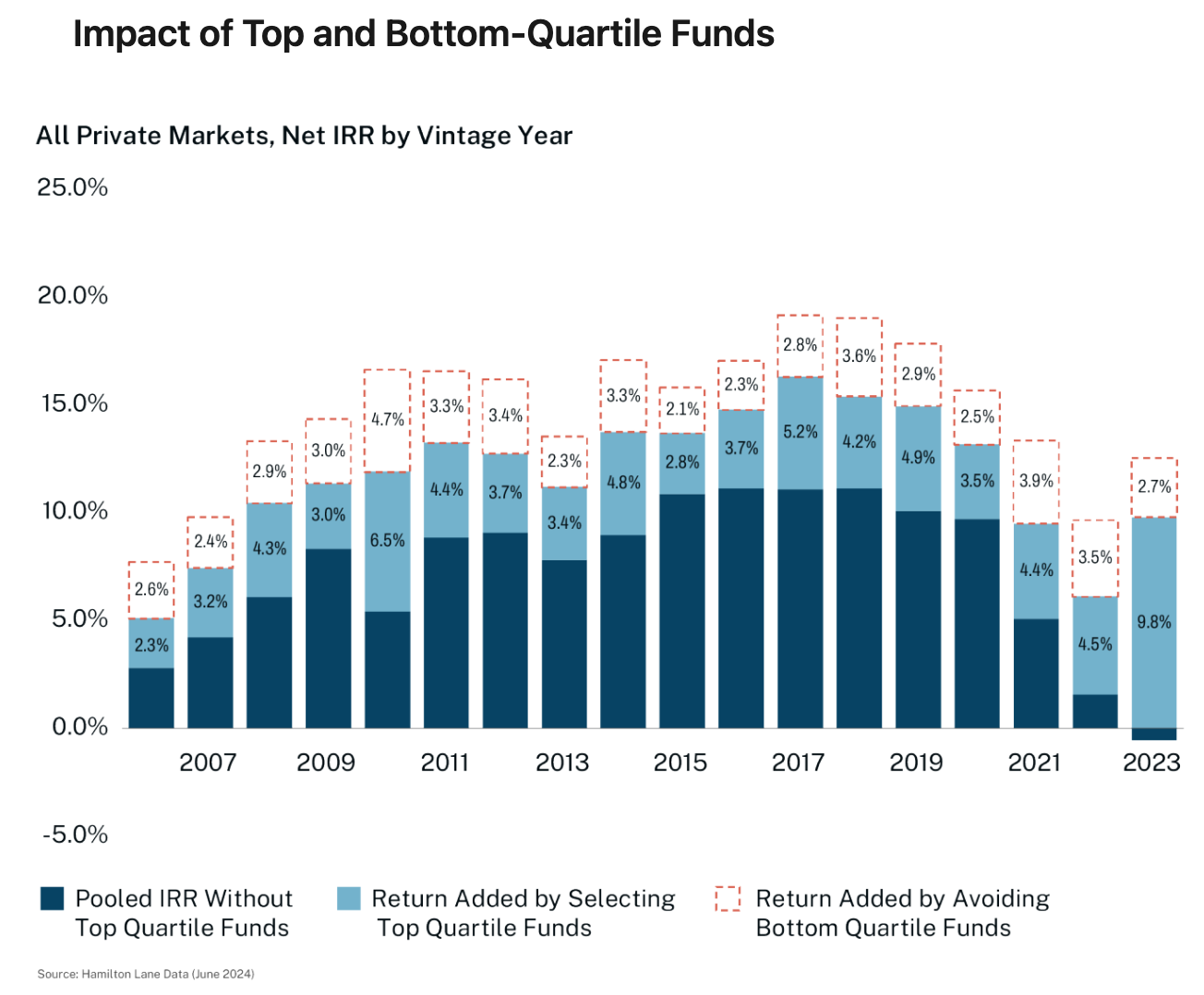

Top-quartile fund performance can be one of the many drivers in a private markets portfolio. However, there is also meaningful upside to avoiding bottom-quartile funds. Shown this week is the impact of top and bottom-quartile funds by vintage year for all private markets funds. It’s important to note that even without the top-quartile funds (dark blue), on a pooled IRR basis, private markets have still performed quite well.

That begs the question of how much alpha can be added by only selecting top-quartile funds. While this varies by vintage year, the chart above illustrates that roughly 3-5% can be added by selecting top-quartile funds. That is a substantial premium that comes with good portfolio management. While everyone strives for the best of the best, what can be said of simply avoiding the bottom-quartile funds? Does that have as drastic of an impact to pooled performance? Not quite; however, roughly 2-3% can be added by avoiding bottom-quartile funds. In either scenario, the importance of portfolio management is evident and careful manager selection – knowing who to choose and avoid – can drastically impact returns.

Related:

Definitions: All Private Markets – Hamilton Lane’s definition of “All Private Markets” includes all private commingled funds excluding fund-of-funds, and secondary fund-of-funds.