Does PE Performance Reign Supreme?

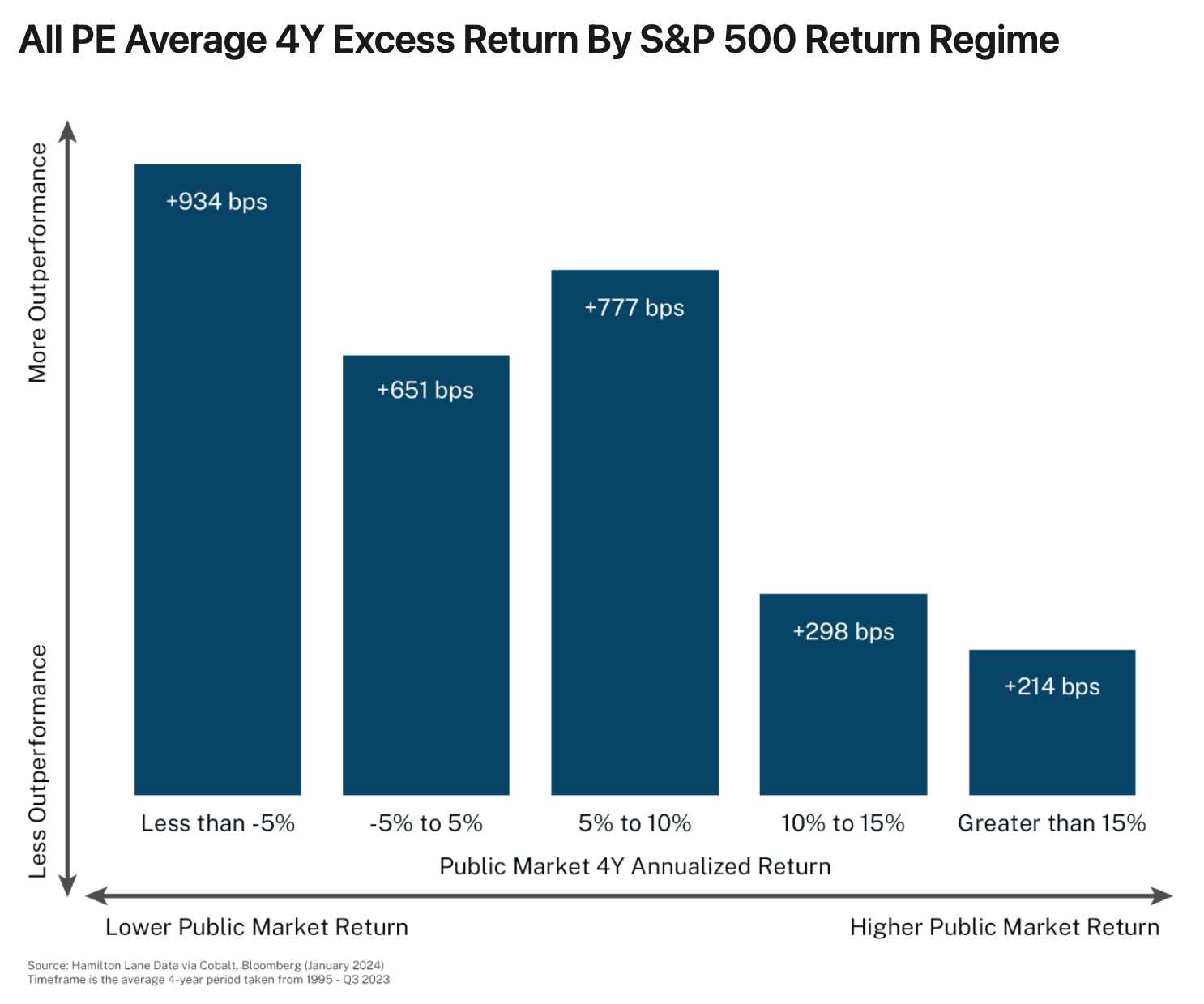

In the spirit of our 2024 Market Overview’s theme Hamlet, we beg the question: To invest or not to invest in the S&P 500? To aid Hamlet’s decision, this week's chart highlights the degrees to which average private equity (PE) four-year rolling performance surpasses S&P returns. Regardless of your expectations for interest rates over the next few years, historical performance indicates that private equity has outperformed public markets. In other words, regardless of who was the President, Fed Chair, or winner of the World Series for the past 30 years, private equity performance has historically rewarded investors with lofty premiums. Talk about consistency!

Private equity outperformance is historically most pronounced during periods of mediocre or negative public market returns. This disparity arises more from volatility in public markets than from the nature of private markets themselves. When public markets are strong, PE's outperformance diminishes; in any other environment, it historically increases. This is because PE tends to be conservative in its valuation practices. GPs might avoid inflating expectations and provide a cushion in their valuations when public markets are rising.

We believe that PE performance will continue to outpace public markets due to key factors such as governance and the alignment of investor interests. PE boards are structured to align with management teams, focusing on maximizing business value. Without the pressure of quarterly earnings calls, management can make medium and long-term investments rather than concentrating solely on short-term operations. That’s a tough act for public markets to follow.

Related: Sustainability Data Challenges Assumptions

Definitions

All Private Markets: Hamilton Lane’s definition of “All Private Markets” includes all private commingled funds excluding fund-of-funds, and secondary fund-of-funds.

S&P 500 Index: The S&P 500 Index tracks 500 largest companies based on market capitalization of companies listed on NYSE or NASDAQ.