Market highs can lead to worry for investors wary of potential corrections. However, historical data suggest that all- time highs are more common and less daunting than perceived. Since 1988, the S&P 500 has, on average, reached new highs 20 times per year.

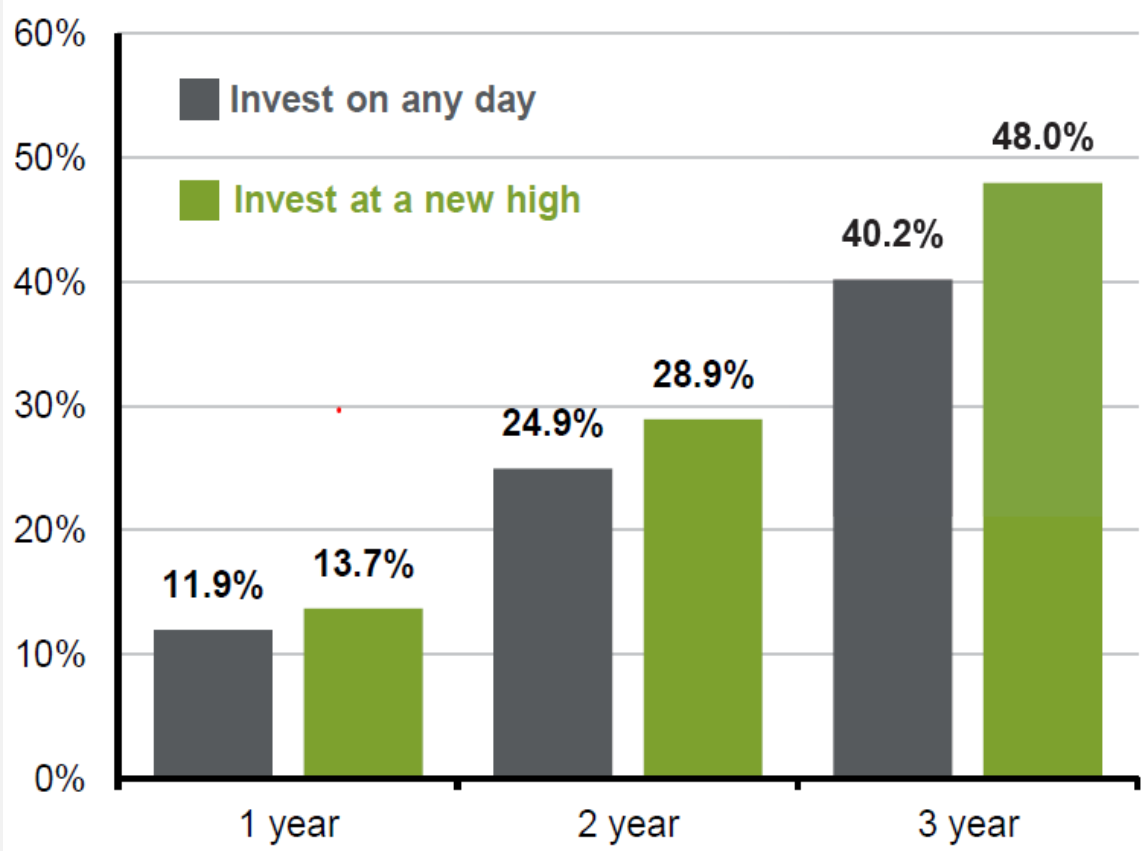

More importantly, nearly 85% of the time, one- year forward returns from these highs were positive. In fact, during this period one, two and three-year forward returns were more favorable when investing at all- time highs compared to a random day.

Given that markets spend about half the time within 5% of all-time highs, remaining on the sidelines can result in significant opportunity cost.

Related: Consumer Confidence: Impact on Subsequent S&P Returns

Source: J.P. Morgan Asset Management. Past performance is no guarantee of future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.