From: DoubleLine

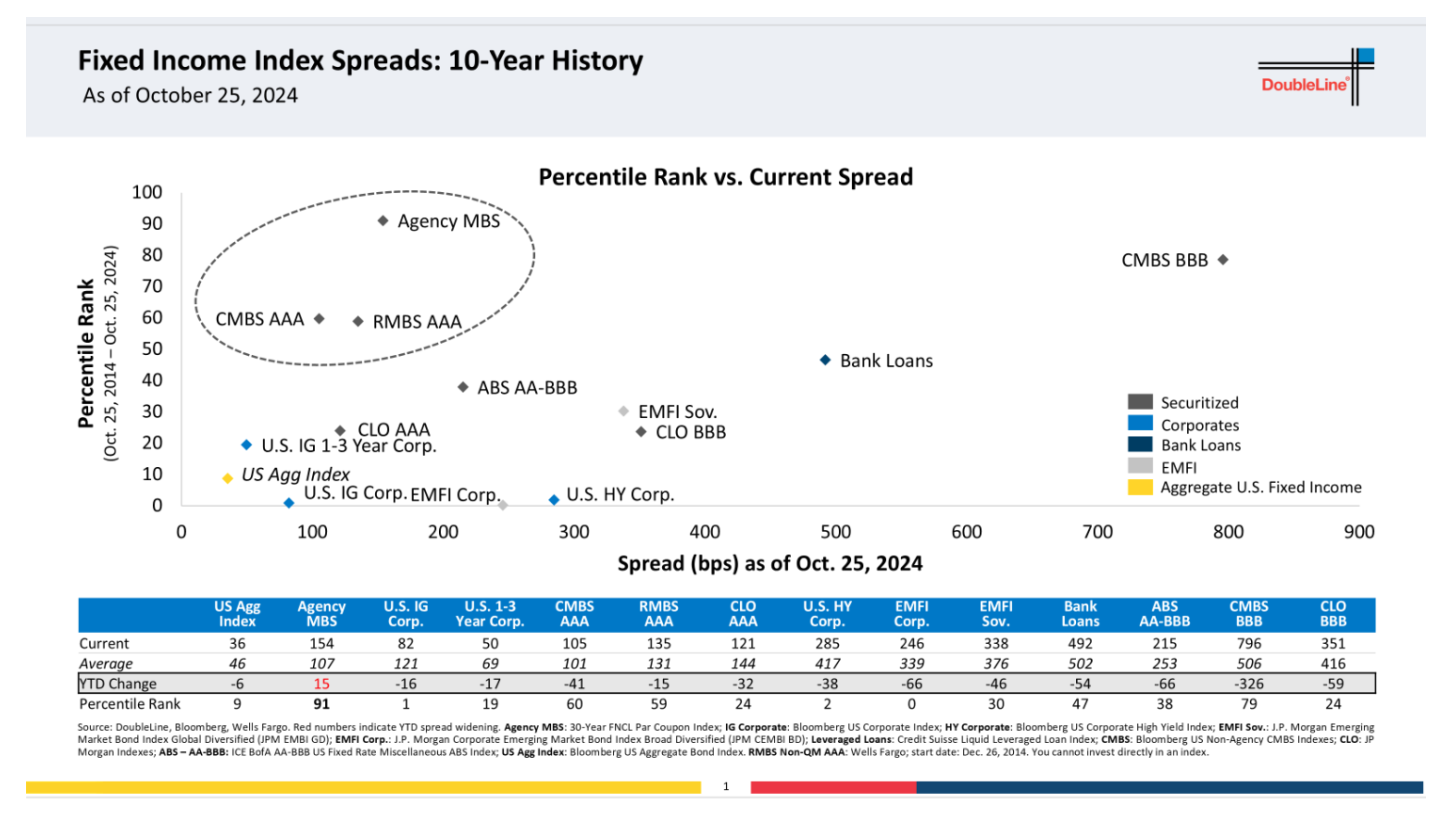

With the rise in U.S. Treasury yields, MBS current-coupon spreads have widened in sympathy, providing would-be investors an opportunity to add at higher yields and wider spreads. Agency MBS are government-guaranteed bonds with additional spread for taking on refinancing risks, not credit risk. Agency MBS can be complementary to portfolios with a heavy corporate credit focus, especially in risk-off markets when credit spreads typically widen more on credit than MBS spreads. Today, MBS spreads still look cheap relative to historical spread levels.

As we expected at DoubleLine, securitized credit spreads have been playing catch-up to corporate credit this year, posting some attractive returns. While spreads have tightened, most of the securitized credit universe still looks above average from a valuation standpoint and cheap relative to corporates, which have seen spreads compress to near-post-Global Financial Crisis tights. The potential for more spread tightening exists absent a meaningful correction in equity markets.

Related: The Yen Carry Trade