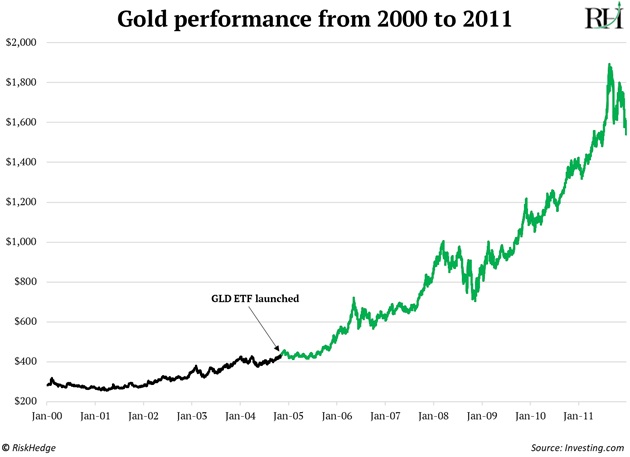

My friend who runs a small hedge fund was trading when the first gold ETF—the SPDR Gold Trust (GLD)—debuted in 2004.

Before the ETF, it was hard for big pools of money like pensions to buy gold. It meant managing a basket of “physically delivered futures.”

In theory, if the trade went wrong, you could be on the hook to take delivery of a truckload of 100 gold bars!

Then GLD debuted. All of a sudden, and for the first time ever, anyone could buy gold at the click of a button in unlimited quantities.

Big money gushed in and gold quadrupled in price over 10 years:

1. The exact same thing just began in crypto.

Until recently, it was extremely difficult for big pools of Wall Street’s money to buy bitcoin (BTC).

- You had to pick a reputable crypto exchange and trust it wouldn’t get hacked.

- If you stored your bitcoin in a wallet, you had to deal with self-custody.

- Above all else, lack of regulation kept most big money investors away. In a survey of 4,000 institutional investors, 75% cited “lack of regulatory clarity” as their main concern.

Wall Street money managers looked at this laundry list of risks and said, “You know, I like having a job. I’ll wait until I can buy crypto just like Apple (AAPL) stock, thanks.”

Finally, they got their wish. The first bitcoin ETFs started trading in January.

This is bitcoin’s IPO moment.

ETFs remove the taboo of investing in crypto for Wall Street. These ETFs are a genuine game-changer.

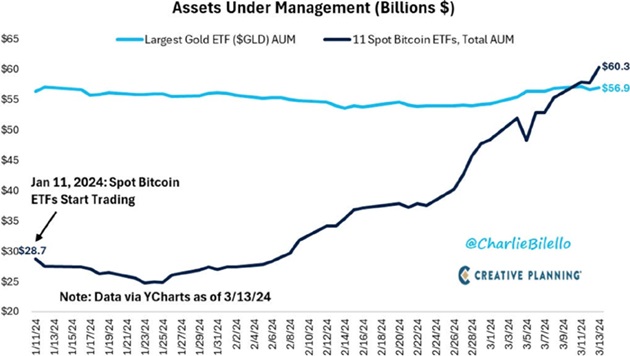

GLD was the fastest ETF to accumulate $10 billion in assets. That is, until the bitcoin ETFs debuted.

GLD took three years to reach $10 billion. BlackRock’s iShares Bitcoin Trust ETF (IBIT) did it in just seven weeks.

IBIT has enjoyed 50 straight days of inflows. First time that’s happened in ETF history.

The amount of money flooding into the ETFs has exceeded my wildest expectations. There are now 10 bitcoin ETFs. They’ve hoovered up $60 billion in two months. That’s more than GLD, which has been trading for 20 years!

Source: @CharlieBilello on X

$60 billion worth of inflows in a few weeks is absurd. Especially for a small market like crypto.

2, Remember, Microsoft (MSFT)—one company—is larger than the worldwide crypto market.

How high could crypto’s new “infinite bid” push prices?

When tens of millions of Americans get paid every other week, they buy stocks on autopilot through their retirement accounts.

This creates continuous demand for stocks, which puts a floor under prices.

Thanks to the ETFs, crypto now has an “infinite bid” as well. The world’s largest asset managers—including BlackRock, Fidelity, VanEck, and others—are telling their clients to buy and hold BTC in their 401(k)s.

The floodgates have opened. Billions of dollars of Wall Street’s money are pouring into crypto for the first time ever. I think we’re only getting started.

3. Although the ETFs are live, my contacts tell me only around 20% of financial advisors have been cleared to recommend them to clients so far.

They expect this to rise to 80% by the end of this year.

On Wall Street, things move slow. They joke you must get legal signoff to buy a box of pens. It’s funny because it’s (almost) true.

Bitcoin has surged from $45,000 to $70,000 since the ETFs launch. Yet most of the largest wealth managers aren’t even able to buy it yet.

What will happen when the Wall Street sales machinery cranks into high gear? Much higher prices, I expect.

A Jolt reader wrote me saying, “ETFs seem set to be major drivers in this bull market for bitcoin, potentially leading to more significant gains than we’ve seen in the past.”

I agree. The bitcoin ETFs unlock trillions of dollars of retirement money that were previously off-limits to crypto.

Maybe my $150,000 bitcoin price target from last October wasn’t bold enough.

4. Coming soon: Ethereum ETF.

Ethereum (ETH) is the second-largest crypto, bitcoin’s little brother.

I think an ETH ETF will debut this year for two reasons:

Reason 1: Bitcoin cleared the way.

The US Securities and Exchange Commission (SEC) approved the BTC ETF on the grounds that the bitcoin price closely tracks the price of bitcoin “futures,” which trade on regulated US exchanges.

This is also true for Ethereum. In short, Ethereum passes the same important test bitcoin does.

Reason 2: BlackRock doesn’t miss.

BlackRock filed an application for an Ethereum fund last November. Its ETF approval record is a near-unblemished 576-1.

The resounding success of the bitcoin ETF ensures the world’s largest asset manager will push hard to get its Ethereum ETF listed.

BlackRock runs 420 ETFs. Yet its bitcoin ETF accounted for 42% of its net flows this year. Wild.

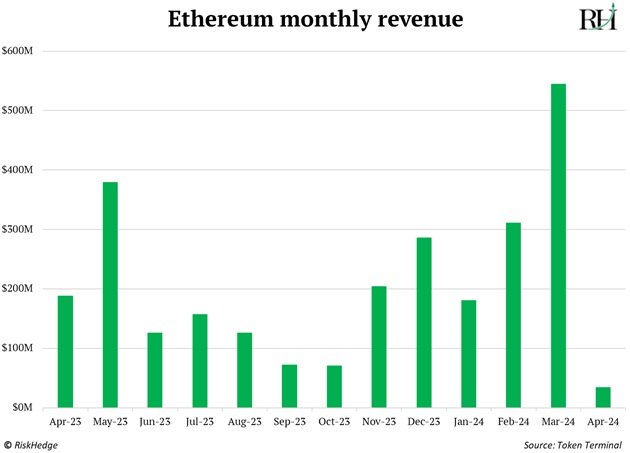

Ethereum is only one-third the size of bitcoin. That means it takes a lot less money to move its price. An Ethereum ETF pushes ETH toward—and ultimately beyond—$10,000.

-

Finally, Ethereum is “candy” for Wall Street.

There’s some innovation happening with bitcoin. But it’s nothing compared to Ethereum. ETH raked in $500 million in revenues last month alone—6X more than bitcoin:

The debut of the Ethereum ETF is a question of when, not if.

The first approval deadline is May 23.

My work suggests it’s unlikely to be listed on the first go-around.

But I put high odds on approval sometime in 2024.

Bottom line: Now is the time to get involved in crypto. The bitcoin ETFs are here. Ethereum ETFs are around the corner. And if you’ve been following along, you know bitcoin’s fourth halving is less than three weeks away. (Remember: The first three halvings yielded gains of 7,900%, 2,800%, and 660%, respectively.)

Related: SpaceX Is the Single Most Important Company in America Today