The Sustainable Addressable Market within Private Markets

This week, we’re switching gears to sustainability. We know...mere mention of the word “sustainability” and we run the risk of moving into an unwinnable debate, but bear with us. Sustainability, as it relates to investment choice, is what we’re focusing on today.

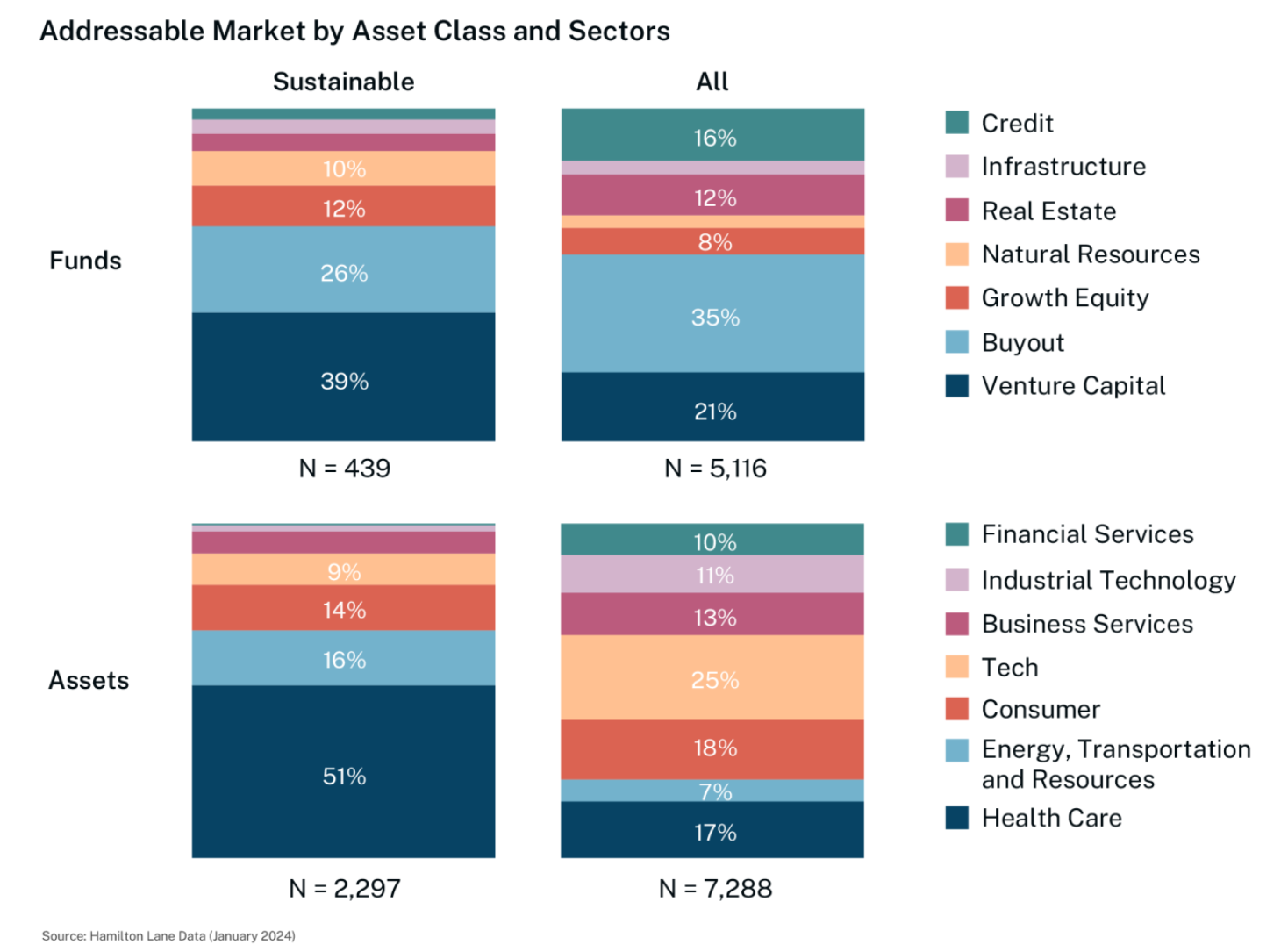

One of the arguments against it relies on the assumption that investments predicated on sustainability are, by definition, lower-returning investments than those that are not. We wanted to test the data ourselves by looking at the difference in addressable market between sustainable and non-sustainable funds. For this analysis, we used the UN SDGs to determine what constitutes a sustainable investment. We then compared the constituent parts of sustainable investments to those of all private equity.

A large proportion, more than one-third, of sustainable fund opportunities are in the venture sphere. That percentage is more than double venture’s overall market share. This is an important takeaway to keep in mind as you build a sustainable portfolio in today’s environment. Additionally, healthcare investments comprise more than half of sustainable assets and triple what that sector represents in the private markets universe. This contrast demonstrates that sustainable investing could require a portfolio construction shift, and that's why data matters.