From: The ETF Shelf

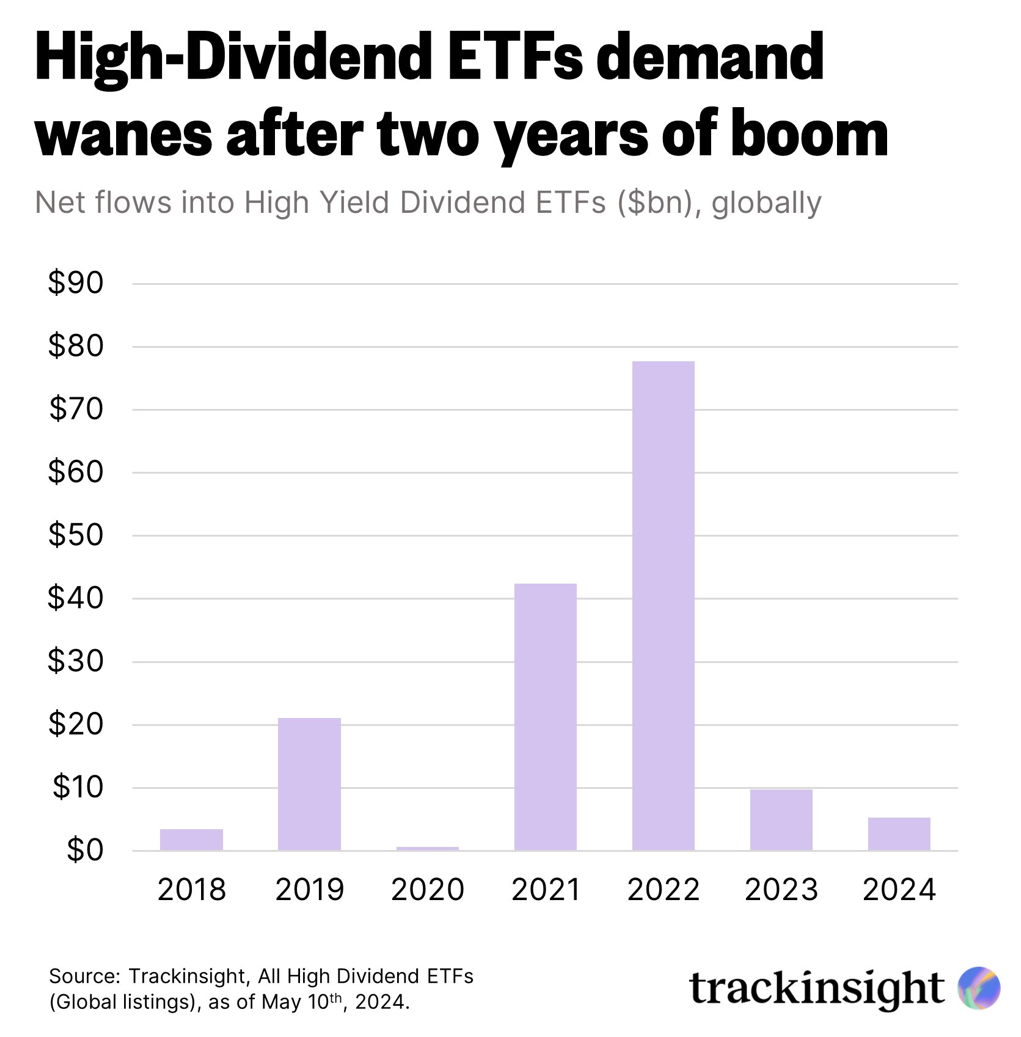

In 2021 and 2022, high-dividend ETFs surged in popularity. Their allure? Attractive yields in a low-interest-rate environment, providing a steady stream of income as the economy bounced back. Bonds, meanwhile, were having their worst year ever, further tipping the scales in favor of high-dividend ETFs.

However, in 2023 and 2024, the Federal Reserve's rate hikes increased bond yields, making bonds more appealing than dividend stocks and ETFs. This shift led investors to reallocate towards bonds and other safer assets with better returns in the new economic climate.