From: The ETF Shelf

Investors in the US are flocking to options-based ETFs that either leverage option strategies to potentially boost returns (e.g., covered calls) or shield portfolios from downturns (e.g., buffer ETFs), among other strategies.

This innovative approach is particularly appealing in today's volatile market environment, where traditional investments like stocks and bonds are offering lackluster returns and yields or heightened risk.

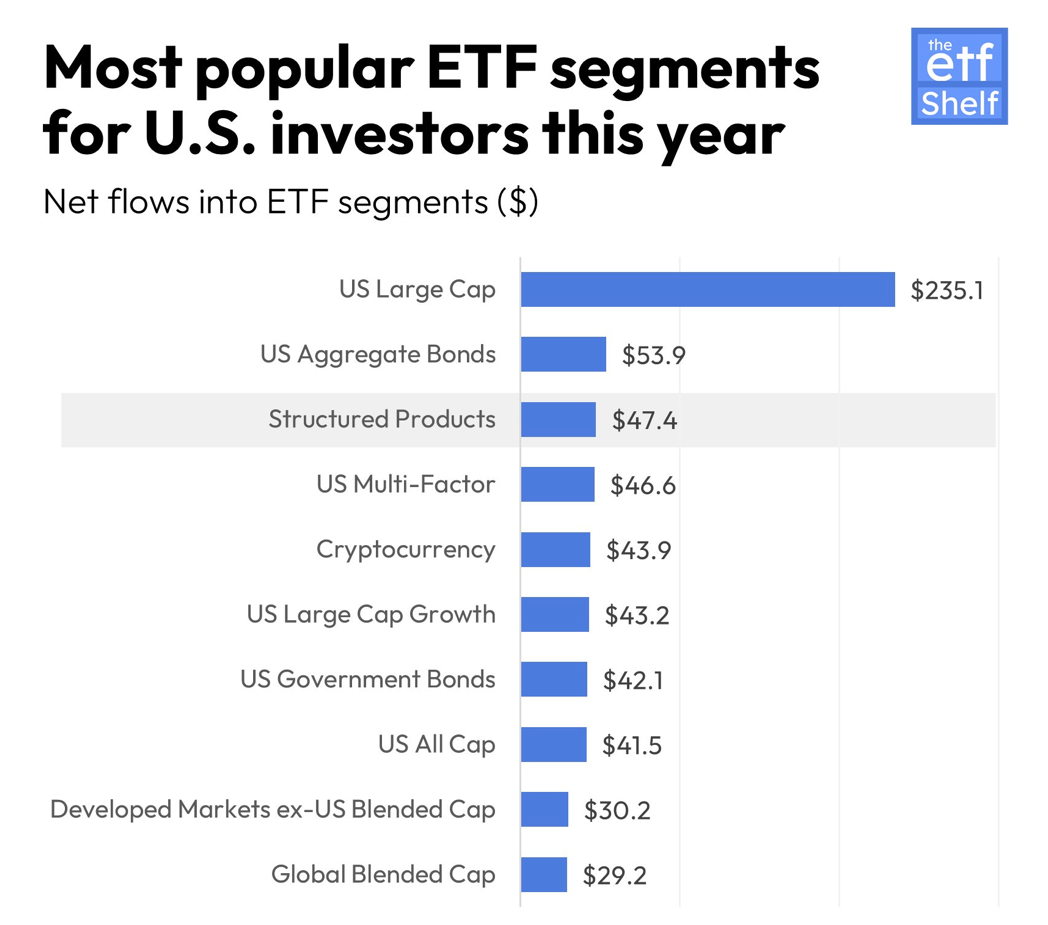

One of the most popular ETF segments

This segment of the ETF market in the U.S. has now close to 450 ETFs with a combined AUM of $136 billion. Over the past year, investors added $47 billion to these ETFs.