In thinking about the timing and catalyst for the Fed’s next rate move, it’s important to remember that their two main goals are price stability and maximum employment. The central bank has not hesitated to make policy moves in either direction in past election years. Political agendas do not drive their decision making!

What is this chart showing?

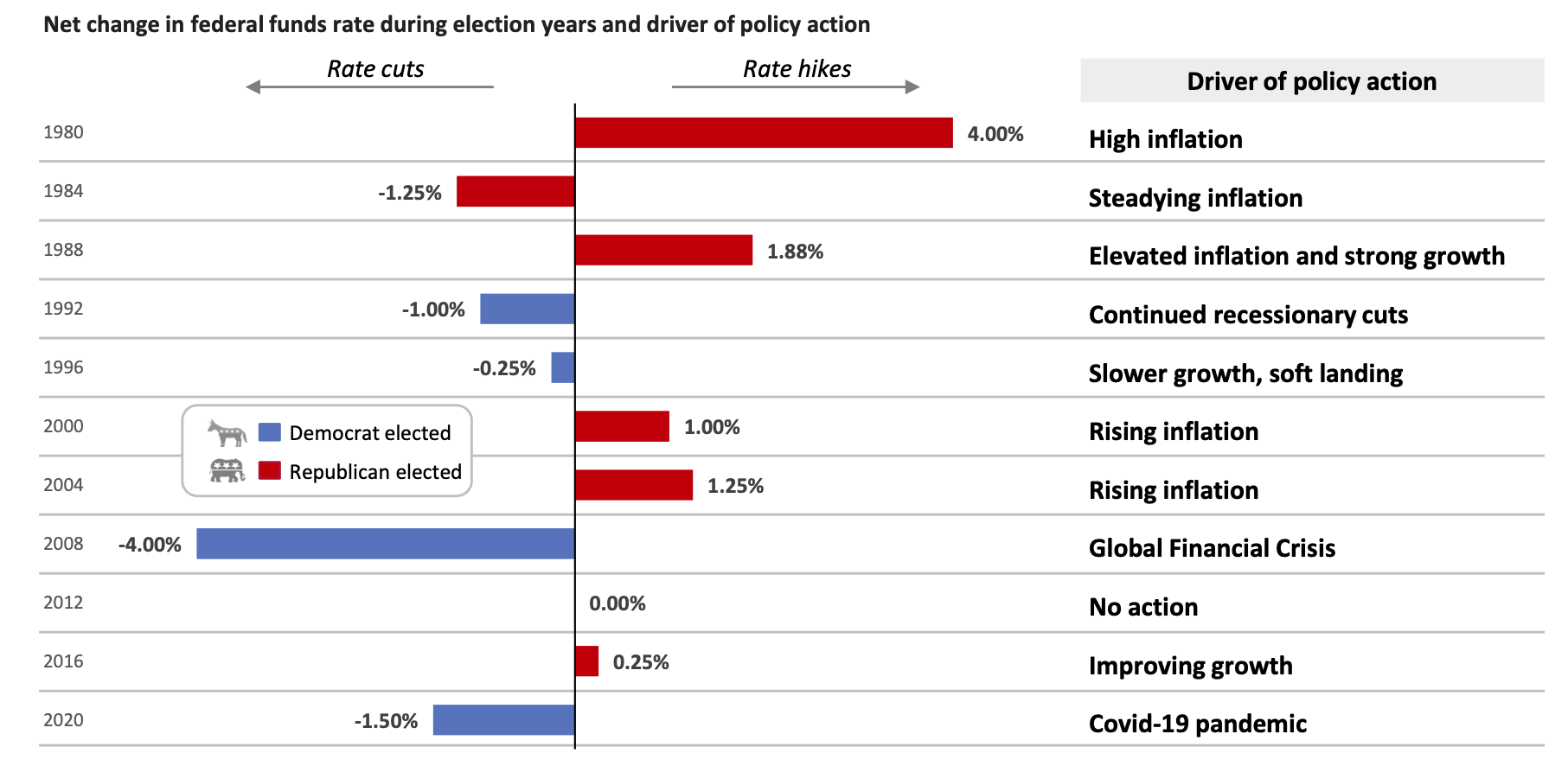

This chart shows monetary policy actions during previous election years, as well as the drivers for those actions.

Why is it important?

The U.S. Federal Reserve has not hesitated to enact changes in monetary policy during election years, and 2024 is likely to be no different should the economic picture warrant it.

Only one time since 1980 has the central bank not adjusted interest rates during a presidential election year – in 2012 when rates were near zero and the U.S. was still recovering from the Global Financial Crisis. In each instance, whether rates were hiked or cut, the economy — and not political motives — was primarily in the driver’s seat.

Related: Investment Considerations During an Election Year

Source: Federal Reserve Bank

LCN-6693388-061224