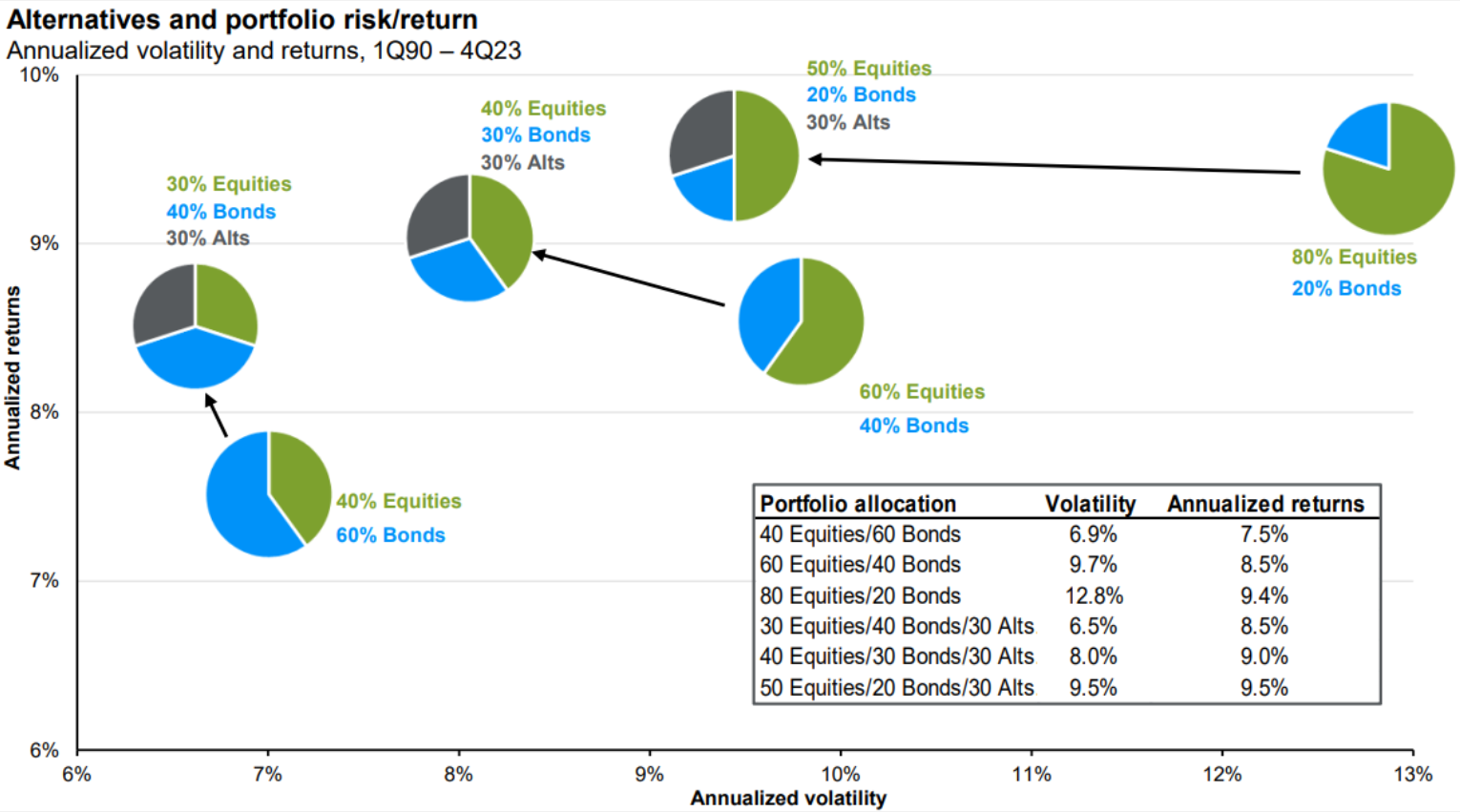

This chart shows how adding a diversified sleeve of alternatives (real estate, private equity and hedge funds) to traditional stock/bond portfolios can help manage risk and improve return.

Related: Markets in the Mood to Price in a Recession, Here Is How to Position

Source: Bloomberg, Burgiss, HFRI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Volatility calculated as the annualized standard deviation of quarterly returns. Data based on availability as of May 31, 2024.

Source: J.P. Morgan Asset Management, "Guide to Alternatives," 2024.