A common question we hear among investors is what to expect from private equity during market crises and downturns.

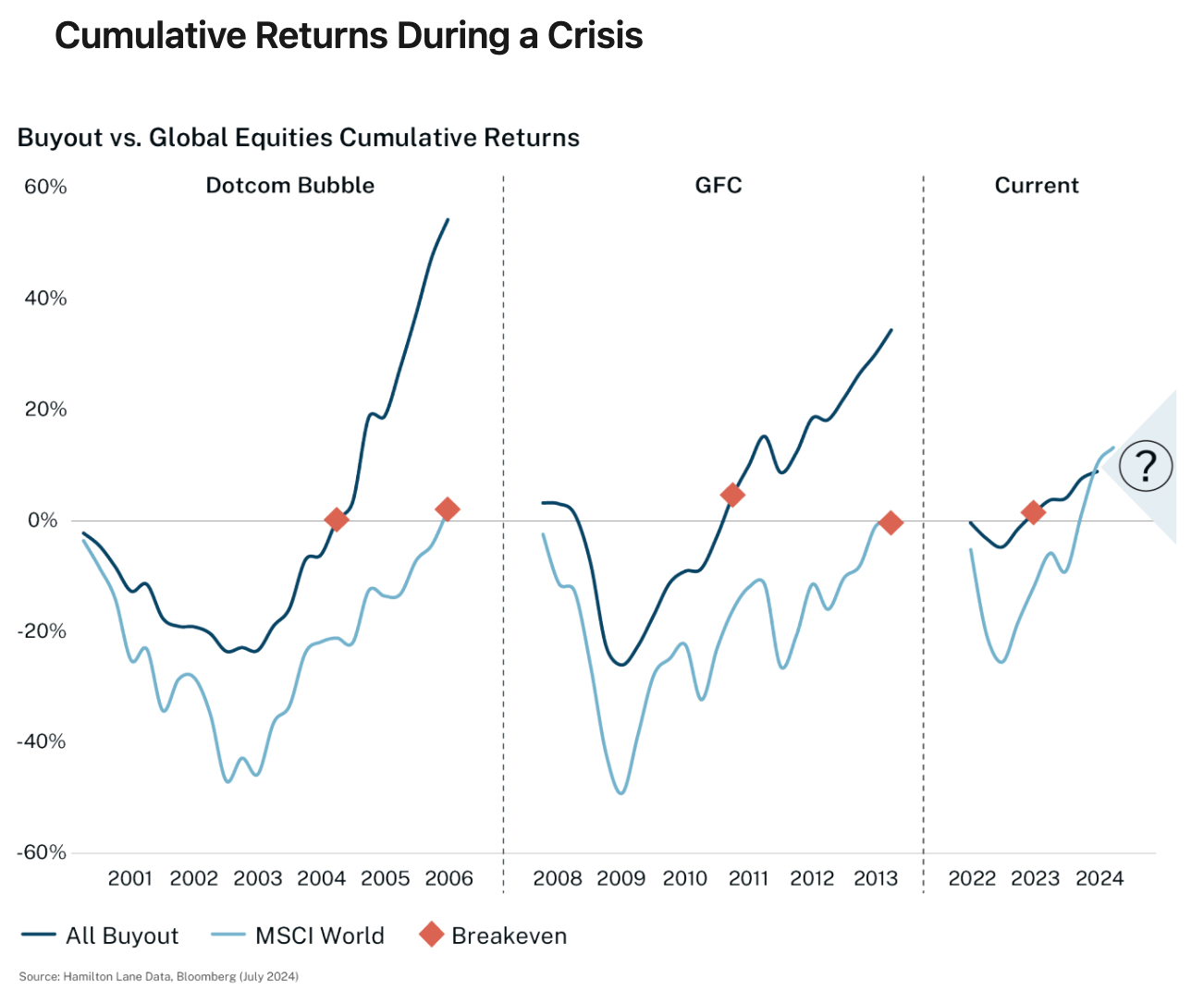

We’ve looked at a few significant market crisis environments: The dotcom bubble in the early 2000s as well as the Global Financial Crisis (GFC) and compared them to equity market drawdowns over 2022 and portions of 2023. During both the dotcom and GFC eras, the public market decline continued well past three quarters and took five to six years to reach breakeven. The downturns in buyout, however, were much more muted than those of the public markets. In addition to taking less of a hit, the private markets recovered sooner than public markets during both crisis periods.

At the start of 2022, we saw another market downturn, though much less severe than previous eras.

Private markets once again showed more resilience and muted aspects, including breaking even prior to the publics. But there’s something noticeably different this time around: The sharp rebound in the public markets from 2023 through 1H 2024 has not yet been matched by the private markets. Perhaps a rebound in M&A activity will provide a boost to private markets... It is safe to say, however, that the downturn seen in 2022 is nothing like what we saw in the dotcom bubble or GFC era.

Related: Is PE Performance King?