With the S&P 500 finishing 2024 with a second year in a row of 20% + gains (first time since 1997-1998 of this magnitude of back-to-back gains), are some people about to make a big mistake? Maybe....

When planning for retirement, benchmarks matter—but the wrong one can lead to costly mistakes.

Your portfolio allocation probably doesn’t match the S&P 500. If you’re 60% stocks and 40% bonds, comparing your performance to an all-stock index isn’t apples to apples.

And you should have international and small cap exposure too!

The tendency is to chase what just did well. And often that leads to horrible timing and poorer outcomes than just maintaining a well diversified portfolio over many decades.

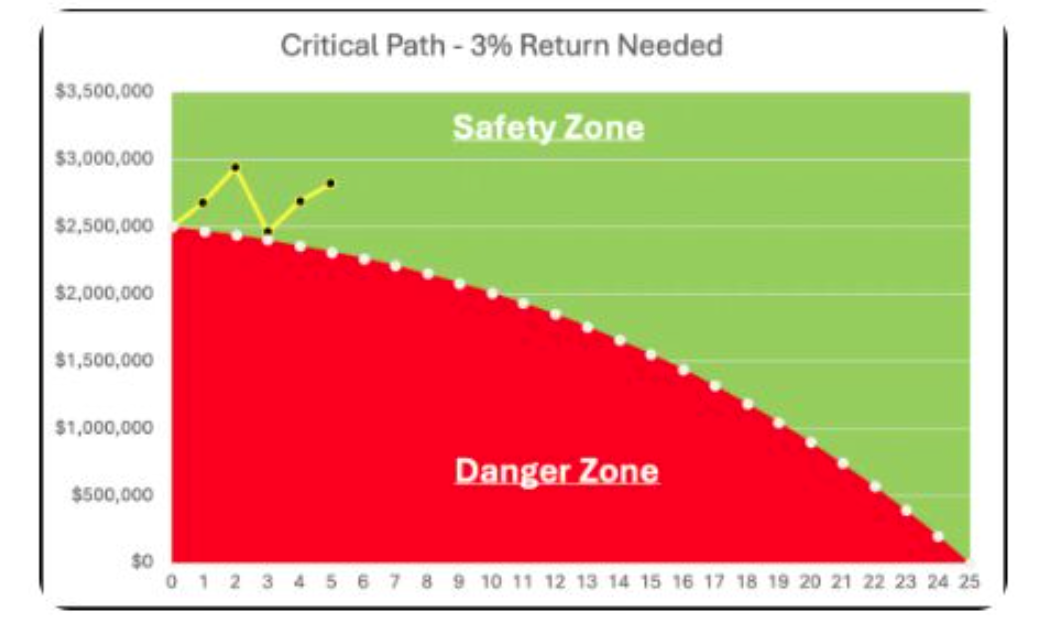

It's time to re-think how you measure success. You need a customized benchmark based on your lifetime cash flow needs. We call this benchmark a Critical Path.