From: Dimensional Fund Advisors

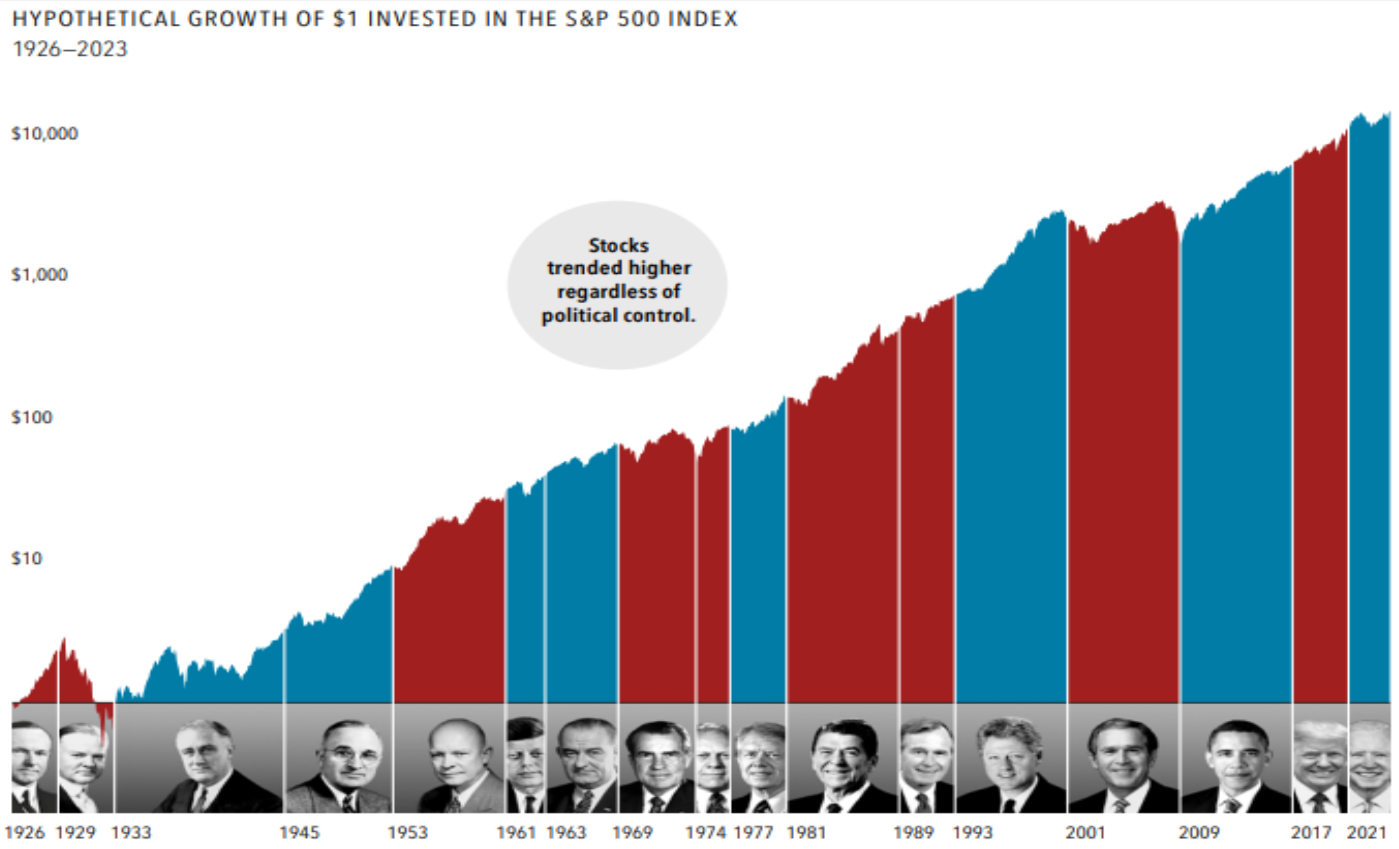

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. But regardless of who wins, nearly a century of returns shows that stocks have trended upward.

Shareholders are investing in companies, which focus on serving their customers and growing their businesses, regardless of who is in the White House.

U.S. presidents may have an impact on market returns, but so do many other factors — the actions of foreign leaders, interest rate changes, changing oil prices, and technological advances, just to name a few.

Stocks have rewarded disciplined investors for decades, through both Democratic and Republican presidencies.

Related: Investment Considerations During an Election Year

Source: Dimensional. Reprinted with permission from Dimensional. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In USD. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 Index. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

LCN-6693388-061224