Last Thursday, HIVE Blockchain Technologies listed on Nasdaq (HVBT), providing U.S. investors access to Bitcoin and Ether mining.

As many of you know, HIVE became the first crypto miner to be traded publicly when it debuted on the TSX Venture almost four years ago. Its uplisting to Nasdaq, the world’s premiere tech stock exchange, represents the culmination of months of hard work by our team. I want to thank shareholders for their loyalty and patience.

That said, I believe the best is yet to come. We’re of the opinion that Ether 2.0 Proof of Stake (PoS) will take at least another two years before Ether mining is no longer financially attractive. That’s part of the reason why we’ve been expanding our enterprise cloud services focused on high-performance computing (HPC) workloads such as gaming, artificial intelligence (AI) and movie animation.

Toward that end, HIVE just agreed to join the NVIDIA Partner Network (NPN) as a cloud service provider, providing us access to the tech company’s ecosystem, partners, customers and deep industry expertise. We also substantially increased our computing capacity by buying NVIDIA graphics processing units (GPUs) with a total contract value of more than $66 million.

In the meantime, HIVE continues to hold its newly minted Bitcoin and Ether, mined using only 100% green renewable energy, in secure storage.

It’s important for investors to keep in mind that the crypto mining space is still incredibly volatile. Whereas gold has a daily standard deviation of ±1%, Bitcoin has one of ±6%. By introducing our enterprise cloud service offerings, we hope to lower some of HIVE’s volatility while maintaining its attractive margins.

Bitcoin Network a Far Bigger Consumer of Sustainable Energy Than Fake News Reports

Besides being an NVIDIA cloud service provider, HIVE is proud to be a founding member of the Bitcoin Mining Council (BMC), the group conceived in May after recent talks between North American Bitcoin miners, Elon Musk and MicroStrategy co-founder and CEO Michael Saylor.

In the past couple of months, the global Bitcoin mining network has come under heightened scrutiny over its energy consumption. Critics, most notably Elon Musk, have tried making the case that Bitcoin uses an unacceptable amount of electricity generated by fossil fuels, with Musk going so far as to cancel Tesla’s policy of accepting the cryptocurrency as a form of payment.

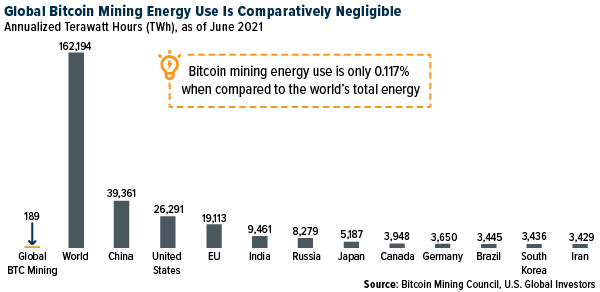

Newly compiled research, though, proves just how unfounded these criticisms really are. In its very first report, the BMC releases results of its survey of over 32% of the current global Bitcoin network, finding that participants are using electricity with a 67% sustainable power mix. Based on that data, the total sustainable power mix could be as high as 56%, making Bitcoin mining one of the most sustainable industries globally.

To put that in perspective, the U.S. currently uses electricity that’s only 30.5% sustainable. For China, that figure is less than 15%.

Take a look at the stunning chart below. Fake news makes Bitcoin out to be the biggest energy guzzler on the planet. On the contrary, its energy usage is negligible, as it consumes only 0.117% of total global electricity.

There may be many reasons why people spread misinformation about Bitcoin. Much of the misinformation may originate from Ripple, which is currently under investigation by the Securities and Exchange Commission (SEC). The fintech firm is believed to employ a great number of bots on Twitter and other social media platforms with the intent of tearing Bitcoin down in favor of its own XRP coin.

Busy Roads and Skies this Fourth of July

This past weekend marked America’s independence from Great Britain, and in many ways, it also marked American families’ independence from the pandemic. The American Automobile Association (AAA) forecasted that holiday travel volume would rival that of 2019 volume, with 47.7 million people taking to the roads and skies. Car travel may have even exceeded 2019 levels.

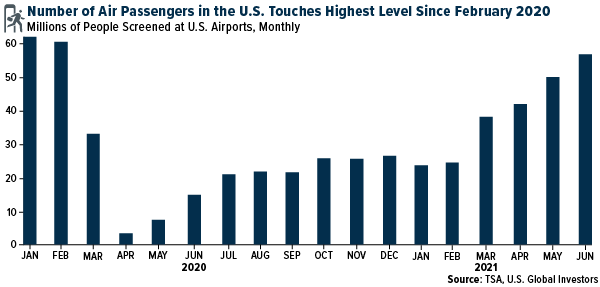

Air passenger traffic, meanwhile, was expected to reach 90% of 2019 volume, bringing it as close to pre-pandemic levels as we’ve seen so far. In June, more than 56.7 million people were screened at U.S. airports, the greatest amount since February 2020, soon before the entire world economy went into lockdown.

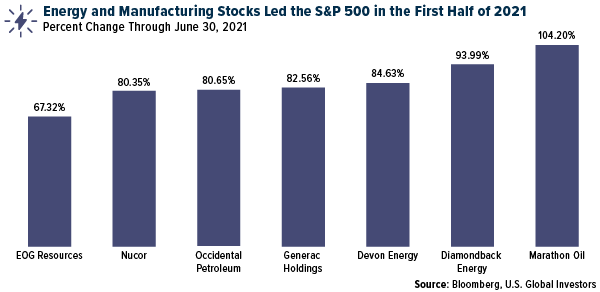

Unexpectedly strong demand is reflected in the performance of energy and manufacturing stocks in the first half of 2021. Among the leaders in the S&P 500 were oil exploration and production such as Marathon Oil (whose stock doubled in the six months ended June 30), Texas-based Diamondback Energy and Devon Energy, as well as manufacturers such as power generator-producer Generac and steel-producer Nucor.

Despite Labor Shortages, Factories Expanded at a Record Pace

All of this strong demand has put a strain on gas stations, some of which have already started seeing outages ahead of the July Fourth weekend. To be clear, this is the result of a labor shortage, not fuel shortage. According to National Tank Truck Carriers, the industry is short some 50,000 drivers right now.

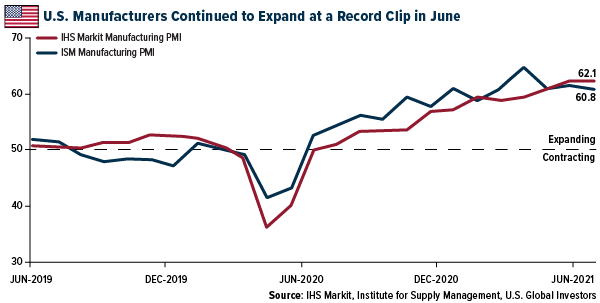

Factories both here and abroad also continue to experience a labor shortage as suppliers struggle to keep up with a wave of new orders. Nonetheless, factories reported very strong growth in June, with some surveys indicating record or near-record levels of expansion. The IHS Markit Manufacturing PMI came in at 62.1, unchanged from May’s record reading, while the ISM Manufacturing PMI dipped slightly from 61.2 to 60.6.

One of the most exciting manufacturing orders in recent memory happened last week when United Airlines put in an order for an incredible 270 new aircraft, including 200 Boeing Max jets and 70 Airbus 321neos. This represents the carrier’s largest such order in company history, and I see it as extremely bullish not just for United and Boeing but the commercial airline industry as a whole. United is positioning itself to capture market share as vaccination rates rise, travel restrictions are lifted and economies fully reopen.

Related: Is China's Crackdown on Bitcoin Mining Good News for North American Crypto Miners?