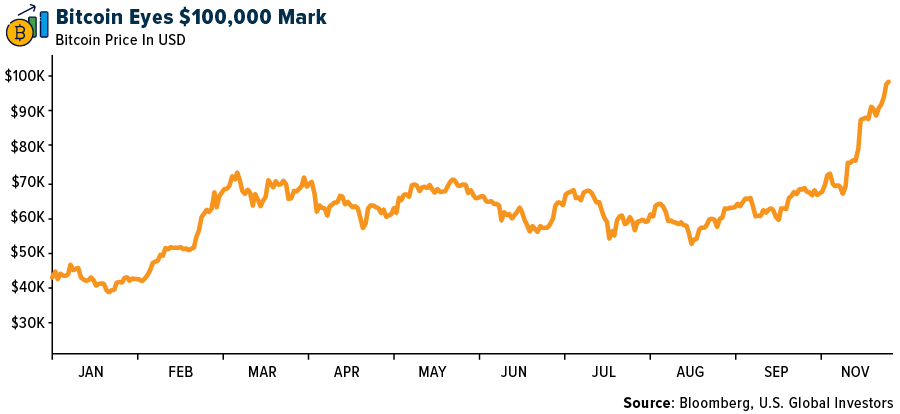

Just a few short years (months?) ago, few would have believed it possible. But it happened: Bitcoin has traded above $100,000 for the first time ever.

Global adoption of the world’s largest digital asset by market cap is getting harder to ignore. We’re no longer talking about magic internet money favored by tech enthusiasts. We’re talking about a serious financial asset that central banks, corporations and even national governments are now paying close attention to.

Consider the most recent developments: President Nayib Bukele’s El Salvador, the first nation to adopt Bitcoin as legal tender in 2021, has reported more than $333 million in Bitcoin profits.

And here in the U.S., everyone’s talking about the incoming Trump administration’s plans to establish its own strategic Bitcoin reserve.

More Than Digital Gold

Part of Bitcoin’s allure is that it shares many characteristics with gold. This week, Federal Reserve Chairman Jerome Powell said he believes Bitcoin is a competitor to gold rather than the U.S. dollar.

“It’s just like gold, only it’s virtual, it’s digital,” Powell told the audience at the New York Times’s DealBook Summit.

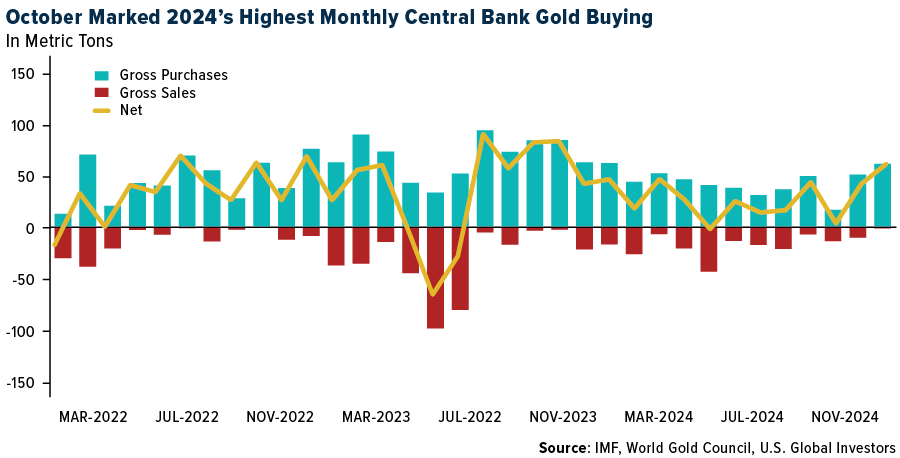

I believe this comparison says a lot. Gold has been a trusted store of value for thousands of years, prized for its scarcity and global liquidity. Central banks just reported buying 60 metric tons of the precious metal in October, the most in a single month this year.

Bitcoin shares these attributes in a modern, digital form. Unlike fiat currencies, there’s a fixed supply of Bitcoin, capped at 21 million coins. That scarcity, combined with growing trust and acceptance, has helped it ascend to this six-figure milestone.

For the record, I don’t believe gold is going anywhere. It’s been around for over 5,000 years and is deeply ingrained in global commerce and traditions. Gold trades over $160 billion every day, second only to the S&P 500, according to the World Gold Council (WGC). Plus, unlike Bitcoin, gold has many practical use cases, from jewelry to electronics.

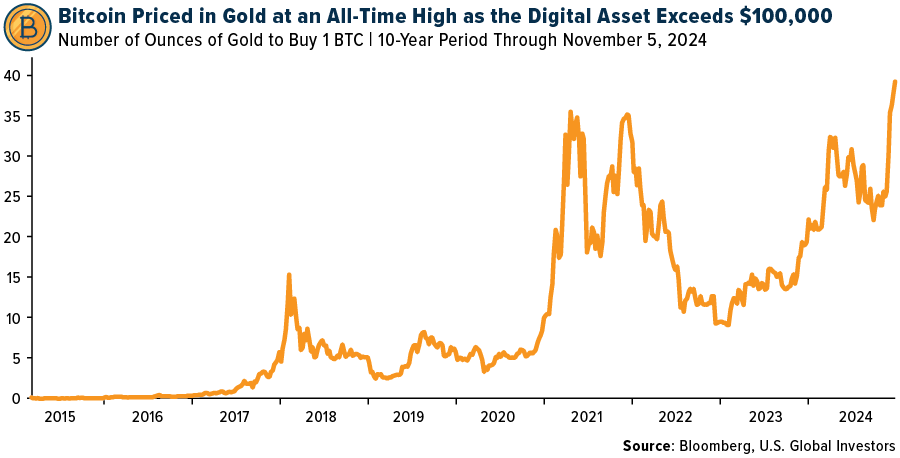

But Bitcoin is carving out its own path, proving it can also serve as a store of value in turbulent times. The chart below shows the Bitcoin-to-gold ratio, which tells you how many ounces of gold it takes to buy one Bitcoin. This week, the ratio surpassed 38, a new all-time high.

Political Winds Shifting in Bitcoin’s Favor

It’s not just Wall Street that is warming to Bitcoin. The political climate appears to be shifting as well.

President-elect Donald Trump—a former crypto skeptic turned fan—recently nominated Paul Atkins, a conservative and crypto-friendly lawyer, to replace Gary Gensler as the head of the Securities and Exchange Commission (SEC). During his tenure at the SEC from 2002 to 2008, Atkins fought for balanced, innovation-friendly policies. His return could pave the way for more regulatory clarity, attracting even more institutional capital into the crypto space.

Trump also just named billionaire venture capitalist David Sacks as his “AI and crypto czar.” Sacks, a member of the so-called PayPal Mafia, is another strong advocate for clear regulations in cryptocurrency and artificial intelligence. His leadership, I believe, could help position the U.S. as a global leader in emerging technologies, including Bitcoin, blockchain and AI.

And on Capitol Hill, Senator Cynthia Lummis of Wyoming, a longtime Bitcoin advocate, has proposed the BITCOIN Act, which, if passed, would lead to the creation of a U.S. strategic Bitcoin reserve. Just as the Strategic Petroleum Reserve (SPR) ensures a steady supply of oil in times of emergency, a Bitcoin reserve could serve as a digital financial backstop, a buffer against economic shocks and runaway inflation.

Analysts’ Forecasts Turn (Even More) Bullish

Major financial institutions and research firms aren’t sitting idle. Bernstein Private Wealth Management projects Bitcoin could reach $200,000 by late 2025, a forecast echoed by Standard Chartered.

One of the key drivers of these higher forecasts is the inflow of institutional money. Big investors—corporations, pension funds, endowments—are starting to treat Bitcoin as a legitimate part of a diversified portfolio. According to analysts, if U.S. retirement funds or a proposed U.S. strategic Bitcoin reserve started accumulating even a small percentage of their assets in Bitcoin, demand could skyrocket.

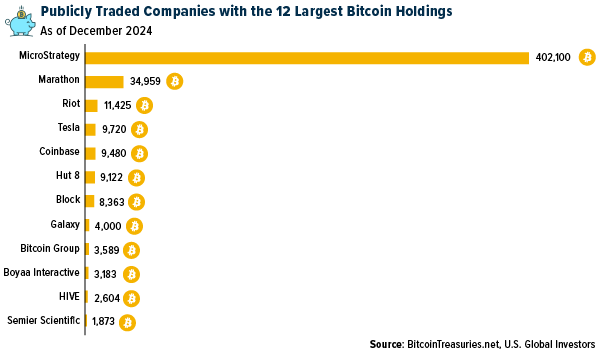

MicroStrategy, a publicly traded company, has shown leadership in this area. Its aggressive three-year Bitcoin purchasing plan has already exceeded expectations. Its strategy? Treat Bitcoin like a corporate treasury reserve asset.

Allocate Responsibly

So, what does all this mean for investors?

First, it means that Bitcoin is no longer a fringe phenomenon. At over $100,000 per coin, it’s a force to be reckoned with, attracting serious interest from global institutions and governments.

That said, investing in Bitcoin should still be approached thoughtfully. Volatility remains high. While gold typically moves at a measured pace, Bitcoin’s price can swing more dramatically. Proper allocation could provide exposure to Bitcoin’s growth potential without taking on excessive risk.

As regulators become more crypto-friendly, and as the U.S. government considers strategic reserves, Bitcoin’s credibility and staying power have only grown. This isn’t to say Bitcoin will replace gold overnight or that it comes without risks. But after crossing the psychologically important $100,000 mark, it’s clear that the world’s largest cryptocurrency is maturing into a bona fide financial instrument worthy of consideration.

Index Summary

-

The major market indices finished mixed this week. The Dow Jones Industrial Average lost 0.60%. The S&P 500 Stock Index rose 0.96%, while the Nasdaq Composite climbed 3.34%. The Russell 2000 small capitalization index lost 1.06% this week.

-

The Hang Seng Composite lost 2.62% this week; while Taiwan was up 4.18% and the KOSPI fell 1.13%.

-

The 10-year Treasury bond yield fell 2 basis points to 4.15%.

Airlines and Shipping

Strengths

-

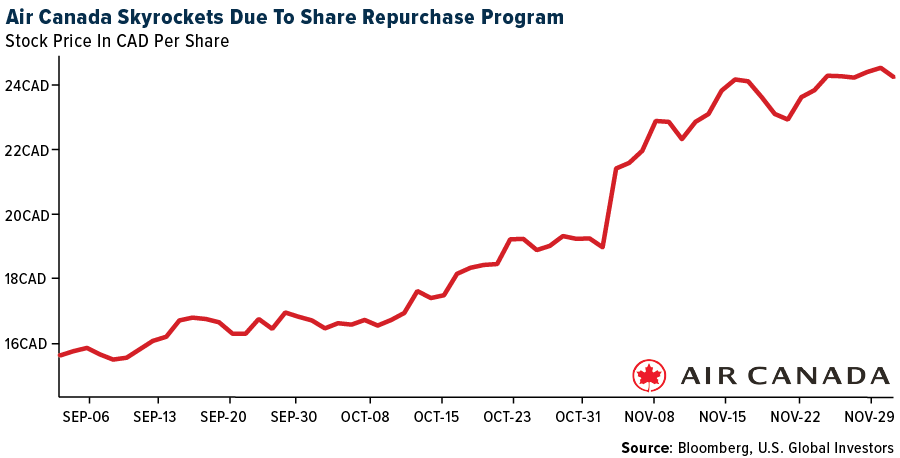

The best performing airline stock for the week was American Air, up 19.8%. Air Canada, once again, is very active on its share buyback, repurchasing the daily maximum every day. The company has now repurchased 9.6 million shares at an average price of $23.86 since the start of the program. Total authorization is for 35.8 million shares and runs to November 4, 2025. The stock has been up 32% since reporting third quarter results at the beginning of November.

-

U.S. container volumes grew 15-20% year-over-year in November, showing unseasonally strong demand during the slack season. This is led by pre-shipping ahead of tariffs and another potential U.S. East Coast port strike from January 15, 2025, according to Bank of America.

-

On a trailing seven-day basis, TSA throughput rose 14.3%, well ahead of last week’s -1.9%, reports Bank of America. This year’s Thanksgiving week throughput was up 3.1% ahead of 2023, with Sunday, December 1, seeing the highest single-day throughput since the TSA began publishing data in 2019.

Weaknesses

-

The worst performing airline stock for the week was Skywest, down 4.5%. According to Bank of America, domestic Japan airline profits are trending below pre-COVID levels with limited pricing power given price sensitive demand and elevated unit costs on the weaker Yen and higher jet fuel. JAL and ANA are focused on boosting load factors for now with second half 2025-unit prices trending slightly down year-over-year.

-

According to Stifel, the market has already softened in the tanker, dry bulk, and LNG markets, although thus far very little in any of those categories has been scrapped. This year, tanker scrapping is 88% below normal levels, dry bulk is 66% below, and LNG is roughly in line. However, very little scrapping in almost every category has been done in many years. Currently, 17% of the tanker fleet is above 20 years old, 13% of dry bulk vessels, and 11% of container ships.

-

Chinese domestic air travel spending declined 10% year-over-year in November 2024 with domestic yields almost -20% year-over-year, suggesting earnings pressure in the fourth quarter, according to Bank of America.

Opportunities

-

American Airlines expects cash remuneration from the new co-brand credit card and other partners to increase 10% per annum, reports Goldman. American’s last twelve-month remuneration is $5.6 billion, with management noting that as this figure approaches $10 billion it will drive an incremental $1.5 billion in pretax income versus expected 2024 results.

-

According to Stifel, on January 1, the first wave of Fuel EU Maritime regulations take effect, which requires ships calling on EU ports to have an increasing component of low carbon fuel/reduced emissions. Ultimately, the plan calls for an 80% reduction in emissions by 2050 but starts with a 2% change in 2025.

-

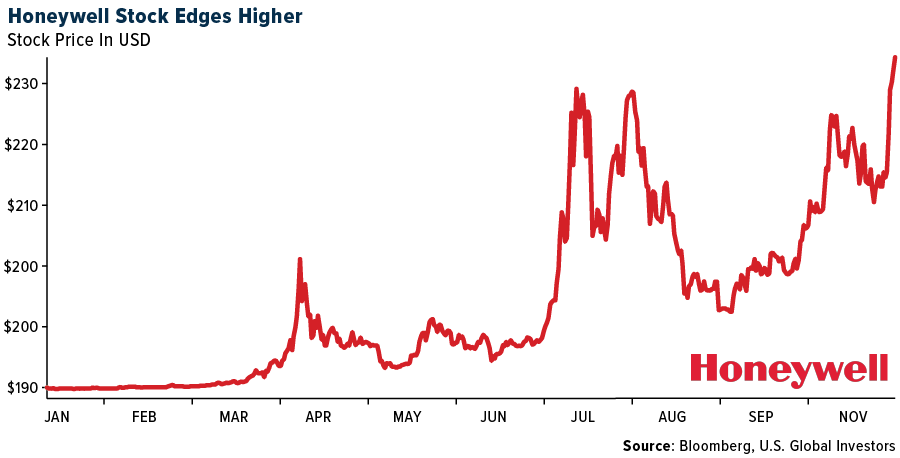

Honeywell and Bombardier announced an agreement that includes collaborative research and development centered on Honeywell Anthem avionics, selection of more powerful engines, and next-generation satellite communications technologies for Bombardier aircraft. After-market offerings and new technologies provide Honeywell revenue potential of up to $17 billion over the life of the agreement.

Threats

-

Bank of America estimates that Airbus delivered 76 aircraft in November versus 61 last year. If correct, this would bring the total to 635 aircraft year-to-date and requires 115 aircraft to meet the low estimate of expectations at 750 aircraft. This compares to 112 last year in December.

-

Looking ahead to January through March, JPMorgan thinks shipping share prices might weaken because: 1) expectations for upward revisions to guidance in the third quarter may already be priced in to an extent, 2) sentiment might deteriorate as cargo movement and freight rates decline due to seasonal factors in January through March, and 3) cargo movement could slow down if the U.S. hikes tariffs.

-

According to UBS, next year Frontier is likely to face meaningful cost pressures from lower sale leaseback gains as well as higher rent expenses. The group calculates that these factors together could drive 700-800 basis points of CASM-ex increase in 2025. As such, for the company to expand its margins, they think it is imperative that it drives a strong RASM increase.

Luxury Goods and International Markets

Strengths

-

The final Eurozone Services PMI for November was reported at 49.5, slightly above the preliminary reading of 49.2. In China, the Caixin Services PMI remains in expansionary territory, reported at 51.5. Additionally, China surprised investors with a stronger-than-expected Manufacturing PMI, which stood at 50.3 in November.

-

This week, the S&P 500 Index reached a new high, while equities in Germany, Europe’s strongest economy, also hit a record. U.S. stocks, as measured by the S&P 500, have gained 29% in 2024, while the Deutsche Börse AG Germany Stock Index (DAX) has surged 21% year-to-date.

-

Hugo Boss was the top-performing stock in the S&P Global Luxury sector, gaining 23.6% in the past five days. Share gained after UBS raised its rating for the company.

Weaknesses

-

In the United States, ISM’s Services PMI fell a greater-than-expected 3.9% in November, to 52.1. The final November reading for S&P Global U.S. Service PMI was reported at 56.1, below the preliminary reading of 57.0. The U.S. Services PMI and the S&P Global U.S. Services PMI are both economic indicators that measure the health of the U.S. services sector, but they are based on different methodologies and are published by different organizations.

-

The U.S. November unemployment rate unxepectatdly increaed to 4.2%, from 4.1% in the prior month. Expectations for the Fed to cut interest rates later this month increaed to 87% from 70%.

-

Segnet Jewelers was the worst-performing stock in the S&P Global Luxury Index, falling 9.1%. Shares declined after the company reported weaker-than-expected quarterly results amid Noth American weakness.

Opportunities

-

This week, HSBC upgraded its ratings for Hermes, Louis Vuitton and Burberry while Goldman Sachs raised its ratings for Prada and Moncler. UBS raised its ratings for Hugo Boss and Ferragamo, while brokers increased price targets for Richemont and Swatch, citing reduced downside risk for the sector after this year’s selloff. Despite the recent market downturn, stock picking remains crucial, as luxury stocks are expected to continue diverging based on each company’s ability to generate strong sales.

-

The recent start to the holiday shopping season, with Black Friday specials and Cyber Monday deals, highlights consumers’ continued resilience. According to NRF data, shoppers spent an average of $235 during the five-day shopping period from Thanksgiving to Cyber Monday, up slightly from $227 last year.

-

Two European cities, Zurich and Vienna, were voted the best cities for expats in a Mercer report, with western European cities dominating. Boston was the highest ranked city in the United States, ranked number 32, and New York city was ranked 45.

Threats

-

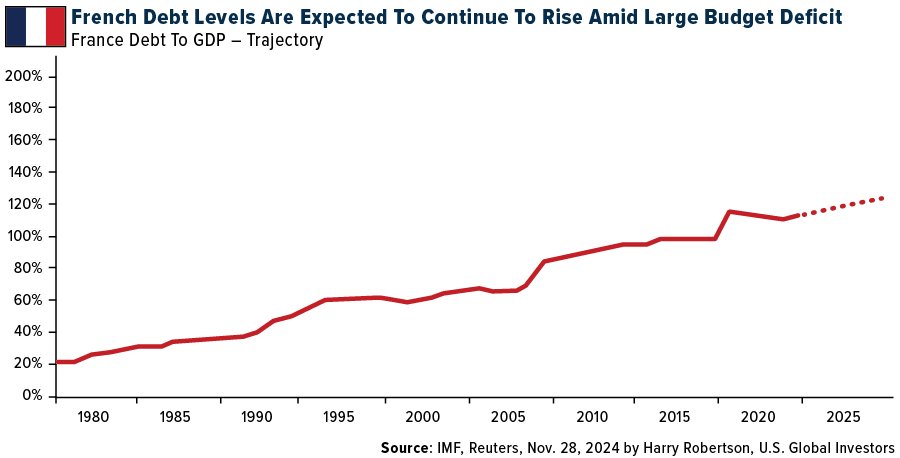

France joined Germany in political turbulence due to disagreement over the country’s budget proposal. French borrowing costs have surged due to concerns of a political showdown in Parliament over spending cuts and tax increases. France’s fiscal situation is worse than that of Greece, Spain, and Italy, with its deficit rising to 6.1% of GDP, up from 5.5% last year, and debt exceeding €3.2 trillion, over 112% of GDP.

-

General Motors recorded over $5 billion in impaired charges and write-downs on its joint venture in China, as the company faces market challenges and increased competition. The Chinese car market has shifted toward electric vehicles, leaving less room for traditional cars. According to Citi analyst Jeff Chung, Chinese car buyers are expected to purchase around 23 million new vehicles in 2024, up from 20 million five years ago. Of these, only 12 million will be gasoline-powered, down from 20 million, while all-electric and plug-in hybrid sales have surged to 6 million and nearly 5 million, respectively.

-

Kering issued another warning about its 2024 financial outlook due to weak China demand, expecting the operating income to nearly halve. The company reported a 16% drop in revenue in the third quarter.

Energy and Natural Resources

Strengths

-

The best performing commodities for the week were cocoa, up 4.54%, followed by coffee, rising 3.84% and then sugar up 3.46%. Life’s pathway to indulgence is getting more expensive. Incidentally, these are all equatorial crops that could be impacted by climate change. According to JP Morgan, Chinese steel demand has rebounded and is now down just 1% year-over-year in October; output has recovered rapidly through October and into November as steel margins improve, and steel inventory remains below seasonal average levels.

-

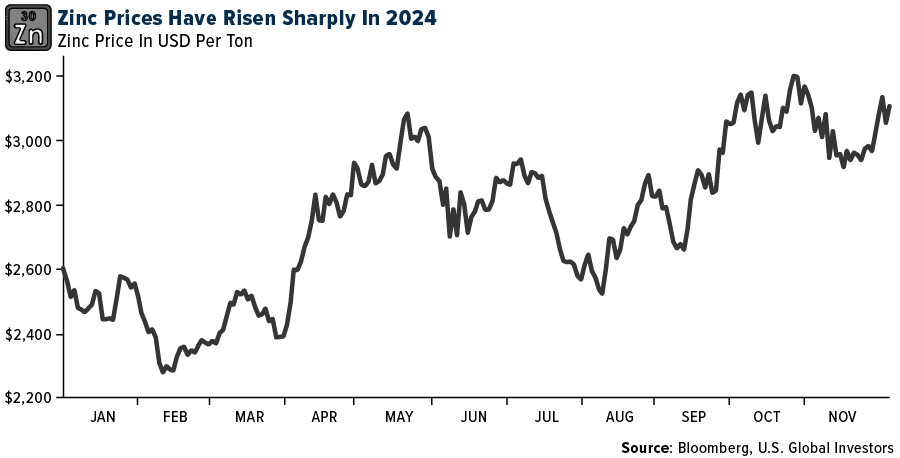

Zinc could see more sharp price swings as growing tightness along the metal’s supply chain leaves buyers exposed to sudden changes in availability. The spike was fueled by the withdrawal of huge volumes from LME warehouses, which stoked speculation of a potential squeeze on short-position holders, according to Bloomberg.

-

Canada now has some leeway with the expansion their Trans Mountain pipeline to redirect oil exports away from US markets directly to their west coast for international export, and thus could potentially blunt some of Trump’s tariffs. A substantial amount of Canadian oil goes to US refiners on the west coast, so plants operated by Chevron, Marathon Petroleum and Valero Energy could be forced to more expensive oil purchases.

Weaknesses

-

The worst performing commodity for the week was natural gas, dropping 8.33%. on mild weather forecast and a lower-than-expected drop in inventories, as reported by Bloomberg. According to Morgan Stanley, oil exports from Iran appear to have started declining in late October and early November. Vortexa data indicates that recent exports have averaged just 1 million barrels per day, down from 1.5 million barrels per day for much of the year.

-

UBS’s weekly refining margins tracker shows a significant decline. The average refining margin for the week fell by $2.48 per barrel to $3.89 per barrel. The largest drop was in middle distillates: diesel decreased by $3.61 per barrel to $15.28 per barrel, while jet fuel dropped $3.47 per barrel to $13.26 per barrel. Gasoline margins also declined, falling $2.19 per barrel to $7.01 per barrel.

-

According to BMO, average cobalt standard-grade metal prices in 2024 are projected to range between $12.10 and $12.30 per pound. When compared to historical annual average prices adjusted for inflation dating back to the early 1900s, 2024 is on track to be the worst year on record for cobalt prices.

Opportunities

-

According to Bank of America, exploration is technically challenging, expensive and risky. Historically, it has a low “hit” rate with only 1 target out of 1,000 delivering a potentially economic deposit. By applying AI to early-stage target identification, and exploration processes, innovators are trying to improve these odds. Should the approaches prove viable, there is great opportunity for disruption.

-

APA Corp. says gas will always be an essential part of the energy mix for miners in the iron ore-rich Pilbara, where it has a $3 billion growth strategy linked to the big miners with ambitious decarbonization targets. APA plans to build solar farms and battery storage on big tracts of land it picked up in the $1.7-billion acquisition of Alinta Energy’s Pilbara power network as miners like BHP, Rio Tinto and Fortescue grapple with how best to secure renewable energy supplies, according to The Australian.

-

Meta Platforms Inc. is seeking as much as 4 gigawatts of new nuclear energy to run data centers and support the U.S. electric grid, starting in the early 2030s. The Facebook parent is asking developers to submit proposals to deliver 1 gigawatt to 4 gigawatts of reactor capacity, according to a statement Tuesday.

Threats

-

According to Bloomberg, the copper pipeline for the period 2024–2033 includes 51 projects, of which 11 are new, according to data released Wednesday by Chilean copper agency Cochilco. The updated investment estimate is 27% higher than a previous projection for 2023-2032, according to a presentation at the mining ministry in Santiago.

-

China announced an outright ban on exports of several materials with high-tech and military applications, in a tit-for-tat move after President Joe Biden’s government escalated technology curbs on Beijing. Gallium, germanium, antimony and superhard materials are no longer allowed to be shipped to America, the Ministry of Commerce said in a statement Tuesday.

-

Many Chinese metal importers have stopped buying U.S. copper scrap in anticipation of tariffs when Donald Trump assumes the presidency, according to Beijing Antaike Information Development Co. The purchases were halted from mid-November because those cargoes are likely to arrive around the time Trump takes office on Jan. 20, the state-owned researcher said in a note, citing its survey of traders.

Bitcoin and Digital Assets

Strengths

-

Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Curve DAO, rising 144.31%.

-

Crypto trading volume climbed to an all-time high in November, with more than $10 trillion of digital assets changing hands for the first time on centralized spot and derivatives exchanges. Crypto markets have surged amid optimism for a friendlier regulatory environment for the industry under the newly elected Trump administration, according to Bloomberg.

-

Cryptocurrency speculators kept Bitcoin in sight of the landmark $100,000 after digital-asset proponent Paul Atkins was selected by U.S. President-elect Donald Trump to lead the SEC, writes Bloomberg. The original digital asset erased earlier losses to trade about 1% higher at around $97,300 on Wednesday following a more than 40% advance since Trumps decisive election victory.

Weaknesses

-

Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was RAY, down 15.03%.

-

Options suggest that some traders may have already started to hedge against a potential pullback in Bitcoin after the original cryptocurrency surged to more than $100,000 for the first time. There has been an uptick in demand for puts with strike prices of $95,000, and $100,000 has seen the largest open interest position over the last 24 hours.

-

Crypto traders have triggered vertiginous jumps in digital assets beyond Bitcoin, stirring up memories of a buying frenzy that swept the market during the pandemic before giving way to an epic bust. Unsung tokens such as CRV, TRX and IOTA from the digital ledger of the same name have jumped over 40% in the past five days, according to Bloomberg.

Opportunities

-

President-elect Donald Trump’s pick of a crypto proponent to be the next head of the U.S. securities regulator lifted Bitcoin to $100,000 for the first time, reports Bloomberg, as traders warmed to the prospect of relaxed regulations. Bitcoin rose as much as 6.1% to $103,801 on Thursday.

-

Etoro is working with Goldman Sachs group on a potential initial public offering in the U.S. The trading and investment platform is considering going public as soon as the second quarter though that timeline is subject to change. The company is seeking a valuation above the $3.5 billion figure, writes Bloomberg.

-

Donald Trump says he is selecting venture capitalist David Sacks of Craft ventures LLC to serve as his artificial intelligence and crypto czar, a newly created position that underscores the president-elect’s intent to boost two rapidly developing industries, Bloomberg reports.

Threats

-

The UK police said they have shut down Russian networks that were moving billions of dollars for oligarchs, street gangs and spies by swapping cash for cryptocurrency across Europe, the Middle East and South America, Bloomberg writes. Officers at the National Crime Agency unveiled a complex laundromat that they said could support almost any crime, the article continues.

-

Bitcoin and the broader crypto market are witnessing strong demand for bullish leveraged plays, a sign the market is overheated. While market makers hedging is likely to keep BTC supported at around $100,000, the heightened activity raises the risk of pullbacks for other cryptocurrencies.

-

Despite online backlash, Solana memecoin Hawk has dropped over 90% in market cap. The token was launched by Hailey Welch who went viral earlier this year for her quote “Hawk Tuah” in a street interview video posted on YouTube, according to Bloomberg.

Defense and Cybersecurity

Strengths

-

Rheinmetall AG has strengthened its position in the U.S. defense market by acquiring Loc Performance Products for $950 million, gaining expanded production capacity, workforce, and capabilities to support military programs like the XM30 Mechanized Infantry Combat Vehicle.

-

Honeywell has signed a strategic $17 billion aviation technology deal with Bombardier, settled pending litigation, and revised its 2024 earnings and sales guidance downward, impacting its stock price.

-

The best performing defense stock this week was National Presto INDS, rising 11.06% after trading volume increased as much as seven times the 20-day average, making it the top performer among peers.

Weaknesses

-

French President Emmanuel Macron’s government collapsed amid Marine Le Pen’s rising influence, deepening political deadlock, economic uncertainty, and increasing public frustration. This comes as France edges closer to a far-right administration.

-

Airbus plans to cut 2,043 jobs in its Defense and Space division by mid-2026, focusing on combat aircraft, connected intelligence, and headquarters roles. The cuts come amid heavy losses and increased competition in the U.S. satellite market.

-

The worst performing defense stock this week was Aerovirnment, falling 16.03%, after second-quarter earnings missed expectations due to higher spending, with analysts citing weaker profits, increased operating expenses and softer revenue guidance.

Opportunities

-

TSMC is reportedly in talks with Nvidia to produce its Blackwell AI chips at a new plant in Arizona.

-

Huntington Ingalls announced its acquisition of South Carolina-based W International’s assets, integrating advanced metal fabrication facilities and skilled workers into its Newport News Shipbuilding division to support U.S. Navy programs. This includes nuclear-powered submarine and aircraft carrier production, with the transaction expected to close by the end of 2024.

-

The UK plans to “war-game” its defense supply chain resilience while developing a new strategy to boost local industries and raise defense spending to 2.5% of GDP amid growing geopolitical threats.

Threats

-

Russian tycoon Konstantin Malofeev predicts Moscow will reject a Ukraine ceasefire proposed by Donald Trump, insisting a truce offers “zero benefits” as Russia believes it is winning and seeks further concessions.

-

Syrian insurgents led by HTS and Turkish-backed militias captured the city of Hama in a significant setback for President Assad after taking Aleppo. Ongoing offensives target Homs, as regional and international dynamics complicate support for the Syrian government.

-

Iran plans to begin enriching uranium to 5% purity using thousands of advanced centrifuges at its Fordo and Natanz facilities, signaling potential leverage in negotiations with the West despite ongoing regional tensions and its previous near weapons-grade enrichment activities.

Gold Market

This week, gold futures closed at $2,654.80, down $26.20 per ounce, or 0.98%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 1.64%. The S&P/TSX Venture Index came in off 0.66%. The U.S. Trade-Weighted Dollar rose 0.25%.

Strengths

-

The best-performing precious metal for the week was silver, up 1.26%. According to BMO, the first silver pour at Aya’s Zgounder expansion was achieved, in line with previous commentary after ore processing in the new plant commenced. The plant reached nameplate capacity of 2ktpd, and commercial production continues to be targeted for year-end.

-

Australia’s biggest gold miner, Northern Star, has agreed to buy smaller rival De Grey Mining for $3.3 billion, as the soaring value of the precious metal bankrolls the highest price ever offered for an undeveloped Australian gold project, according to the Financial Review. On Friday, SSR Mining agreed to buy the Cripple Creek and Victor gold mines in Colorado from Newmont Corp. for an upfront cash payment of $100 million.

-

Gold buying by central banks surged to 60 tons in October, mainly led by the Reserve Bank of India (RBI), which added 27 tons of the precious metal to its reserves, the World Gold Council (WGC) said on Thursday. India added 27 tons of gold in October, bringing its total gold purchases to 77 tons from January to October, according to WGC data based on reported monthly data from the International Monetary Fund (IMF).

Weaknesses

-

The worst performing precious metal for the week was palladium, down 3.11%. According to Scotia, B2Gold announced that a strike has begun at the company’s Fekola mine in Mali with the Fekola workers union giving notice that the strike will last until December 5. BTO continues to process ore through the Fekola mill during this period and noted that it still expects fiscal year 2024 production to be toward the lower end of its 420-450k ounce guidance. Additionally, Mali issued an arrest warrant for Barrick Gold’s CEO Mark Bristow as they have not settled their tax dispute with the company.

-

De Beers has cut diamond prices by more than 10% across the board as the world’s biggest producer abandons attempts to put a floor under the slumping market. The diamond industry has been struck by one of its deepest and most prolonged slumps in decades, according to Bloomberg.

-

The day after De Beers’ announcement, Chinese lab-grown diamond companies saw their share prices surge 9% to as high as 30%. The price cut instituted by De Beers may stimulate more diamond sales, but this shows the eroding future outlook for natural stones to be undercut by synthetic stones.

Opportunities

-

For two years, J.P. Morgan strategists have urged investors to buy gold, and for two years they have been right. On Tuesday, the bank predicted a triple crown, saying gold is once again the top commodity to buy. “Gold still looks well situated to hedge the elevated levels of uncertainty around the macro landscape heading into the initial stages of the Trump administration in 2025,” wrote a team led by Natasha Kaneva, head of J.P.Morgan’s global commodities strategy. Gold’s extended rally is reminiscent of the late 1970s, another period when inflation was a persistent problem. The price has risen 29% this year to a recent $2,667 per ounce.

-

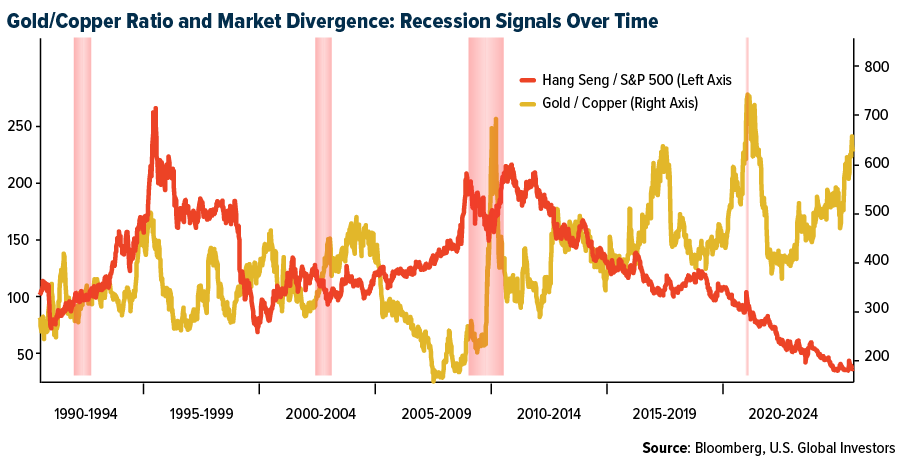

Gold versus copper and the ramification of China’s strength versus the U.S., (as proxied by the Hang Seng Index divided by the S&P 500 Index) points more toward gold as the best opportunity in this macro backdrop. Copper typically outperforms gold when economic demand forces are predominant. The graphic created by Bloomberg shows the opposite, and with good reason, China is in decline. A roughly 50-year low in the Hang Seng Index versus the S&P 500 may suggest the potential for reversion, but with new U.S. leadership focused on correcting trade imbalances with China, the enduring uptrend in gold/copper could be gaining more fuel. The red shaded areas indicate recessions.

-

Montage Gold has entered a strategic partnership with Sanu Gold Corporation, given its highly attractive exploration properties in Guinea, obtaining a 19.9% interest in Sanu through the issuance of 2.3 million basic shares of Montage equating to C$5.5 million. The company is joining existing strategic investor AngloGold Ashanti who acquired a 14.0% stake in Sanu in September 2024.

Threats

- A group of Indigenous tribes in Alaska have launched a legal challenge of a gold mine in northwest B.C., a project the group says threatens the Nass and Unuk rivers. Ecojustice, a Canadian environmental law charity, on behalf of a consortium of 15 Alaskan tribes called the Southeast Alaska Indigenous Transboundary Commission (SEITC), has applied to B.C.’s Supreme Court for judicial review of the Environmental Assessment Office’s decision that Seabridge Gold’s KSM mine near Stewart, B.C., according to CBC.

- Gold’s year-end outlook faces risks from a resurgent dollar, challenging the seasonal tailwinds that typically support the metal this time of the year. The precious metal typically sees its highest returns in December and January, with average gains of 2.4% and 3.5%, respectively, over the past 10 years. But after dropping 4% in November, its worst month in more than a year, gold has also started off December on the back foot, according to Bloomberg.

- Federal Reserve Chair Jerome Powell was speaking at the New York Times Dealbook Summit and compared Bitcoin to gold. “People use Bitcoin as a speculative asset. It’s like gold, it’s just like gold —- only it’s digital. People are not using it as a form of payment or a store of value,” he said. “It’s highly volatile. It’s not a competitor for the dollar, it’s really a competitor for gold. That’s how I think about it.”