What is this chart showing?

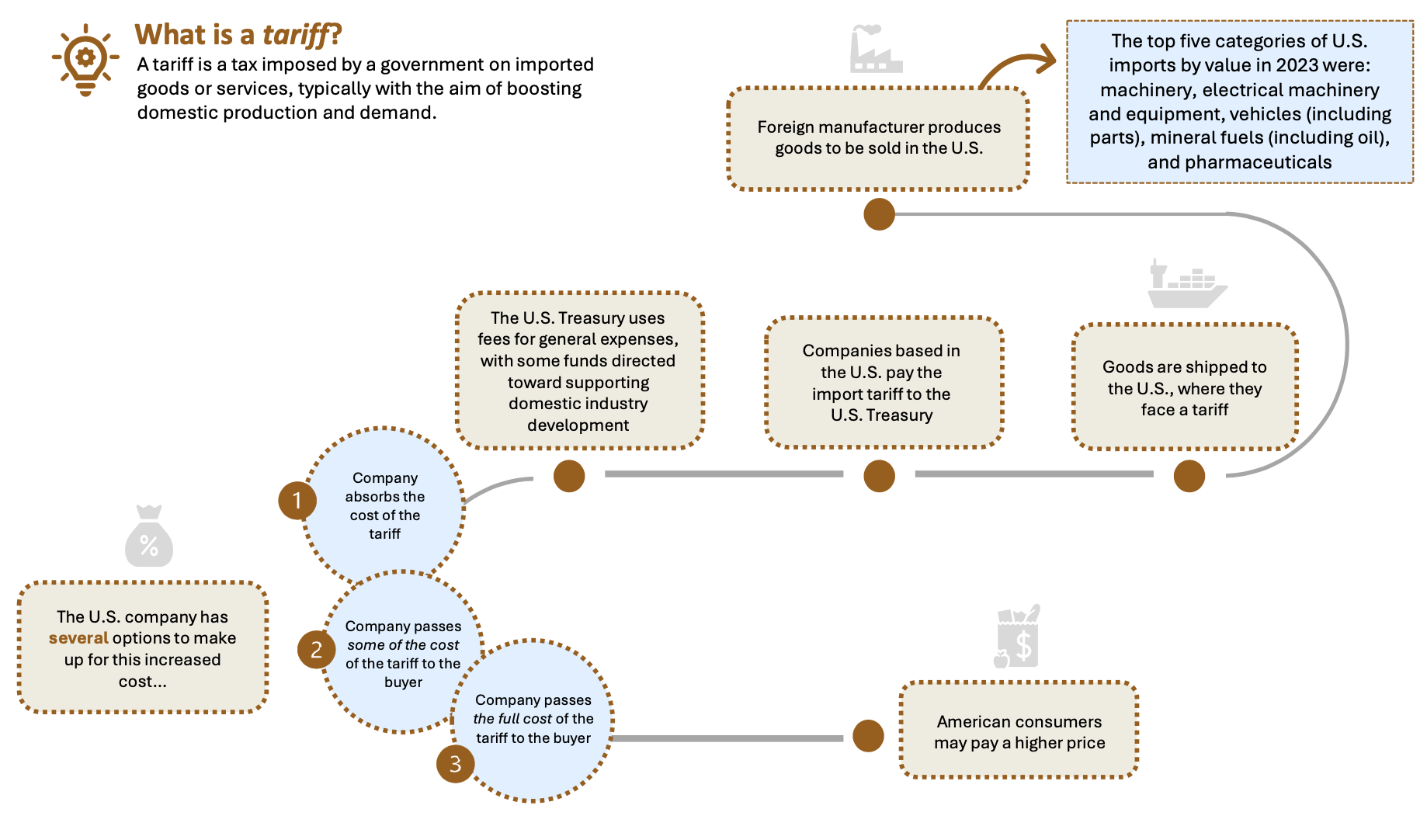

This chart shows a breakdown of how tariffs work.

Why is it important?

Tariffs have become a large topic of conversation since the 2024 presidential election, with President Trump proposing broad tariffs on imports. While proponents argue tariffs protect American industry and encourage domestic production, critics warn of increased costs and potential retaliation from trading partners. That said, it is important to understand how tariffs work.

A tariff is a tax on imported goods, applied at the border when a U.S. business or individual purchases a product from abroad.

This tax is proportional to the import's value; for example, a $50,000 car with a 25% tariff incurs a $12,500 charge, paid by the domestic importer.

Tariffs increase the cost of imports, prompting consumers to consider domestic alternatives, but potentially enabling domestic producers to raise prices.

If importers choose to pass these costs onto consumers, they will pay a higher price. However, if importers absorb the costs, their profits likely decline.

Subscribe to the Market Intel Exchange, Lincoln’s chartbook keeps you informed on the most notable economic and market insights from this quarter.

Related: Growth vs. Inflation: What to Expect from Rate Cuts in 2025

Source: Statista, 2024. Volume of imports of trade goods to the United States in 2023, by product industry class (NAICS).