Private equity has contributed to portfolios seeking long-term gains from its historical strong, multi-decade performance. While private equity offers investors access to potential outperformance (relative to listed assets), it can also entail higher illiquidity.

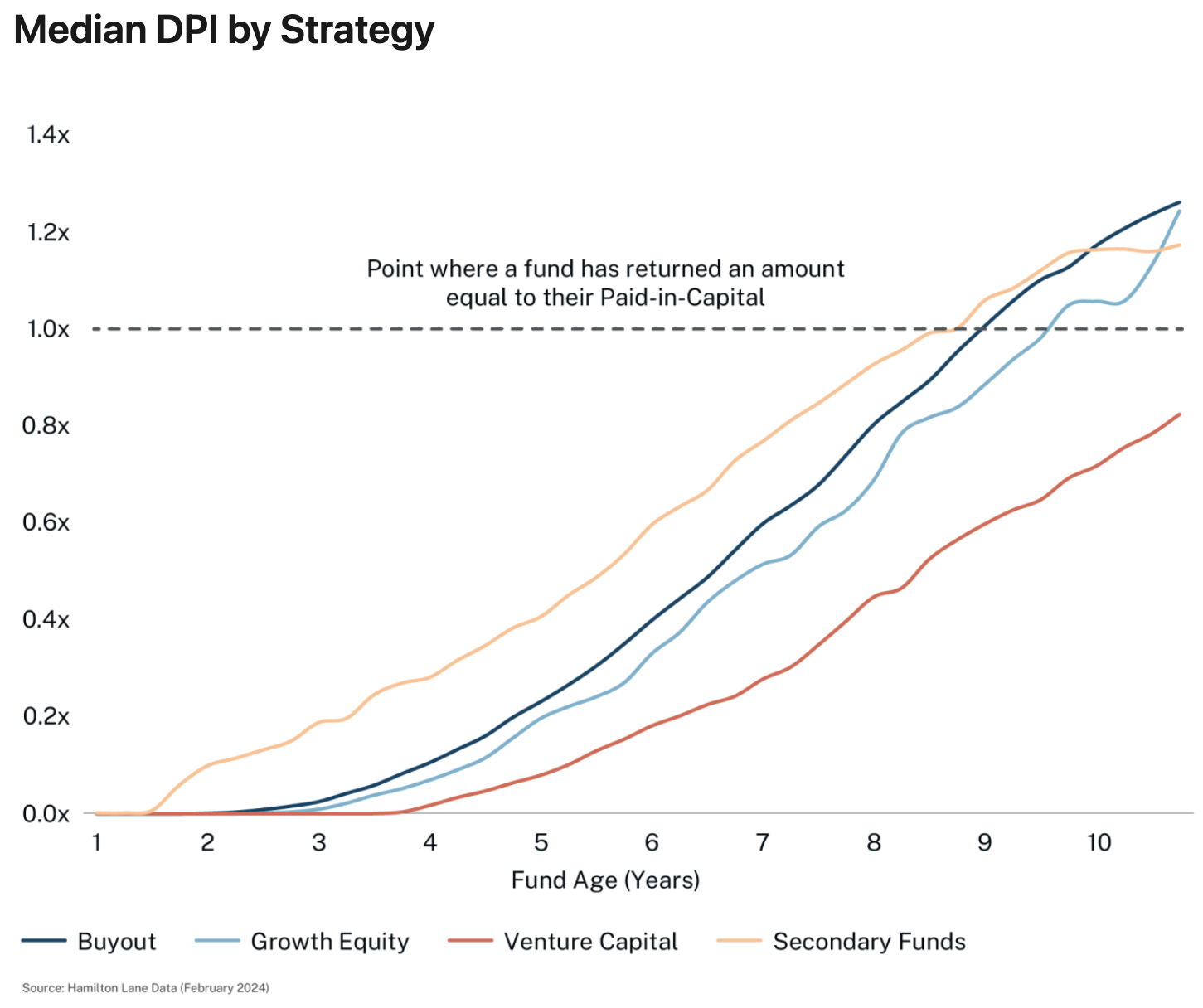

A closed-end private equity fund’s investment period may last a few years and underlying assets may be held for five years or more. During this period, investors are likely to see limited distributions, as measured by the distributions to paid-in capital ratio (DPI). As portfolio companies in the fund generate value and are sold at a profit, DPI begins to accelerate, though it takes the average buyout fund over eight years to distribute its cost basis. Venture funds may take even longer. We believe secondary funds can offer valuable mitigants to these effects by presenting investors with immediate diversification and enhanced liquidity opportunities.

Secondary buyers step in as replacement investors by purchasing the commitment to a fund from the original investor. This provides immediate access to an established, mature portfolio and can facilitate faster distribution of cash flows to investors on a DPI basis.

As a part of thoughtful portfolio construction, LPs should weigh the potential for secondary funds' liquidity advantages, risk mitigation features, and diversification benefits across vintage years, industries, geographies, and GPs, alongside pricing advantages.

Related: Reevaluating Portfolio Leverage: Implications for Buyout Returns

Definitions

Corporate Finance/Buyout: Any PM fund that generally takes control position by buying a company.

Growth Equity: Any PM fund that focuses on providing growth capital through an equity investment.

Secondary FoF: A fund that purchases existing stakes in private equity funds on the secondary market.

Venture Capital: Venture Capital incudes any PM fund focused on any stages of venture capital investing, including seed, early-stage, mid-stage, and late-stage investments.