Bitcoin could be headed for the stratosphere, according to a new report by Bernstein. The global investment firm is predicting that the world’s top digital asset could hit $200,000 by 2025, $500,000 by 2029 and—no, you’re not seeing things—$1 million per token by 2033. This decade-long rally, Bernstein analyst Gautam Chhugani writes, will be largely driven by institutional investors as the Bitcoin ETFs are approved at major wirehouses and private bank platforms.

These bold predictions were just one of the hot topics at a recent crypto gathering I had the pleasure to attend this week at Galaxy Digital’s New York headquarters. Galaxy’s billionaire founder and CEO, Mike Novogratz, was a gracious host to a small number of visitors hailing from broker-dealers, crypto exchanges, energy providers and everything in between.

The consensus among attendees is that Bitcoin is looking increasingly ready for primetime. Some big names have recently jumped on board, including Larry Fink, CEO of BlackRock, the world’s largest asset management company ($10 trillion in AUM), and even former President Donald Trump. They’ve been “orange pilled,” as the crypto crowd likes to say.

Bitcoin’s Path To $1 Million Depends On Clearer Regulations And Lower Rates

This wasn’t always the case. Just five years ago, Trump tweeted that he was “not a fan of Bitcoin and other Cryptocurrencies, which are not money.” Fast forward to today, and he now says that he wants “all the remaining Bitcoin to be MADE IN THE USA!!!” Both Trump and independent candidate Robert F. Kennedy Jr. are accepting Bitcoin as campaign donations.

For Bitcoin to really take off and hit those lofty price targets, two things need to fall into place: clearer regulations and lower interest rates. Clear rules will give both big institutions and everyday people more confidence to invest, while lower rates might make Bitcoin look more attractive compared to risk-off assets like cash and bonds.

Will Ethereum ETFs Attract Investors Beyond Bitcoin?

Bitcoin has been stealing the spotlight, but Ethereum isn’t too far behind. ETFs that track the world’s number two crypto are coming, with several firms just waiting for the green light from the Securities and Exchange Commission (SEC).

The big question is: Will people buy in? Do regular investors need to look beyond Bitcoin?

Ethereum has some advantages over Bitcoin, like smart contracts and decentralized apps. But it lacks Bitcoin’s compelling story and star power, and its daily trading volume is roughly half that of Bitcoin’s. These factors could sway investor interest as Ethereum ETFs hit the market.

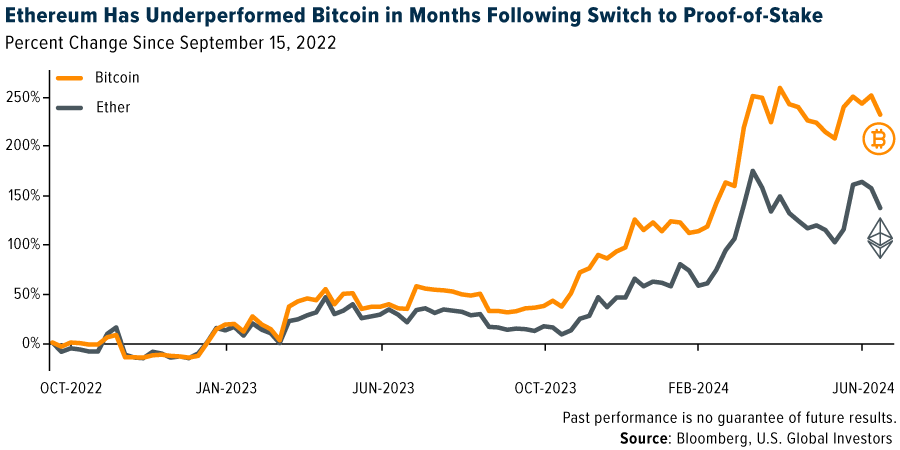

There’s also the fact that Ethereum switched its consensus protocol from proof-of-work (PoW) to proof-of-stake (PoS) a little over two years ago. The “Merge,” as it’s called, drastically improved efficiency, but investors don’t appear to place too much of a premium on this. Since the Merge, Ethereum has underperformed Bitcoin.

The Growing Distrust In Government And Its Potential Impact On Bitcoin

Blockchains are often called “trust machines,” but the challenge is getting more people to trust them. A big hurdle has been the lack of interest from big institutions. But here’s the kicker: Trust in traditional institutions is crumbling, which—while worrisome for the country—could be constructive news for decentralized assets like Bitcoin.

A recent survey by the Partnership for Public Service found that only 23% of Americans trust the federal government, down from 35% in 2022. Even worse, only 15% think the government is transparent, and a whopping 66% see it as incompetent. These numbers show people are losing faith in centralized systems, which could push them towards alternatives like Bitcoin.

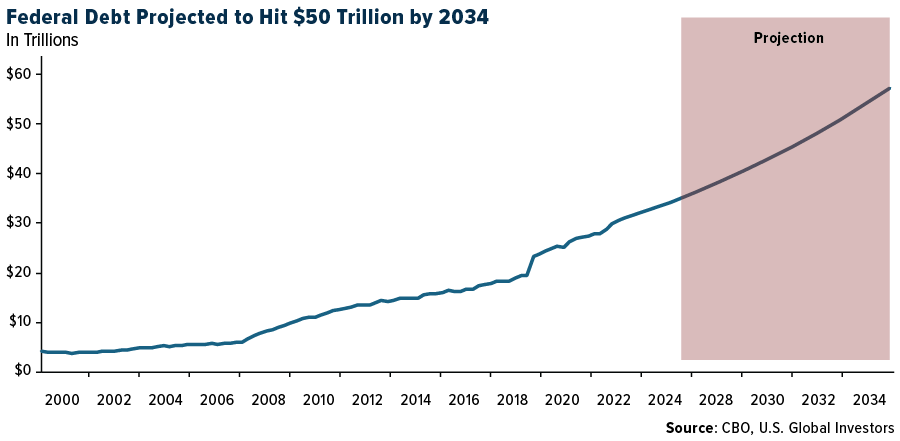

The government’s debt situation is a huge part of the problem. In a new report, the Congressional Budget Office (CBO) predicts that public debt will skyrocket from $34.8 trillion today to a head-spinning $50.7 trillion by 2034, when debt is expected to hit 122% of the U.S. economy. This ballooning debt makes a strong case for financial innovation and diversification, potentially boosting Bitcoin’s appeal.

Voters Want Crypto-Savvy Officials

Conversely, crypto knowledge is increasingly being seen as a political asset. A recent Grayscale-Harris survey found that three in four people want political candidates to be up to speed on innovative tech including Bitcoin and Ethereum. Over half of likely voters said they’d be more likely to support candidates who understand and advocate for crypto.

Taking his cue, perhaps, from Trump and RFK Jr., President Joe Biden seems to be warming up to digital assets. There’s talk of a “Bitcoin roundtable” in D.C. next month, suggesting that the administration may be keen to engage with the crypto community.

Related: A New Era for Southwest? Elliott’s $1.9 Billion Bet