Not everyone has heard of SHA-256, but I believe it to be one of the greatest American inventions of the 21st century.

Developed by the National Security Agency (NSA) in 2001, SHA-256 is a secure hashing algorithm that, among many other things, is used by your iPhone to encrypt data, including the unique facial characteristics that many of you use to unlock your phone.

It also makes Bitcoin encryption possible. I won’t bore you with the details—you can read more about the algorithm here—but SHA-256 has never been hacked or compromised, making Bitcoin one of the most secure protocols on earth.

This is precisely why Satoshi Nakamoto, Bitcoin’s pseudonymous inventor, chose to build the digital asset on top of it. Writing in 2010, Satoshi said that SHA-256 “can last several decades unless there’s some massive breakthrough attack.”

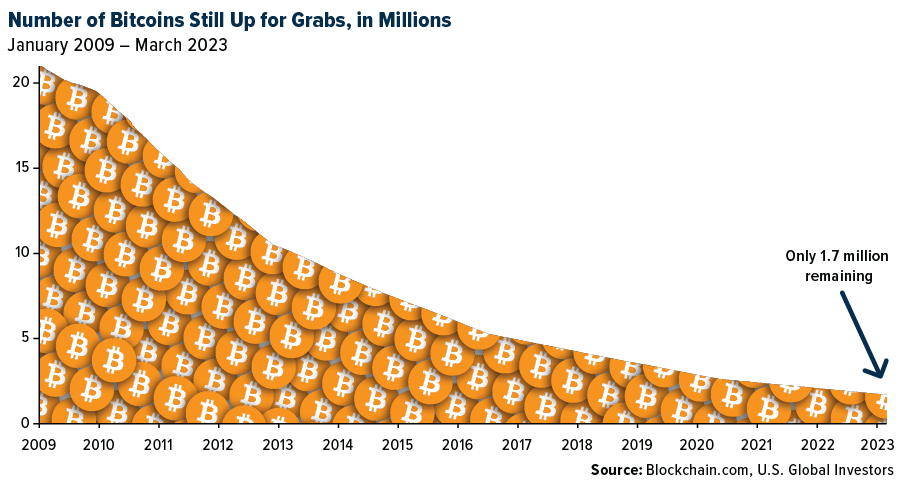

That’s good news, as Bitcoin is designed to be mined and held for decades to come—and beyond. The very last available bitcoin is expected to be produced sometime in the year 2140. As of this writing, close to 92% of every bitcoin that will ever exist has already been mined, meaning approximately 1.7 million are still up for grabs.

Setting The Record Straight

So why am I telling you all this? Mainly to set the record straight on Bitcoin.

First of all, Bitcoin is a U.S. invention, despite the Japanese-sounding pseudonym of its creator(s). This is important because there are still people who believe it was designed specifically to destabilize the dollar and the traditional monetary system.

That couldn’t be further from the truth, though many advocates believe Bitcoin could one day replace fiat currency. Even the Bank of International Settlements (BIS), one of the most vocal critics of Bitcoin, has issued guidance for central banks to potentially hold digital assets as reserve currencies.

I’m sure you’ve noticed that there’s been a lot of negative press about “crypto” since at least last summer, first with the implosion of Terra/LUNA and the bankruptcies of crypto lending firms Celsius and Voyager Digital. Then, of course, came the massive fraud scandal involving Sam Bankman-Fried and his crypto exchange FTX.

Last week, crypto bank Silvergate announced it would shut its doors, and New York-based Signature Bank, also crypto-friendly, was closed by regulators on Sunday.

Due to its association with crypto, Bitcoin’s price has suffered as a result of these setbacks, even though it has nothing to do with the firms in crisis, and even though its proof-of-work (PoW) protocol makes it far more secure than proof-of-stake (PoS) coins such as the now-worthless LUNA.

Bitcoin is the only crypto asset to officially be considered a commodity, according to the U.S. Commodity Futures Trading Commission (CFTC), citing its PoW protocol. All other coins and tokens may very well be classified as securities.

Part Of The Digital Transformation

Like face recognition, artificial intelligence (AI), mRNA vaccines and other modern technology, Bitcoin itself is neither “good” nor nefarious. Instead, it’s a key component of the ongoing, rapidly accelerating digital transformation.

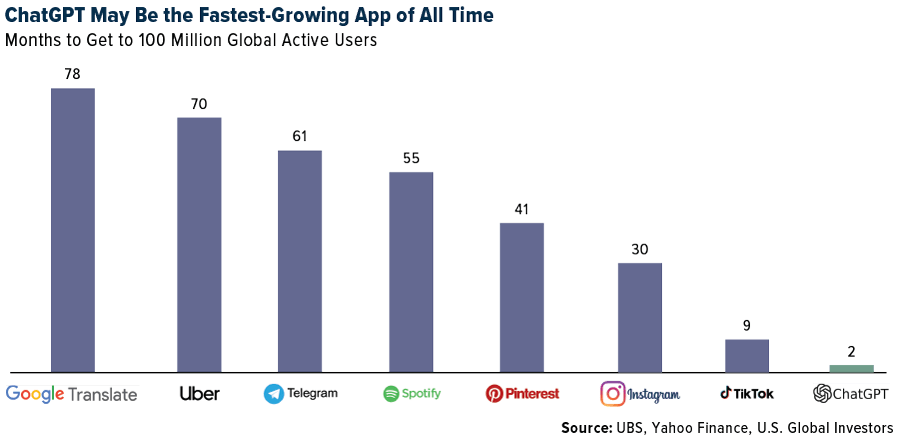

I think the lightning-fast adoption of ChatGPT is proof of this hyper-acceleration. The AI chatbot, developed by OpenAI, may be the fastest-growing app of all time. Launched at the end of November 2022, it reached 100 million active users, including Holly Schoenfeldt, in only two months, significantly beating other popular apps such as TikTok, Instagram and Pinterest. Last month, ChatGPT netted a staggering 1 billion visits to its website, according to Similarweb.

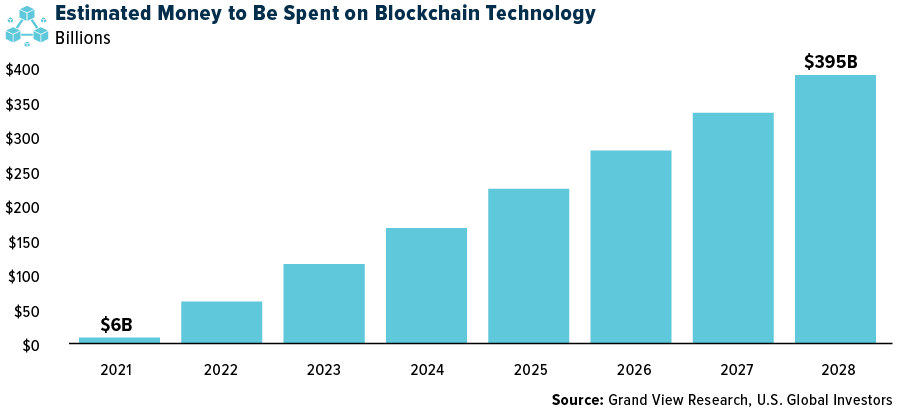

Take a look below. Spending on blockchain technology is expected to expand more than 65 times from 2021 to 2028, when it could hit $395 billion, according to one research firm. Due to its superior security properties, Bitcoin will be used to validate everything on these blockchains, which I believe will increase its value exponentially. As I often say, follow the money.

A Decentralized Asset Like Gold And Silver

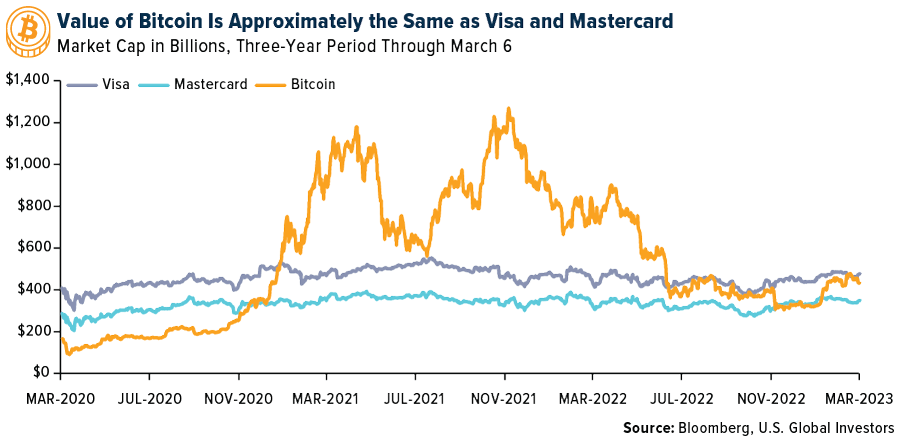

Speaking of money, Bitcoin’s market cap now rivals that of Visa and Mastercard, which have millions of users and decades’ worth of name recognition. Bitcoin is decentralized, meaning it has no CEO, no board of directors and no marketing budget. And yet its total value is approximately in line with that of the two biggest credit card companies. When it was trading at $55,000 and $65,000, Bitcoin’s market cap completely eclipsed that of Visa and Mastercard.

As big as Bitcoin is, it’s nowhere close to the market value of gold and silver, two more decentralized assets. Gold’s total global value is currently a little over $12 trillion, roughly the size of five Apples, while silver’s is approximately $1 trillion, sitting right between Alphabet and Amazon at today’s prices.

To me, this bodes well for Bitcoin, whose market cap is around $433 billion right now. For the digital asset to have the same value as silver, each bitcoin would need to be priced at $60,000, which it’s achieved before and likely will do so again.

For it to have the same value as gold right now, Bitcoin would need to trade at an eye-popping $630,000.

Is that doable? Some people think so. Billionaire investor Tim Draper believes Bitcoin could hit $250,000 by the end of this year. Cathie Wood says it could go as high as $1.5 million in seven years.

I’ll refrain from making my own price prediction, but I will say that as the digital transformation advances, I expect Bitcoin’s price to advance alongside it.

Related: Is Commercial Aviation Ready To Make a Landing in Investors’ Portfolios?