shut down by the government. Founders and funds were sued. Protocols were subject to constant surveillance sweeps.

That era just ended.

Think of it like taking the handcuffs off thousands of entrepreneurs at once. The innovation surge will shock people who think crypto is just about speculation.

Chris: Can you give one example of a crypto business with a real use case, one where innovators were able to flourish?

Stephen: Sure. We invested in Hivemapper (HONEY) at $0.01, which is reinventing “mapping.” Hivemapper makes a 4K, high-definition dashcam. Anyone can buy one of these dashcams and attach it to their rearview mirror.

The camera automatically “maps” the roads as you drive around, just like a Google Street View car. Hivemapper then feeds these images into its global map. Hivemapper pays you in crypto for updating its map. And it’s growing 5X faster than Google Maps did in its early days.

Chris: Any others?

Stephen: Helium (HNT) sells hotspot routers you can install on your roof. It successfully built the world’s only global Internet of Things network. And it achieved this without constructing a single cell tower.

Akash Network (AKT) and Render Network (RNDR) are building artificial intelligence chip networks spanning the globe.

But my recent recommendation is building a location data network that’s 100X more accurate than standard GPS.

Standard GPS gets you within 20 ft. of your target. This crypto provides centimeter precision. Its revenues surged 450% in the past year.

Chris: Thanks, Stephen.

And reader, if you want updates on exciting investment disruptions like crypto, Stephen writes a free letter called The Jolt, which you can join here. It’s all about where innovation meets investing.

Related: Mastering Crypto: 7 Keys to Win Big