Trends shaping the economic landscape

What is this chart showing?

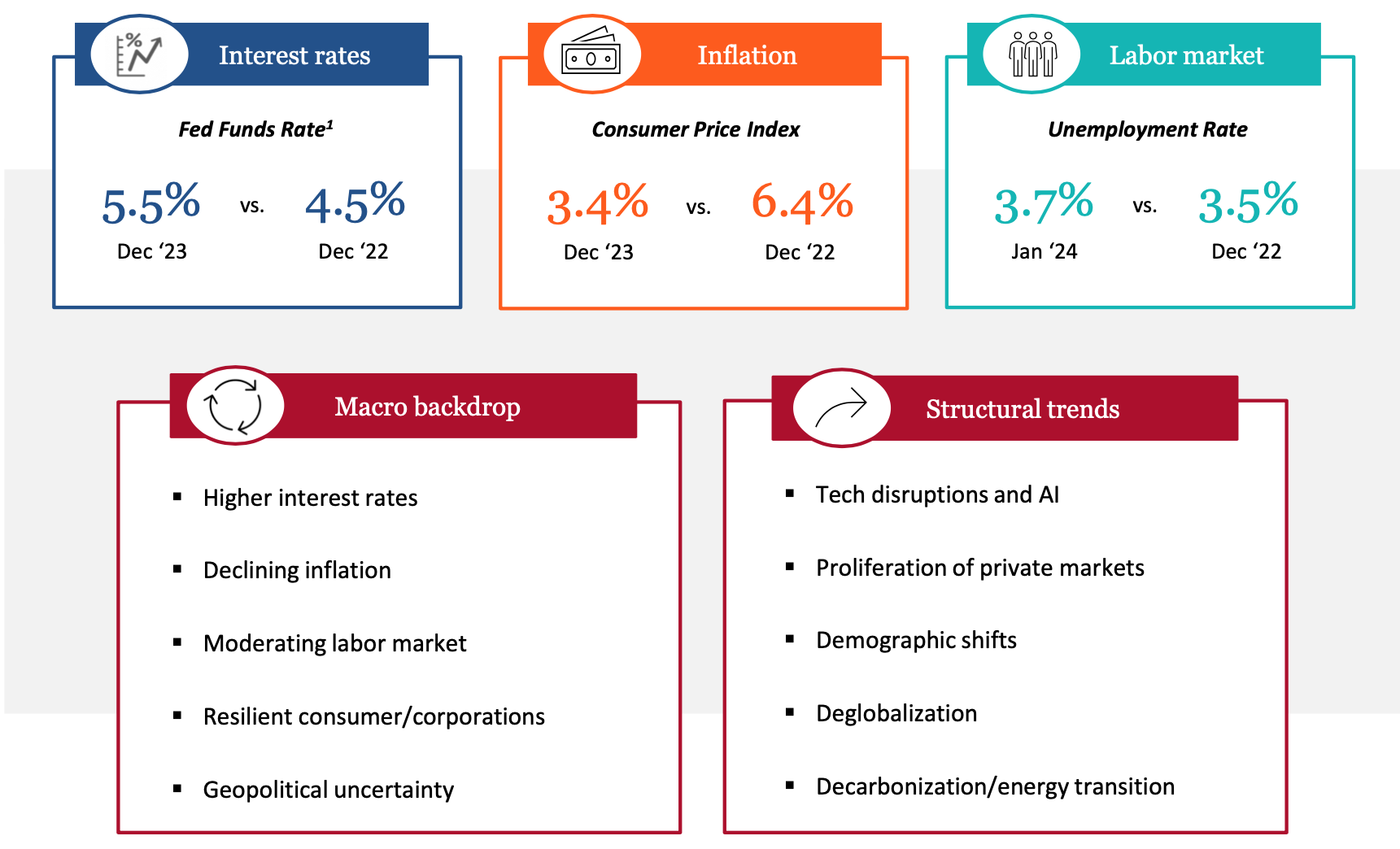

This chart is showing where several key economic data points both started and ended in 2023, along with considerations for investors regarding both the current macro backdrop, as well as long- term structural trends.

Why is it important?

Inflation, interest rates, and labor markets were closely watched in 2023. Rate hikes largely helped drive disinflation, but investors remained concerned about how these actions could impact the economy and the markets. Despite the economy’s resilience to date, astute investors will continue to keep a close eye on the macro backdrop for any signs of weakening.

The latest data will continue to dominate short- run concerns, but there are several dominant trends playing out that will likely shape the economy and markets in 2024 and beyond. Some are more firmly intact, like demographic shifts, while others will take time to unfold, like the climate transition. Thinking about these structural themes may provide insights into longer term investment opportunities.

Sources: Bureau of Labor Statistics, Bloomberg, Lincoln Financial Group. Based on available data as of 1/31/24 1Represents top end of Fed Funds target range.