After countless delays, the Ethereum “Merge” finally took place last week, switching the blockchain protocol from proof-of-work (PoW) to proof-of-stake (PoS).

What this means, in brief, is that Ethereum’s native coin, Ether (ETH)—the world’s second largest digital asset following Bitcoin (BTC)—can no longer be mined using a graphics processing unit (GPU). Instead, participants can choose to “stake” their ETH on the network. The Ethereum network then selects which of these participants, known as “validators,” gets to validate transactions, and if such validations are found to be accurate and legitimate, participants are rewarded with new ETH blocks.

So what’s the catch? Well, there are a couple of big ones: 1) To become a validator, participants must stake at least 32 ETH, the equivalent of $43,000 at today’s prices, and 2) They must stake them for years.

You can see, then, how the Merge has transformed ETH from a decentralized asset, available to any young gamer with access to a decent GPU, to more of a centralized, oligarchic asset, controlled by a relatively few participants who already own tens of thousands of dollars’ worth of ETH.

In fact, as CoinDesk reported last week, two large validators were responsible for over 40% of the new ETH blocks that were added in the hours post-Merge. Those validators are crypto exchange platform Coinbase and crypto staking service Lido Finance.

PoS Puts Ether In Regulators’ Crosshairs

But wait, there’s more. By converting to PoS, Ether risks being seen by U.S. regulators as a proof-of-security asset. Last Friday, the White House published its first-ever crypto regulatory framework, just a day after the Merge was completed.

Gary Gensler, head of the Securities and Exchange Commission (SEC), has said on numerous occasions that PoW assets such as BTC are commodities, not securities, and should therefore not be regulated as securities.

That’s not the case with PoS, according to Gensler. Last week, the SEC chief commented that digital assets that allow investors to stake their holdings in exchange for new coins may qualify them as securities. The implication, of course, is that oversight of these coins may end up being just as rigorous as that of stocks, bonds, ETFs and other highly regulated assets. Besides ETH, other popular PoS cryptocurrencies include Cardano, Polkadot and Avalanche.

The May crash of Terra’s Luna coin, which triggered the collapse of overleveraged crypto lenders such as Celsius, Voyager and Three Arrows Capital, was a major driver of this year’s crypto winter. Lenders’ promises of high returns on investment have landed them in financial and legal hot water. It’s very important that the Ethereum Foundation not make the same mistakes and invite the same level of scrutiny.

As we like to say at U.S. Global Investors, government policy is a precursor to change. But the change, in this case, may not turn out to be favorable. Regulatory pronouncements could add to volatility within the nascent cryptocurrency industry.

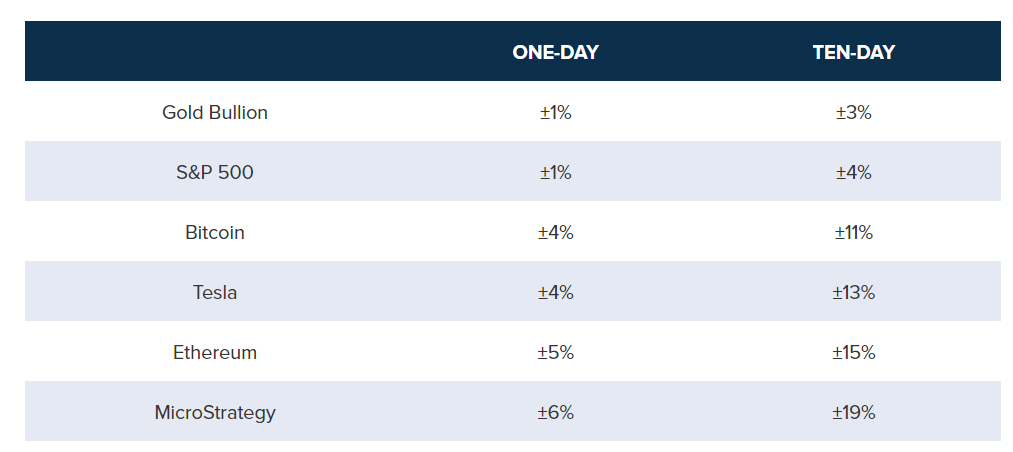

In the table below, you can see that ETH was one of the most volatile assets for the one-day and 10-day trading periods as of August 31—more volatile, in fact, than BTC and shares of Tesla. I can’t help believing that’s due to investors’ apprehension of the Merge and the regulatory uncertainty that surrounds it.

DNA Of Volatility

Standard Deviation For One-Year, As of August 30, 2022

Energy FUD Contributed To Decision To Transition To PoS

If everything I’ve said up until this point is the case, why did Ethereum decisionmakers choose to switch to PoS in the first place? Simply put, they folded under pressure from misleading charges that crypto mining, particularly BTC mining, consumes too much energy and is bad for the environment.

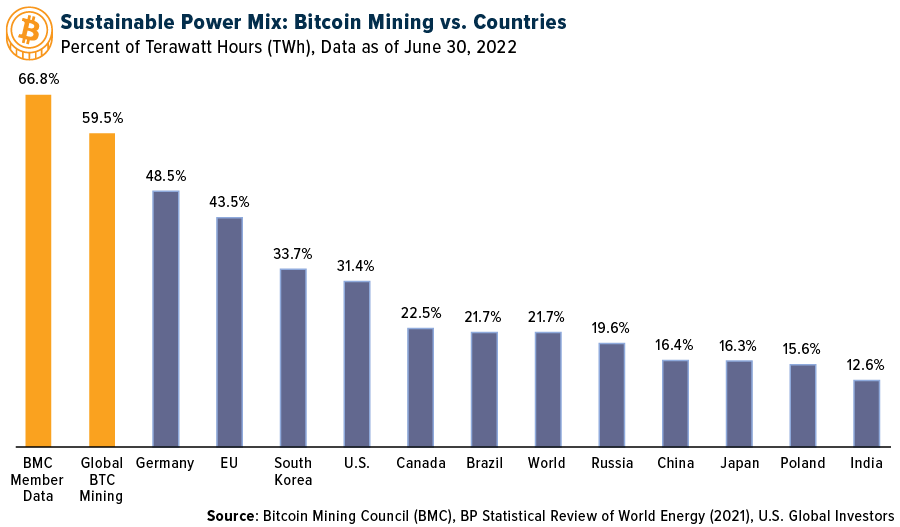

This is FUD, or fear, uncertainty and doubt. Yes, BTC mining requires electricity, but compared to nearly every other major industry—including finance and insurance, household appliances and gold mining—energy consumption is incredibly negligible, according to the Bitcoin Mining Council (BMC). What’s more, the BMC found that global BTC miners collectively use a higher sustainable energy mix than every major economy on the planet.

Supporters of the ETH Merge say that the move to PoS could cut the network’s energy usage by as much as 99.5%. None other than the World Economic Forum (WEF) praised the success of the Merge last week, writing that crypto “has been waiting for a recalibration towards sustainability… for Web3 climate innovators, the new generation of environmental advocates, as well as U.S. climate efforts more broadly.”

But as many PoW proponents have rightfully pointed out, the GPUs that were previously used to mine ETH will likely now be used for other purposes post-Merge, including mining other coins, high-performance computing and gaming. In reality, little to no energy will have been offset.

The question is: Who is funding the FUD about PoW and energy usage? It’s a complicated question.

Last week, a group of environmental activists, including Greenpeace and the Environment Working Group (EWG), announced that it plans to spend $1 million on a new campaign to encourage Bitcoin to follow ETH’s lead and move to PoS. The campaign, titled “Change the Code, Not the Climate,” falsely claims that BTC “fuels” the climate crisis.

This is the same covert tactic used by Russian president Vladimir Putin, who over the years has funded environmental groups and non-governmental organizations (NGOs) in the West in an effort to discredit and undermine the U.S. fracking industry.

Surprise! Gold Is Still One Of The Best Performing Assets Of 2022

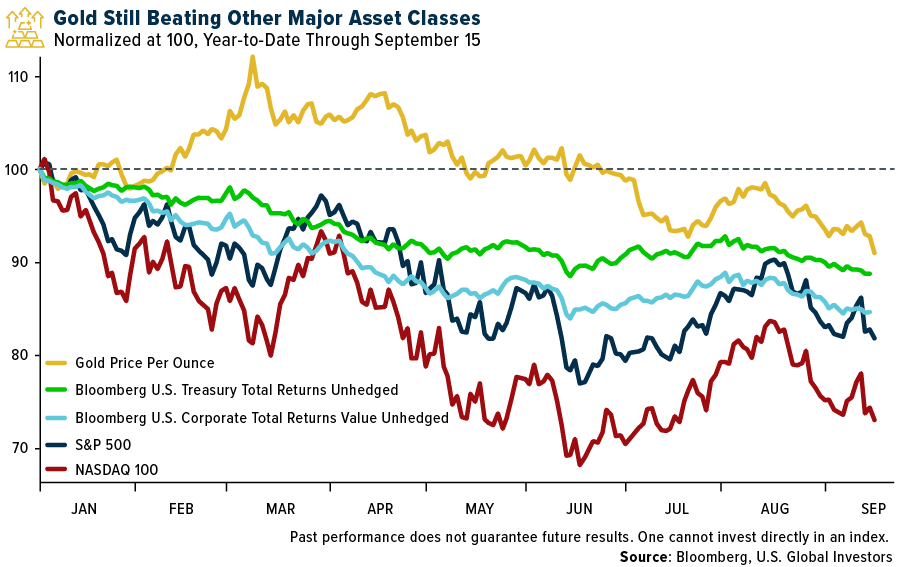

Switching gears, I want to say a few words on gold. BTC’s analogue cousin hit its lowest price since 2020 last week even as inflation remains near 40-year highs and recession fears persist. As I write this, the yellow metal is trading at around $1,666 an ounce, approximately 19% off its peak in March this year.

Some investors may read this and jump to the conclusion that gold is no longer a valuable asset during times of economic and financial uncertainty, but they would be mistaken. Although gold is down for the year, it’s nevertheless outperforming most major asset classes including Treasury bonds, U.S. corporate bonds, the S&P 500 and tech stocks. The precious metal has therefore helped investors mitigate losses in other areas of their portfolio.

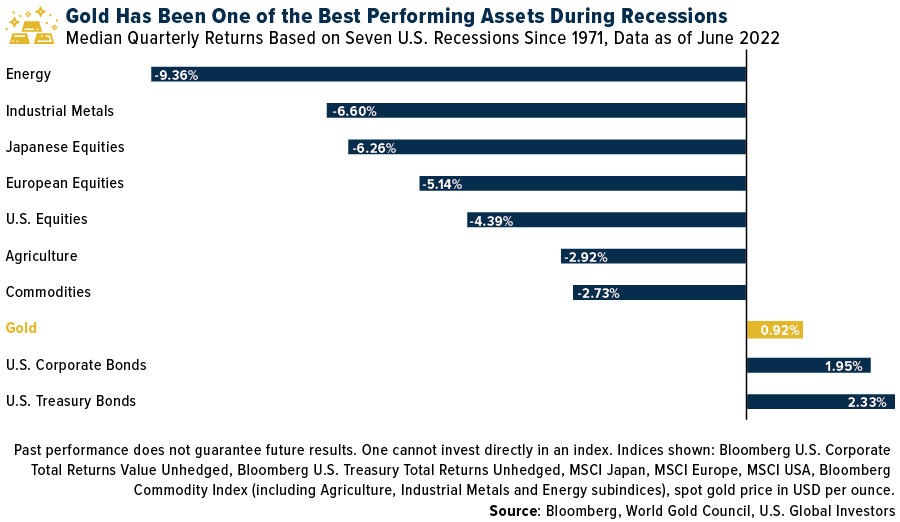

The latest report by the World Gold Council (WGC) also makes the case that gold could be a powerful investment in the face of a potential economic recession. The London-based group compared the performance of a number of asset classes during the past seven U.S. recessions going back to 1971, and it found that gold performed the best on average aside from government and corporate bonds.

That said, I still recommend a 10% weighting in gold, with 5% in bullion (bars, coins, jewelry) and 5% in high-quality gold mining stocks and funds. Remember to rebalance on a regular basis.