By: DoubleLine

“What protectionism teaches us, is to do to ourselves in time of peace what enemies seek to do to us in time of war.” – Henry George

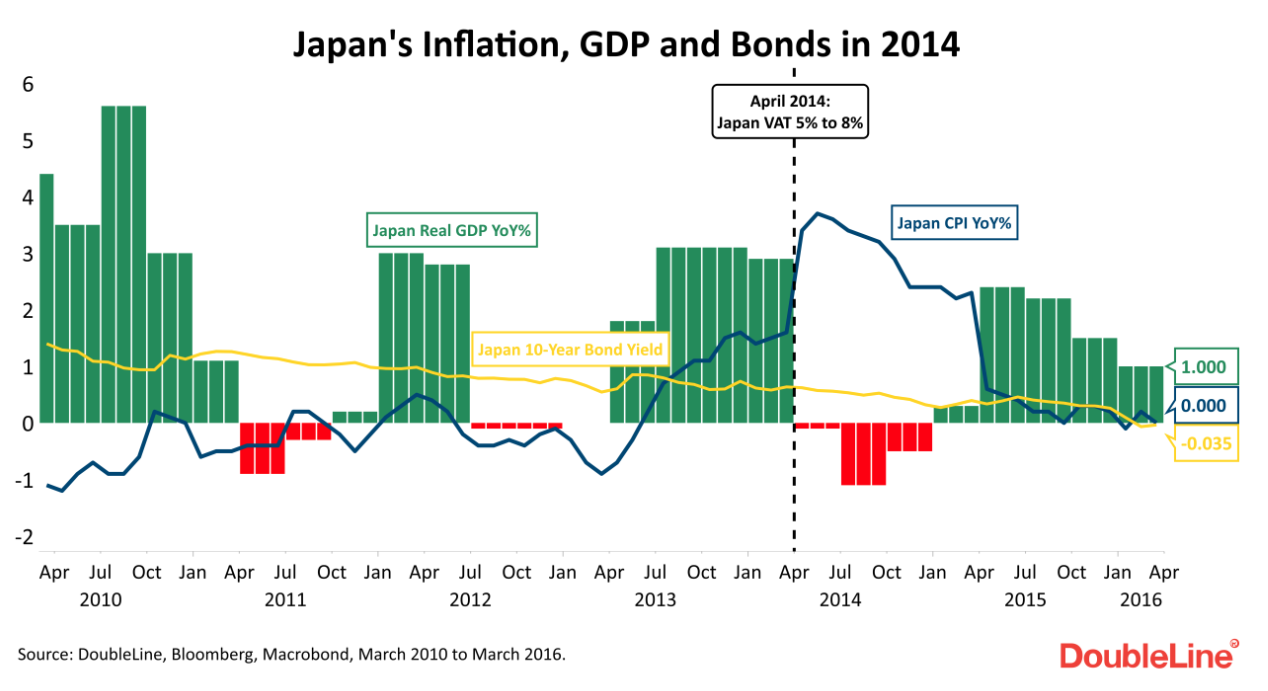

In April 2014, Japan raised its national consumption tax (or value-added tax, VAT) from 5% to 8% to curb public debt. The move triggered an immediate economic response: inflation spiked, consumer spending plummeted, and GDP contracted – visible in this week’s chart. Yet, long-term Japanese government bond (JGB) yields remained low, as investors expected the slowdown to outweigh inflation.

Today, as the U.S. imposes tariffs on key trading partners, investors can draw valuable lessons from Japan’s move. While tariffs and VAT hikes differ, both act as a consumption tax, initially driving inflation and ultimately slowing growth.

Japan VAT Hike in 2014: Economic Impact

Japan’s VAT hike aimed to address its fiscal deficit but had immediate economic effects:

- Inflation Surge: The VAT hike immediately pushed headline inflation above 3% year-over-year (YoY), the highest in two decades.

- Consumer Spending Decline: Anticipating the tax, consumers front-loaded purchases before April 2014. Japan retail sales surged 11% YoY in March 2014 before collapsing to negative 4% in April.

- GDP Contraction: The economy shrank by an annualized 6.8% in the second quarter of 2014, reflecting the impact of higher costs.

- Muted Bond Market Response: Despite rising inflation, JGB yields remained low, near 0.6%, as investors focused on weakening economic growth.

This episode highlights that while tax-induced price hikes can raise inflation temporarily, they do not necessarily lead to sustained inflation.

U.S. Tariffs in 2025: A Parallel to Japan?

The U.S. has recently imposed tariffs on imports from China, Canada and Mexico, increasing costs for consumers and businesses. Like Japan’s VAT hike, tariffs can cause an initial inflation spike as companies pass on higher costs to consumers and might also dampen consumption and growth.

- Inflation Effects: The one-year U.S. breakeven inflation rate has risen from less than 1% in October 2024 to over 4% currently, reflecting expectations of a short-term price shock.

- Growth Slowdown: U.S. manufacturers reliant on imports might face squeezed margins or reduced demand if they raise prices. Additionally, companies have front-loaded imports ahead of the tariffs, causing the U.S. to report its largest trade deficit on record last month – likely foreshadowing weaker future growth. The latest GDPNow estimate, from the Federal Reserve Bank of Atlanta, shows GDP contracting 2.8% in the first quarter due to weak personal consumption and front-loaded imports.

- Bond Market Reaction: Despite rising inflation expectations, U.S. Treasury yields have declined sharply since mid-January, mirroring Japan’s experience, where markets prioritized long-term economic fundamentals over inflationary shocks. Given that tariff-induced inflation is likely temporary, the Fed might refrain from tightening policy based on short-term price shocks but could intervene if economic growth weakens significantly – much like the Bank of Japan did in 2014 when it expanded monetary easing to counter the demand shock following its VAT hike.

While Japan’s VAT increase and U.S. tariffs share similar economic effects, tariffs disrupt supply chains, adding uncertainty for businesses.

Conclusion

Japan’s 2014 VAT hike serves as a case study on how policies that raise prices can lead to temporary inflation and often slow growth. U.S. tariffs appear poised to follow a similar trajectory – initial price spikes followed by an economic slowdown. As seen in Japan’s experience, central banks might ultimately respond to demand-side weakness rather than inflation itself. Bond investors will need to balance these risks to properly position their portfolios amid tariff uncertainty.

Related: Is 2025 the Right Time to Invest in Chinese Stocks?