Clients are always wondering about the next big thing and thanks to bitcoin's evolution, clients aren't just increasingly curious about the largest digital asset, they want to know what's next in the world of crypto.

That doesn't imply that bitcoin's run is done. Rather, the predictable search for the “next bitcoin” is stoked by the crypto universe's evolution and investors' enthusiasm. In many respects, ethereum is answering the question about what's next after bitcoin. Ethereum is the blockchain protocol that birthed the digital asset known as ether – the second-largest behind bitcoin.

However, that's just the start of the conversation because ethereum is the sun around which a growing and credible universe of decentralized finance (DeFi) assets revolve. And yes, many fit the bill as “next big thing” opportunities. Some are already realizing that potential and it's easy to see why.

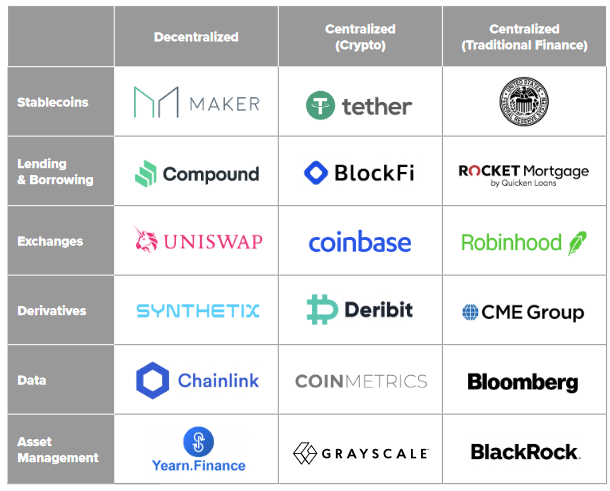

“With DeFi, you can do most of the things that banks support — earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more — but it’s faster and doesn’t require paperwork or a third party,” according to crypto exchange operator Coinbase. “As with crypto generally, DeFi is global, peer-to-peer (meaning directly between two people, not routed through a centralized system), pseudonymous, and open to all.”

DeFi Life Made Easier

Advisors looking for a broad, efficient DeFi solution for clients have a solid option to turn in the Grayscale DeFi Fund. This product employs the index fund structure – it tracks the CoinDesk DeFi Index – advisors and clients have come to love over the years.

Confirming the return potential of DeFi assets, the Grayscale DeFi Fund returned 41% since coming to market six weeks ago. That's hard to beat for any new index fund or ETF, but performance isn't the hole story. In fact, ease of access and removal of the single asset selection burden are just as important.

While many clients are hearing about ether and perhaps some of the other larger DeFi's, such as UniSwap, the fact is that there are nearly 220 DeFi assets on the market today. That's enough to confound most clients – particularly in a still nascent asset class – and it's large enough as to where unknowing investors can just as easily pick a dud as they are to select a winner.

On that note, the CoinDesk DeFi Index is home to 10 DeFi assets. Relative to the index many clients are used to, that is a small number of holdings. However, given where DeFi is in its maturation process, 10 is a fair number and the manner in which the Grayscale DeFi Fund and its index are weighted keep investors away from the riskiest fare in an asset class that is still risky.

These are important factors for clients because as more hear about DeFi and gain some education on this front, many are likely to find it compelling and with good reason. After all the usage cases are attractive with the potential to disrupt a slew of familiar financial services.

“Instead of interacting with a centralized authority to borrow, lend, or trade, users interact directly with decentralized protocols from their wallet,” according to Grayscale research. “Funds are custodied by smart contracts and positions can be opened, closed, or rebalanced 24/7, 365 days

per year, by anyone in the world.”

Just look at this chart to understand where DeFi can make substantial inroads.

Courtesy: Grayscale

Another Reason to Embrace DeFi

Grayscale is likely onto something with the DeFi Fund because it epitomizes the notion that crypto and fintech play integral though overlooked roles in sustainability and equality – jibing with the virtuos investing style many clients seek.

“Today, over 2.3 billion people are excluded from the traditional financial system and even more lack access to sophisticated services such as borrowing, lending, and asset management. Decentralized digital assets are revolutionizing the global transfer of value and require decentralized financial services to support it,” adds Grayscale. “While DeFi is still nascent technology, it has the ability to revolutionize the global financial services market (estimated at $21 trillion) and pave the way for a more accessible, and efficient financial system.”

That could be further confirmation of DeFi's “next big thing” status.

Related: For Accredited Clients, an Umbrella Approach to Big Crypto